The Alphabet Soup of Recessions

Many people have heard of U-shaped and V-shaped recessions; but, what about W-shaped, K-shaped, and L-shaped recessions?

A U-shaped recession is maybe the normal recession. The economy falters, falls into a recession, stays in recession for a while, and then begins a recovery. How long is “a while?” According to people who claim to know, a U-shaped recession lasts 12 to 24 months.

A google search on “U-shaped recession” picked up 4.4 million hits.

A V-shaped recession features a quick recovery. A fast bounce back. During the 2020 campaign, President Donald Trump claimed we were having, or would soon have a V-shaped recession, until that was no longer good enough, at which point we were going to have a rocket ship recovery.

“This is better than a V. This is a rocket ship.” Donald Trump, June 5, 2020

A google search on “V-shaped recession” picked up 6.8 million hits.

A google search on “rocket ship recovery” picked up 5.6 million hits. Most of these were related to NASA recovering rocket ships.

So, what are we in?

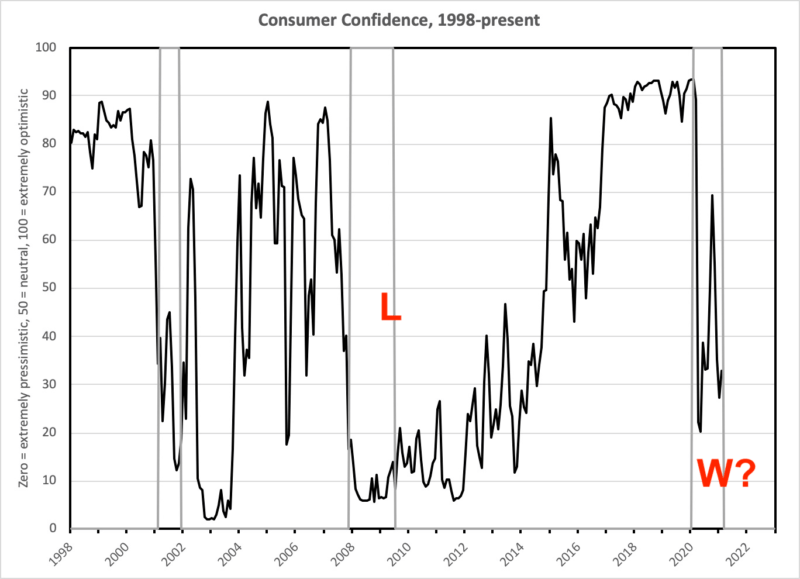

In terms of consumer confidence, based on my composite index, we can see that we were in a classic L-shaped recession following the Financial Crisis of 2008.

Or, to quote a famous commercial, “I’ve fallen and I can’t get up.”

The recession was the falling part, or the vertical shaft of the L; and, the long subsequent period of depressed economic conditions; that’s the horizontal length at the bottom of the L.

As for right now, we may be in a W-shaped recession. Formerly known as a “Double Dip” recession.

You see the decline and then the first recovery. That was the V-shaped recession, past tense, or the rocket ship recovery if you prefer. Then you see a second decline. Hopefully, this second decline is quickly followed by a second rocket ship or, as President Biden might put it, one of those things.

