The IRS Is So 100th Century and Late

Procrastinators rejoiced: they had extra time to complete their taxes for the 2017 financial year.

The deadline extension came from the Internal Revenue Service after its web page that collects online payments crashed.

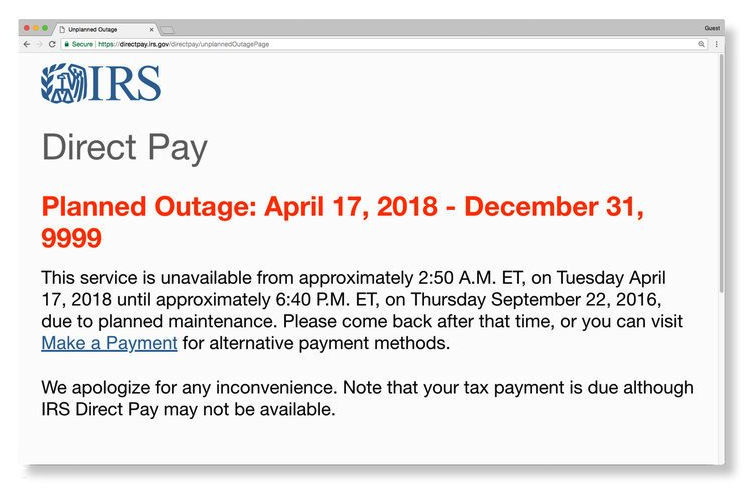

It affected the “Direct Pay” link, a free service for paying taxes via bank accounts, and the “Payment Plan” page, where filers can pay their tax bill in installments. As of 5:05 p.m. ET on Tuesday, the page was functioning, but it was down for the majority of the day.

“This is the busiest tax day of the year, and the IRS apologizes for the inconvenience this system issue caused for taxpayers,” acting IRS Commissioner David Kautter said in a statement.

Taxpayers could have used the IRS site on Tax Day to pay with a debit or credit card, but that would have come with a $2-$3.95 debit fee or a two percent credit-card processing fee. The only other option was mailing a paper check, but who uses those anymore?

Before the extension announcement was made, the agency said on its website that “your tax payment is due although IRS Direct Pay may not be available.” A “planned outage” from April 17, 2018 to December 31, 9999 was also noted.

Uh, what?

This fiasco is just another example of IRS incompetence. The agency announced the launch of this online tool in 2016 after it became apparent that IRS employees jeopardized sensitive taxpayer information.

According to a report released by the Treasury Inspector General for Tax Administration (TIGTA), IRS employees sent hundreds of unencrypted emails containing personal taxpayer information. Some employees even used personal email accounts for conducting official agency business. A random sample of emails from employees in the Small-Business/Self-Employed Division found that 49 percent of employees sent 326 unencrypted emails containing 8,031 different taxpayers’ tax-return information.

Why should Americans be held accountable to pay taxes if the IRS has a history of exposing taxpayer information and not complying with the law, and it can barely keep it together on their self-proclaimed busiest day of the year?

But regardless of the agency’s laughable shortcomings, taxpayers were still expected to pay their tax bills by midnight yesterday or face penalties such as fines and added interest. If you needed even more time, you could have always submitted Form 4868 to push the filing deadline to Oct. 15. Again, the deadline for this form was midnight, April 18.

As Jeffrey Tucker tweeted, government is so last century.