The Greatest Service Economists Perform

My love affair with economics began nearly 42 years ago in a classroom at Nicholls State University (in Thibodaux, Louisiana). I was an 18-year-old freshman with only four passions: girls, football, beer, and The Beatles. But this reality soon changed dramatically.

The winter of 1976–77 was bitterly cold. That January, my hometown of New Orleans had a few low temperatures in the teens, and snow fell as far south as Miami! One dark, bone-chilling January morning as I made the 50-mile drive to school I heard on the radio that an elderly couple in Buffalo had frozen to death in their home. They had no heat because of the nationwide shortage of natural gas.

For the spring 1977 semester, I enrolled in Michelle Francois’s economics course because it didn’t meet on Tuesdays and Thursdays. On those days of the week I worked at the shipyard where I assumed I would soon begin working full-time once I’d satisfied my mother’s unreasonable demand that I attend college for at least one year. When I signed up for Dr. Francois’s course, I hadn’t the slightest idea what economics was, nor did I care. I had a steady girlfriend, enough money to buy a regular supply of Budweiser, and a collection of all Beatles’ records. Life was fine.

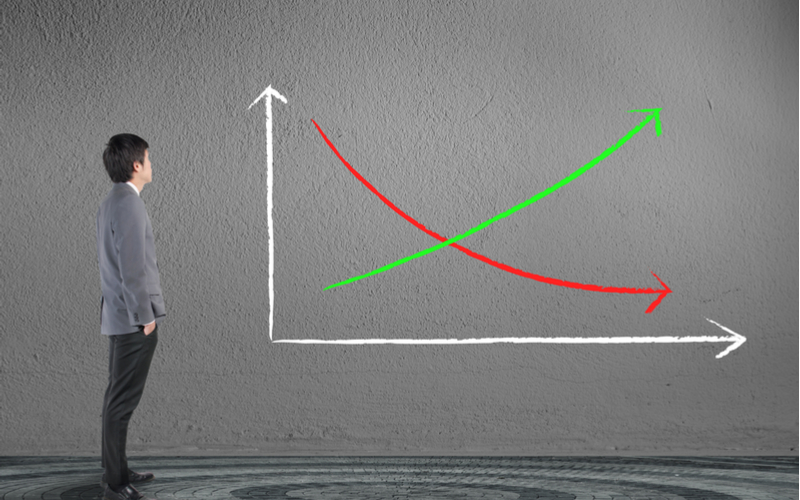

But one day early in the semester Dr. Francois drew a supply-and-demand graph on the blackboard. “Look at what happens when government imposes a price ceiling.” She pointed to the graph. “The quantity demanded exceeds the quantity supplied. There’s a shortage.” Facing her students, Dr. Francois continued: “You all remember the gasoline shortage of 1973. Here’s the explanation. The government now has price ceilings in place in the energy market, keeping gasoline and natural gas in short supply.”

Wow! Just wow! I remember sitting up straighter at my desk to gaze in fascination at that supply-and-demand graph. For the first time in my life, I experienced the thrill of intellectual discovery. Here was a compelling explanation of why that couple in Buffalo froze to death. Here also was a compelling explanation of why, when I first got my driver’s license in 1973, there was a nationwide shortage of gasoline, complete with such long lines at service stations that I didn’t do much driving.

Not only did Dr. Francois’s course convince me to finish college, it inspired me to dream of getting a Ph.D. in economics. Economics is powerful stuff!

Replacing Pop Explanation With Powerful Explanation

What attracted me to economics back then is what I still today hold to be the single greatest public service of sound economics — namely, busting popular myths with impregnable yet straightforward logic.

As a 15-year-old in 1973, I heard two explanations for the gasoline shortage. One was that we were running out of oil (after all, by then we had used oil for a full century). A second popular explanation was that Exxon and other oil companies had gotten greedy and decided to keep their tankers anchored at sea to drive up the prices consumers pay for gasoline. Knowing no better, each explanation seemed plausible to me.

But upon taking my first economics course, I learned that the popular explanations I’d long accepted were bogus. “We didn’t have energy shortages in the ’60s,” Dr. Francois told me one afternoon during her office hours. “Were oil companies less greedy 10 years ago than they are now? Of course not. And if we really are running out of oil, that’s all the more reason the government should let the price rise, because letting the price rise will give those greedy oil companies stronger incentives to drill for more.” Dr. Francois concluded: “I promise you, Mr. Boudreaux, if we get rid of these price controls, we’ll get rid of these shortages.”

History has proven her to be correct.

And history proves also the power of the economic way of thinking to bust countless other popular myths.

Pointed Logic

To think like a good economist is not only to be forever skeptical of popular explanations of economic phenomena, it is also to be fearless at examining reality in ways that often strike non-economists as bizarre.

My favorite example of a seemingly bizarre but enormously revealing take on reality is my late colleague Gordon Tullock’s observation that if Congress really wants to reduce highway traffic fatalities to near zero, all it need do is to mandate that the steering column of each automobile be fitted with a sharp steel dagger pointed directly at the driver’s heart.

Sheer brilliance. Upon hearing Gordon’s suggestion, the typical person immediately asks incredulously, “What?”— a reaction that seconds later turns into the realization that Gordon is indisputably correct. No degree in economics is needed to understand how people would respond to this incentive.

Once someone understands Gordon’s insight, that person can easily be shown its true, practical importance, which is this: reality is more complex than it initially appears. If, for example, government mandates that automobiles be made safer to drive, then people are likely to drive less carefully. The decline in highway fatalities will thus be disappointingly small.

On its own, Gordon’s insight isn’t sufficient to show that government-mandated safety improvements are unjustified. But it is sufficient to warn us to avoid basing policy recommendations on our first impressions. Relentlessly issuing this warning, as simple and obvious as it sounds, is the single most important service economists can render to the public.

A License to Reveal

I close with a final example: occupational licensing. Superficially, a government requirement that, say, electricians be licensed by the state seems to promote consumer welfare by ensuring that homes and offices will be free of incompetently installed and maintained electrical wiring. But if we look just beneath the surface, we’re immediately led to ask: don’t those people who build and occupy homes and offices have strong incentives on their own to use only competent electricians? The answer obviously is yes, and therefore private arrangements will emerge to help those who need the services of electricians to distinguish competent from incompetent ones.

Looking even more deeply, we see that to require electricians to be licensed by the state is perhaps to increase, rather than to decrease, the chance that people will be injured or killed from faulty electrical wiring. The reason is that licensing requirements reduce the number of people offering their services as electricians and thus raise the cost of hiring electricians. In turn, fewer people will use the services of professional electricians. Some homeowners will repair their electrical wiring themselves, while others will delay or forgo electrical repairs. The overall quality of electrical wiring might well deteriorate.

When done well, economics regularly reveals that that which appears to the popular mind to be undeniably true is often a mirage, or at least highly questionable. No service performed by economists is as important as this one.