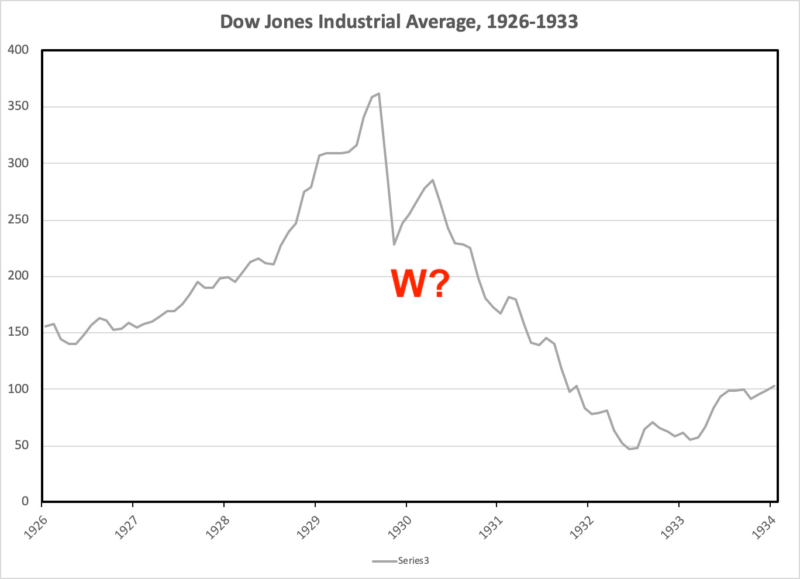

But, you’ve got to watch those double dips. They don’t all turn into Ws. Below I show a famous double dip that didn’t. In 1929, the stock market crashed. October 29th. But, it wasn’t the first time. These things happen. Sometimes, we recovered quickly, V-shaped (they didn’t have rocket ships back then). Sometimes, more slowly, U-shaped. In any case, recovery would be “just around the corner.” That’s what President Herbert Hoover said. And most other people too. And, sure enough, a recovery got underway the next year. At least, that’s what most people thought.

But, instead of a V, we wound up with a W, the second decline of which just kept going and going and going. The Dow Jones just kept falling and falling. And the unemployment rate just kept rising and rising. Among those who lost their jobs was Hoover. So did a lot of professional forecasters.

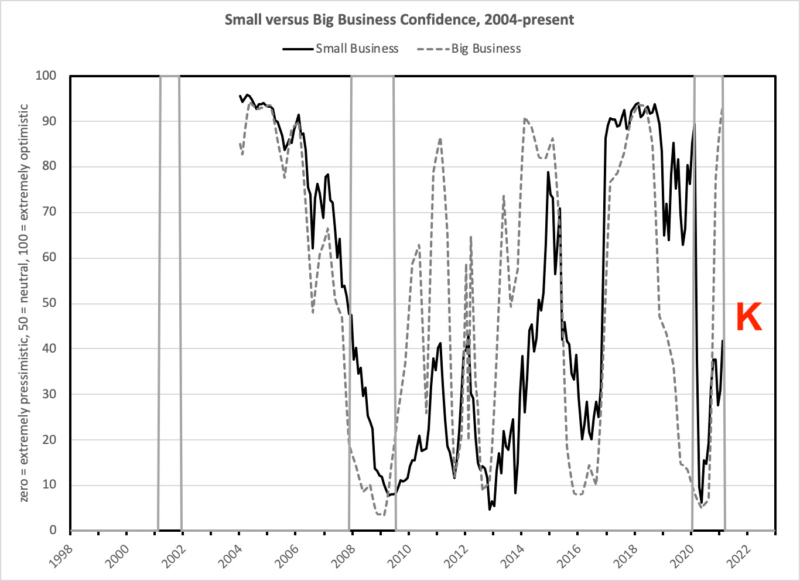

As for the K-shaped recession, I first noticed a divergence of small business and big business confidence in January and can herewith update that observation.

Confidence among both small and big business tanked upon the outbreak of the flu and the shutdown of the economy. Fifteen days to slow the spread, we were told. Okay, we can handle that. In the meantime, we have paycheck protection to maintain our relations with our employees until we can reopen. Then, with the reopening, we’d be like in a rocket ship, even a private-sector, SpaceX rocket ship. Only the reopening still isn’t much happening. Instead of a rocket ship, all we have are some fireworks bought across the state border line, probably illegally.

So, what has happened to business confidence? It’s gone K-shaped. Big business is booming. Their return on their investment in certain politicians is paying off quite handsomely. But, small business isn’t doing so well. Even if the economy is reopened, will they be able to compete with enhanced unemployment benefits? And, what about their stack of IOUs from renters who are protected from eviction for the duration, and the decriminalization of shoplifting and the right kind of rioting?

And, so, our outlook may be for an O-shaped economy; that is, an economy with an empty middle.