The Adverse Impact of Government Bureaucracy on Private Employment

When I did this video about public-sector compensation almost 10 years ago, I focused on why it is unfair that bureaucrats get much higher levels of compensation than people working in the private sector.

Today, let’s consider the economic consequences of excessive bureaucracy.

And what will make this column particularly interesting is that I’ll be citing some research from economists at the International Monetary Fund (a bureaucracy which is definitely not an outpost of libertarian thinking).

The two authors, Alberto Behar and Junghwan Mok, investigated whether nations lowered unemployment rates by employing more bureaucrats.

The contribution of this paper is to investigate the effects of public hiring of workers on labor market outcomes, specifically unemployment and private employment. In particular, does public hiring increase (“crowd in”) private employment or decrease (“crowd out”) private employment? …It is arguably the case that a private-sector job is more desirable than a public-sector job from a public policy point of view…there is evidence that a large government share in economic activity can be negative for long-term growth because of the distortionary effects of taxation, inefficient government spending due in part to rent-seeking or lower worker productivity, and the crowding out of private investment. …Crowding out could occur through a number of channels. Derived labor demand can be affected through crowding out of the product market, possibly via higher taxes, higher interest rates, and competition from state-owned enterprises. It can occur through the labor market, where higher wages, more job security, or a higher probability of finding a public-sector job can make an individual more likely to seek or wait for public-sector employment rather than search for or accept a job in the private sector… Finally, it can occur in the education market, where individuals seek qualifications appropriate for entering the public sector rather than skills needed for productive employment.

As you can see, the authors sensibly consider both the direct and indirect effects of public employment.

Yes, hiring someone to be a bureaucrat obviously means that person is employed, but it also means that resources are being diverted to government.

And that imposes costs on the economy’s productive sector.

So the real question is the net impact.

In their study for the IMF, the authors cite other academic research suggesting that government employment crowds out (i.e., reduces) private employment.

…there is prior evidence that crowding-out effects are sufficiently large to increase unemployment in a number of advanced countries. However, there has hitherto not been a thorough investigation of how public employment affects labor market outcomes in developing countries. We fill this gap in the literature by investigating the effects of public employment on both private employment and on unemployment. An important part of our contribution lies in the assembly of the dataset to expand the number of non-OECD countries… The most related and relevant work to this paper is by Algan et al. (2002), who explore the consequences of public-sector employment for labor market performance. Using pooled cross-section and annual time-series data for 17 OECD countries from 1960 to 2000, they run regressions of the unemployment rate and/or the private-sector employment rate on the public-sector employment rate. Empirical evidence from the employment equation suggests that the creation of 100 public jobs crowds out 150 private-sector jobs.

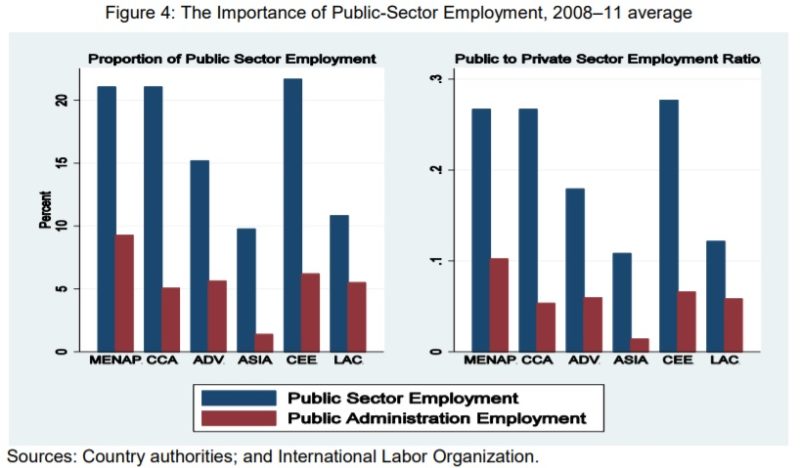

In the study, the authors look at two main measures of public sector employment.

And, as you can see in Figure 4, they look at data for nations in different regions.

They wisely utilize the broader measure of public employment, which includes the people employed by state-owned enterprises.

We have collected data for up to 194 countries over the period 1988–2011. …Our contribution to the literature includes the assembly of data on public and private employment and other indicators for a wide range of developing and advanced countries. …Definitions of “public sector” are different across countries and organizations, so we choose two definitions and generate corresponding public employment datasets, namely a “narrow” measure also referred to as “public administration” and a “broad” measure. …This dataset includes not only governmental agencies but also state-owned enterprises (SOEs). We call this the ‘broad’ measure of public employment, preserving the term ‘public sector’.

