Tell Me Again How Governments Are Essential

I don’t like governments. I don’t like how they are set up, how they’re ruled, how their existence furthers a one-size-fits-all approach to complicated social problems, or how they distort markets and behavior when they grab a share of every productive economic activity that they can spot. I don’t like how they’re the antithesis of liberty, and I particularly don’t like how their services – almost always and everywhere – are subpar.

It would be one thing if governments took 50%, 60%, or 75% of the value you created but gave you such excellent services in return that you felt like you got your money’s worth.

Instead, we get a hodgepodge of regulatory failures, bank bailouts, dead kids in the Middle East, and a runaway national debt, while politicians live grand lives at the expense of the subjects they pretend to represent. Emergency by fake emergency, they grow in size, inching the battle lines of respectable power wielding a little further each time.

Everyone I know has stories about government malpractice, about navigating impossible bureaucratic jungles, about unfair tax practices or creatively interpreted conditions that render the service for which they’re supposedly eligible less than useful.

God knows there are plenty of such stories in the private sector too (dig deep enough and you often find an unsuited government programme or regulation at the bottom of that) but at least private enterprises are financially punished for providing lousy services. And usually there are plenty of options if you want a replacement.

Proponents of governments or social democracy more broadly are often untroubled by stories of obvious government incompetence or inefficiency: that it’s always 45 minutes on the phone before one gets answers to simple questions about arbitrary tax rules; that it’s 10 weeks delay for a simple piece of paper; that every five years or so I must renew official documents that they demand I have, at my own expense. They happily shrug them off as one-offs: bugs and accidents in an otherwise well-functioning system.

It doesn’t take many steps down Alice’s more conspiratorial rabbit hole before you start thinking that the unending stories of government incompetence are connected. That it’s not by chance that government services are so bad. To put it bluntly: this is what governments do and what governments are. They are obstacles in the way: bureaucratic hurdles for the rest of us to move around. They don’t build or create anything; they live off the creation of others.

My latest story is an outstanding transaction I have with the Danish tax authority since 2017. A few years before I had the audacity to put some of my meagre leftover savings (after governments had pilfered their share) in a handful of shares in a Danish company. That was my first mistake: in a world of spendthrift governments, thou shalt not save or invest but merely spend (under certain circumstances, you may buy government bonds to keep down the interest rate on the government debt).

Through a quirk of international capital taxation that I most certainly don’t understand – and if I had to venture a guess: almost nobody does – many countries centered on taxing dividend payments from listed companies at 15%. We can argue over the ethics or efficacy of taxing money that has already been taxed several times (in consuming the company’s products and services, or through corporate income tax), but that’s not the point. Many tax systems adjust to deal with this, automatically deducting in your tax returns the dividend taxes that foreign governments have withheld against your domestic tax bill. Standard government bureaucrats shuffling money around without actually making much of an impact on anything, but since that’s what governments do nobody was much surprised.

A few countries then discovered a sneaky flaw in the system. If they upped their rate above 15% to, say 27% in the case of Denmark or 35% for Finland, they could pocket the difference if foreign shareholders were too lazy to file the papers that would claim back the excess tax. With a stroke of a legislating pen, there’d be more tax funds in the Treasury, involving only the processing of some supporting documents and a few more hires at the relevant tax authorities: a victory for everyone but taxpayers, naturally.

I was not too lazy (even though my time would have been better spent doing precisely anything else). In the winter of 2016-2017 I gathered the documents I needed, I navigated the Danish tax authority’s forms and websites, and submitted everything. A few months later, I received a confirmation that my issue had been received and was being processed. Great: I was on track to get back the lordly sum of DKK 76.68 – or about $11 at the time. More for me, and less for them – precisely in line with my ideological priors.

Then began a long stretch of silence. I made a note in my calendar to periodically remind me, but I mostly forgot about the issue. Some time in 2018, I think, I received a letter from the Danish authority saying that they’ve run into some obscure problem and that the process had been delayed: they guided, as is the way of enlightened government bureaucrats, 12-18 months.

Of course, while I waited, my 76.68 Danish Crowns were not earning interest and if anything were slowly depreciating in their purchasing power. Again, as is the government’s way.

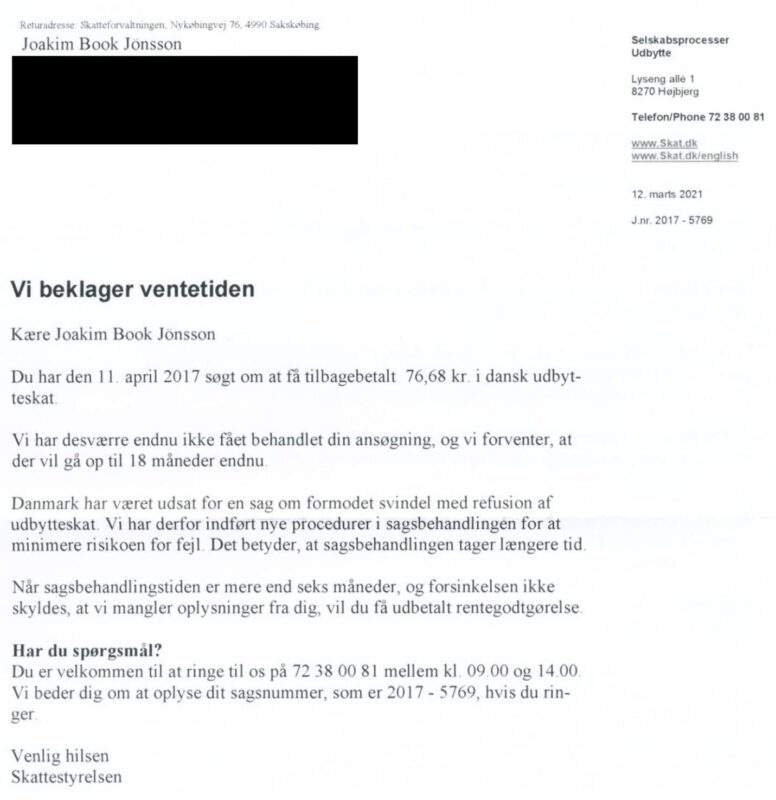

Last week, almost four years to the date after the issue had first been recorded with the Danish authority (and about 12 months longer than the maximum they had estimated), I received the attached letter in the post saying that they had been subject of some unspecific fraud and were further investigating all claims – and estimated another 18 months before payout.

Intriguingly, they mention something about paying interest for the delay. When I peruse the legalese of relevant Danish tax law, it seems to say that it will run at the official central bank rate (0.05%) plus 8%. With compounding, this would be something like 118 DKK (about $19 on today’s exchange rate) by the summer of next year.

To be seen is how they crawl themselves out of that one.

This is just one story, and all things considered a microscopically small story. But, as an old saying goes – that has unfortunately fallen out of favor in the English language but whose Scandinavian equivalent is still widely used – “Many a little makes a mickle.” And stories like these are everywhere.

In public finance, we might tip our hats to what Senator Everett McKinley Dirksen may or may not have observed against excessive government spending: “A billion here, a billion there, and pretty soon you’re talking real money.” Of course, that was before the Great Inflation, and these days the same sentiment must be expressed with “trillions.”

I’m still routinely shocked that people think governments are essential to the operating of civilized life and crucial for our well-being. The more interactions like these that I have, the more confused I am that not everyone jumps ship and embraces a smarter world.

So: tell me again, why do we need governments?