The Domain of Cryptocurrency: Clearing Accounts and Liquidity Costs

The development of cryptocurrencies has provided new, highly liquid substitutes for dollars and other national currencies. I expect that this will radically transform — and help stabilize — banking. We already see evidence of this transformation with Ripple, a blockchain network used to facilitate cross-border financial transfers. Before considering the effects of this transformation, let’s review another stabilizing development in monetary history: the clearinghouse association.

Those who are familiar with the free-banking literature likely know that central banks were preceded by clearinghouse associations, organizations that operated essentially as private central banks. A clearinghouse operated as a “bankers’ bank” and served to stabilize the system that the banks formed. Member banks held deposits at the clearinghouse that were used to increase the efficiency of account settlements between them. The clearinghouse periodically checked the health of banks, withdrawing support from banks it felt were exposed to excessive risk. It also served as a source of credit creation. Particularly important during a crisis, the clearinghouse association would create credit from the reserves deposited by member banks at the clearinghouse. This private system of support overcame problems of moral hazard that are all too familiar in the practice of modern central banking. While nothing is certain, one potential use of cryptocurrencies is to reduce the cost of clearing accounts between banks.

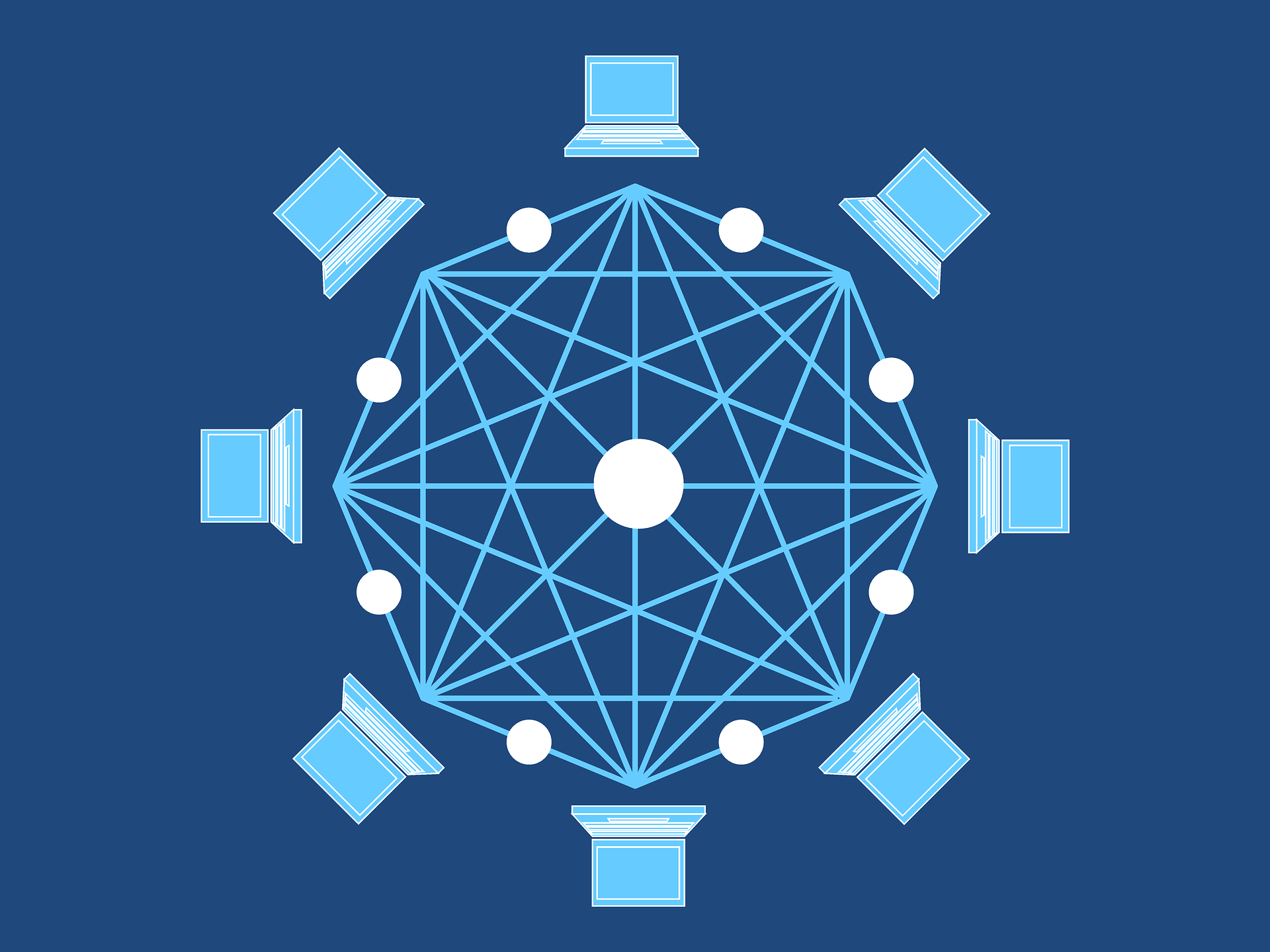

Like the development of clearinghouse associations, the development of cryptocurrencies and the blockchain presents an opportunity to further stabilize the banking system. The blockchain is a public accounting system that ensures that ownership of property, and therefore the transfer of ownership, is recognized across the system. The system reduces the cost of creating a contract to transfer ownership. The creation of a secure and cheap claim to an asset that can also be traded for claims against other assets on an exchange enables owners of assets to monetize their asset holdings.

This understanding explains many things that are otherwise a mystery in these markets. For example, Kodak has announced it plans to launch its own cryptocurrency that will help secure and facilitate licensing for artists, providing them greater control over their products. Since a cryptocurrency lowers transaction fees and provides a homogeneous unit for purchasing rights, rights over photographs will essentially be monetized. This is the beauty of the blockchain: it allows owners of property access to liquidity, thus opening new opportunities for entrepreneurs and expanding the level of resource employment that is sustainable in the market.