The Inconvenient Arithmetic of IOER

The Federal Reserve’s policy of paying interest on excess reserves (IOER) prevents the monetary base from circulating more broadly. Currently, about half of the base money stock is effectively sterilized. The best policy would be to phase out payment of IOER on a predetermined schedule. This would allow the market to prepare for the effects of inflation. The results would be much less distortionary than the current policy, which provides no clear trajectory to anchor expectations in the market.

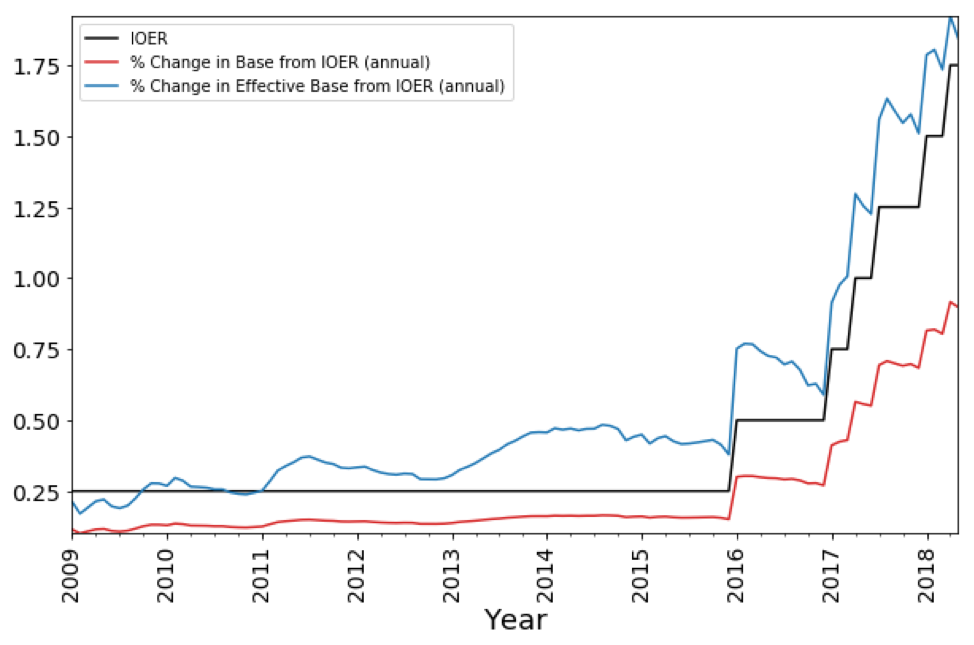

The graph above shows the annual rate of growth of the base money stock extrapolated from the rate paid on excess reserve balances. As should be expected, an increase in the rate paid on excess reserves results in an increase in the proportion of the base money stock that is paid IOER. In April, this value reached 0.91 percent. As for the portion of the base that is not excess reserves — I’ve labeled this the “effective base” — the annualized rate of increase in April was 1.92 percent. Since the size of the base money stock that is collecting interest is about the same as the effective base, the rate of interest paid on excess reserves currently approximates the increase of the effective base. Going forward, I will assume the new money is split evenly between the effective base and excess reserves.

The Federal Reserve is managing monetary policy by offering banks a risk-free rate of return. However, the higher the rate paid on excess reserves, the greater the rate of monetary growth. In a world without price inflation, this might not be problematic. The Fisher equation suggests that interest rates integrate inflation expectations. These tend to track actual inflation. Suppose expected inflation is 4 percent and the real interest rate is 3 percent. The observed nominal interest rate is expected to be 7 percent.

An increase in the nominal rate resulting from an increase in expected inflation will likely lead to an increase in the rate paid on excess reserves. Suppose, for example, that next year the real rate of growth remains the same, but inflation ticks up by 2 percent. If the Federal Reserve is to maintain its stance at a current rate of 1.95 percent, the rate paid on excess reserves will need to rise to 3.95 percent. The base money stock will increase by double the amount of money created to sterilize past increases. If the current ratio of excess reserves to the base money stock is maintained, half of the increase will enter the market. We have no reason to expect that the Federal Reserve will slow its pace purchasing debt from the government.

If half of the new money created from payment of IOER enters the economy, rounding up, the increase will raise the inflation rate by nearly an additional 1 percent. Supposing that is integrated into the inflation rate, now the Federal Reserve will find itself paying a rate of 4.95 percent on excess reserves. If the proportion of the new money that enters the economy is greater than half, then the increase will be greater than this. At one extreme, the inflation rate will increase by the exact amount of the increase of the rate paid on excess reserves. The greater the level of excess reserves, the greater the quantity of money required to be created by payment of IOER.

Suppose investors begin to expect that the Federal Reserve does not have an exit strategy. They will begin to withdraw excess reserves and invest the money in higher-yielding assets unless the Federal Reserve again raises the rate paid on excess reserves. If the level of excess reserves falls, the Federal Reserve will have to choose between contracting the base money stock or allowing the inflation rate to increase. Without a clear policy trajectory, this is an inherently bad outcome. If this policy interacts with a high-impact event such as a sovereign-debt crisis, the Federal Reserve will not be able to maintain control without greatly increasing IOER.

By continuing this policy, the Federal Reserve is courting a crisis. So long as this appears to be far off, confronting this problem can be deferred to a later date. Once investors lose faith in the ability of the Federal Reserve to wind down the excess, we could see a dramatic shift in the market. Either the Federal Reserve can face this problem now or it can foment a much greater crisis that could risk not only our economic health. The habit of politicians, particularly since FDR, to treat an economic crisis as an excuse for intervention means that this policy could become a threat to liberty.