The Federal Reserve and Government Debt

In the past, governments have used seigniorage to finance the purchase goods and services. Seigniorage refers to the government printing money to purchase goods and services. Seigniorage is an inflation tax. When a government prints money, inflation occurs when the money circulates in the economy. The government gets to spend the money first, purchasing goods and services before inflation takes hold.

There are historical examples of seigniorage in early U.S. history. During the American Revolution, congress printed money to purchase war supplies. Massive inflation resulted, leading to the saying “not worth a continental”. In 1811, the charter of the first bank of the United States was not renewed. A year later, the War of 1812 broke out and the Treasury printed money to finance purchases.

Today, seigniorage takes on a different form. The Sound Money Project recently offered an interesting view of how modern seigniorage works. William J. Luther points to The Curse of Cash to explain how modern day seigniorage takes a three-step process.

The government spends beyond its means and issues debt to cover the difference. In stage two, the central bank issues bank reserves and uses the proceeds to buy up government debt. Over time, the central bank usually earns a profit, because the longer-term debt it typically buys usually pays a higher rate than the bank reserves it issues. In stage three, the central bank remits any profit to the government.

How much of the government debt does the Federal Reserve own today? Federal Reserve holding of Treasury securities have been increasing since 2008. In the third quarter of 2016, Federal Reserve holdings of Treasury securities were near an all-time high of $2.4 trillion. This translates into the Fed holding 18.1 percent of all marketable Treasury debt outstanding.

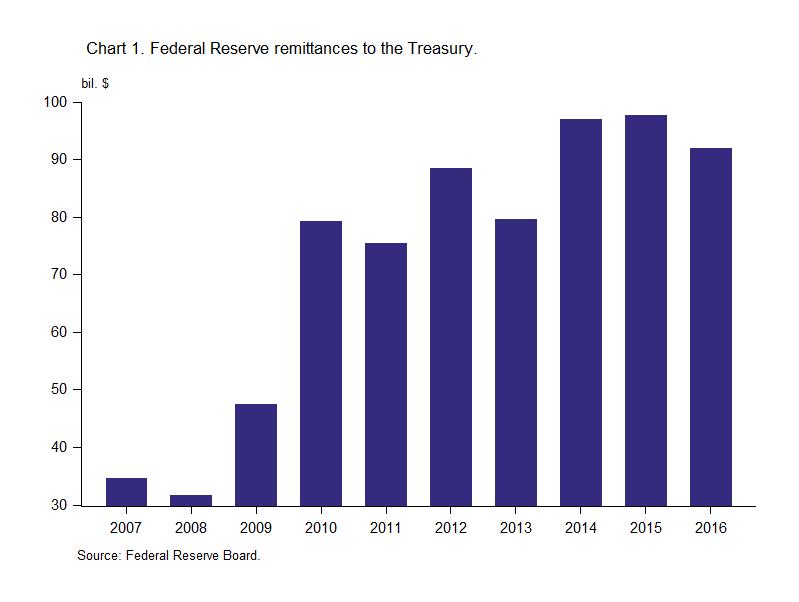

Federal Reserve remittances to the Treasury have risen with Federal Reserve holdings of government debt. Remittances have risen from $34.6 billion in 2007 to $92 billion in 2016.