Suspiciously Pessimistic March Jobs Report

The Employment Situation report from the Bureau of Labor Statistics, known as the jobs report, was weaker than expected for March. Nonfarm payrolls added just 103,000 new jobs for the month, below the consensus expectations of 193,000. Excluding the addition of 1,000 workers from government payrolls, the private sector added just 102,000 for March. That is well below the average of 187,000 new jobs added per month over the past year. The slowdown in job creation was widespread across most industries.

However, there are a number of tensions among the details of the report and with other measures of the labor market. The unemployment rate, for example, held at 4.1 percent for March for the sixth month in a row, the lowest level since 2001, while broader measures all fell in March. The U-4 measure, which includes unemployed and discouraged workers, fell from 4.4 percent to 4.3 percent. The U-5 measure, which adds marginally attached workers, fell from 5.1 percent to 4.9 percent, and the U-6 measure, the broadest measure, which includes workers working part-time for economic reasons, fell from 8.2 percent to 8.0 percent. Meanwhile, the labor force fell by 158,000 in March, pushing the participation rate down to 62.9 percent.

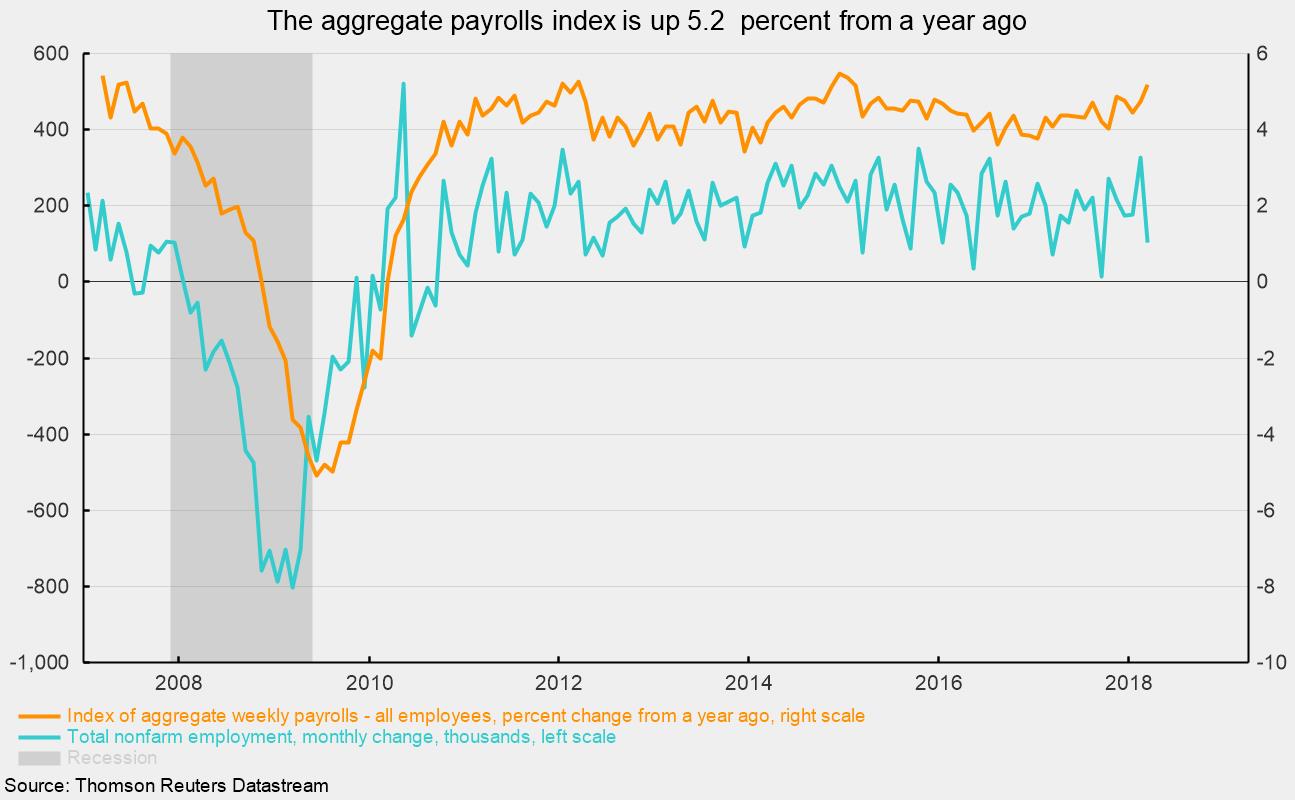

Average hourly earnings rose 0.3 percent for the month, pushing the 12-month change up to 2.7 percent from 2.6 percent, while the length of the average workweek held at 34.5 hours, just 0.1 hours below the peak of 34.6 hours last hit in January 2016. Average overtime hours in manufacturing were 3.6 in March, 0.1 hours below the record-high 3.7 hours recorded in February. The aggregate payrolls index — the combination of payrolls, hours worked, and hourly earnings — is up 5.2 percent from a year ago versus 4.7 percent in February, the fastest gain since January 2015 (see chart). That gain should provide solid support for future consumer spending.

Outside of the employment report, initial claims for unemployment insurance remain near multidecade lows and as a share of employment remain near all-time lows. Reports from the Institute for Supply Management show both manufacturers and nonmanufacturing firms have been expanding employment in March. The survey from the National Federation of Independent Businesses suggests small businesses are still planning on hiring, and the Job Openings and Labor Turnover Survey shows a near-record number of open positions across the economy. Finally, the estimate for monthly payrolls from payroll processor ADP has remained well above the 200,000 level for four straight months (while the estimate may be off in any given month, the trends have been very highly correlated), suggesting a more robust labor picture than the Bureau of Labor Statistics report shows.

Certainly, the Bureau of Labor Statistics report could be the first of a string of weaker reports on the labor market and the economy more broadly. If employers have made a strategic decision to slow hiring because of doubts about the future, that could signal a potential threat to the economic expansion. Under that scenario, wages won’t get bid up as quickly and, when combined with slower jobs gains, could restrain aggregate income growth and future consumer spending. It would also be logical that employers might also begin to slow capital investment if they believe demand might soften in the future.

However, it could also be that the March job survey is an outlier or suffers from technical issues having to do with seasonal adjustment or survey-response rates and may be revised higher in future months. The preponderance of data still support a positive outlook, but the weak jobs report raises some concerns.