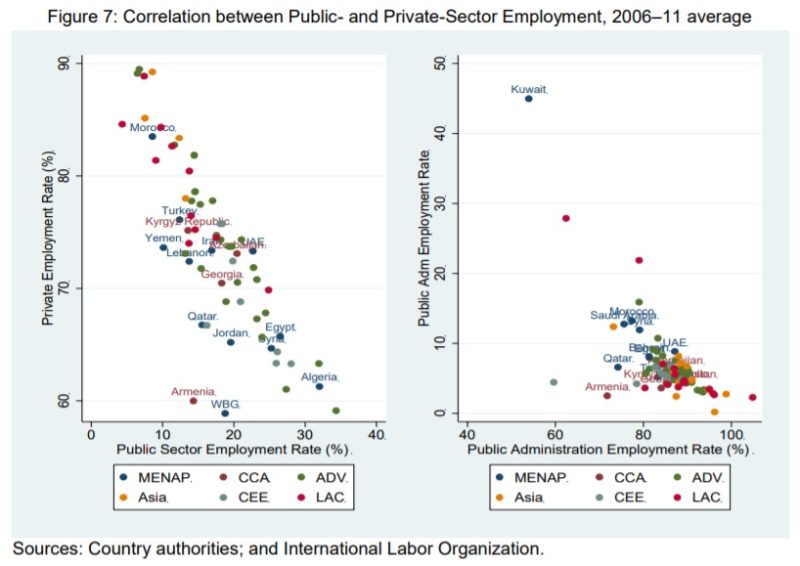

In Figure 7, they use a scatter diagram to show some of the data.

The diagram on the left is most relevant since it shows that private employment (vertical axis) declines as government jobs (horizontal axis) increase.

And when they do the statistical analysis, we get confirmation that government jobs displace employment in the economy’s productive sector.

…all coefficients indicate a very strong negative relationship between public- and private-sector employment rates. For example, 100 new public jobs crowd out 98 private jobs… Taken together with the unemployment results, public employment just about fully crowds out private-sector employment regardless of the definition, such that a rise in government hiring would be offset by decreases in private employment… Regressions of unemployment on public employment and of private employment on public employment, each of which is based on two definitions of public employment, find robust evidence that public employment crowds out private employment. …Public-sector hiring: (i) does not reduce unemployment, (ii) increases the fiscal burden, and (iii) inhibits long-term growth through reductions in private-sector employment. Together, this would imply that public hiring is detrimental to long term fiscal sustainability.

The final part of the above excerpt is critical.

In addition to not increasing overall employment, government jobs also increase the fiscal burden of government and undermine long-run growth.

So the long-term damage is even greater than the short-run damage.

P.S. The IMF isn’t the only international bureaucracy to conclude that government employment is bad for overall prosperity. A few years ago, I shared research from the European Central Bank which also showed negative macroeconomic consequences from costly bureaucracy.

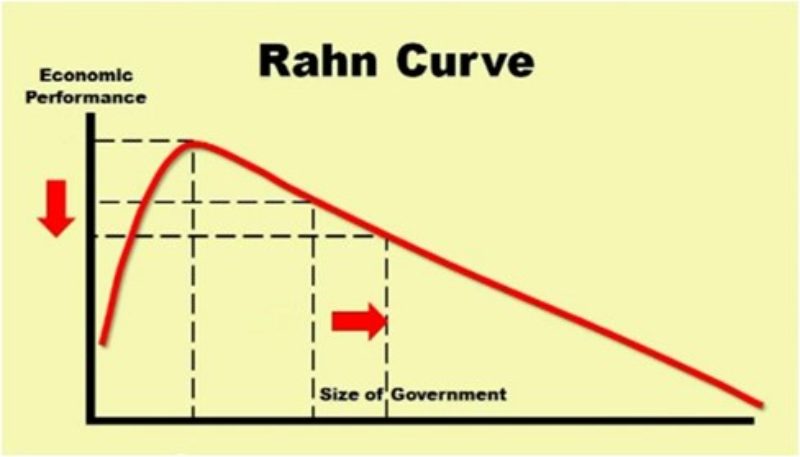

P.P.S. While I’m usually critical of the IMF because it has a statist policy agenda, it’s not uncommon for the professional economists who work there to produce good research. In the past, I’ve highlighted some very good IMF studies on topics such as spending caps, the size of government, taxes and business vitality, fiscal decentralization, the Laffer Curve, and class-warfare taxation.

This piece originally ran at the author’s website.