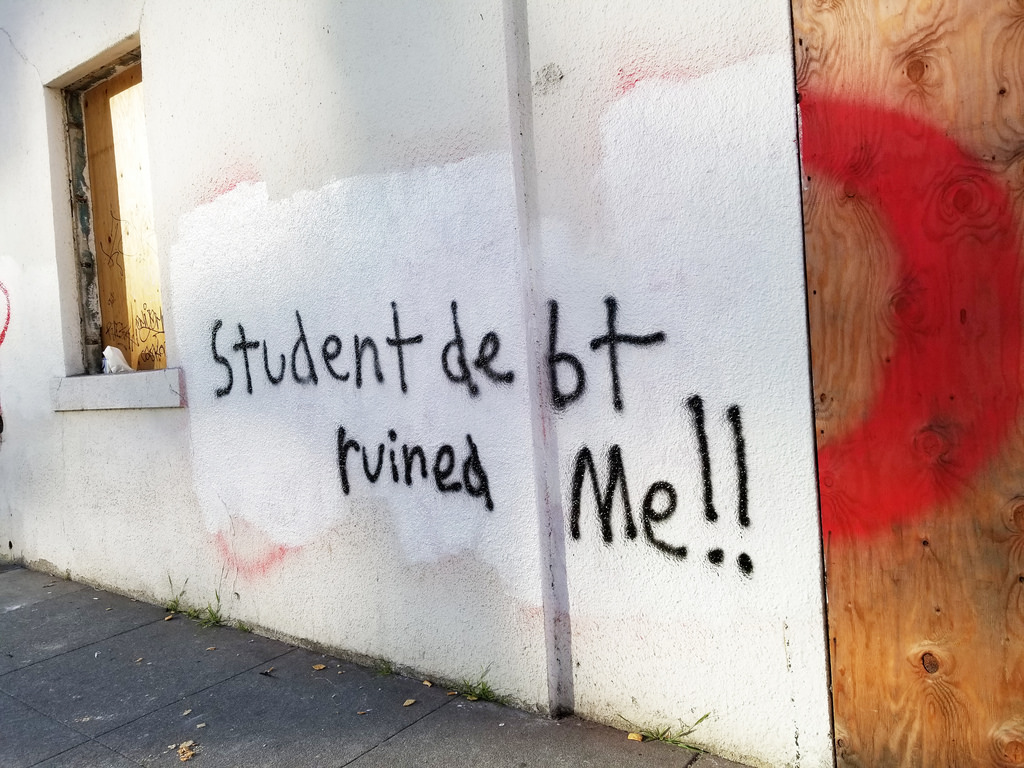

Student Debt: The Bermuda Triangle of Blame

Going into my last year at the University of Maryland, I realized I would soon need to be a real adult: get a job, find a place to live, and pay back government and private debts. For the next 15 years, I would be paying over $300 a month just to expunge all the loans taken out for my undergraduate degree. If you are one of the 40 million Americans in the same situation, you probably feel trapped and angry at the government for digging an even deeper hole just as you try to climb out into the real world. Since 1997, the price of college has more than doubled and 22 percent of students have had to take out loans. This percentage is sure to increase if some change isn’t made soon. Who is to blame for this ever-growing debt? There are three culprits:

- The colleges: Because the price of college has doubled over the past 20 years, people have been asking where all that money is going. Most of it is going into the college, with the hiring of new professors, establishing of new degrees, and expanding of campuses. The reason the colleges can get away with raising tuition every year is the next culprit.

- The government: By giving out loans to students and collecting interest on them, the government offers no incentives for colleges to lower their tuition since they are already subsidizing students to attend college in the first place. For example, the price of college at the University of Maryland in 1997 for in-state/out-of-state tuition was $3,744/$9,873 per year compared to the 2018/19 cost being $10,595/$35,216 per year. Because the cost of college has almost tripled while I have been alive, the government has had to keep offering larger loans for students to pay back their colleges. In 1997, the average student-loan debt was $10,500 for a bachelor’s degree; that number has since tripled, with the average debt being $37,172 in 2016. Since then, the government has provided various student-debt forgiveness programs, but unfortunately those still don’t indicate any real commitment to helping students escape this vicious cycle of student debt.

- The students: Not being taught financial literacy in high school is common throughout the country, so going into college and taking out a large lump sum of money from the government is confusing for the average 18-year-old. Without parental guidance, this is an intimidating and unsecure journey in which students need to take out a significant amount of loans (which they don’t have to pay back until they graduate) to achieve a higher education. Students aren’t necessarily at fault for what their earlier institutions neglected to teach them, but they do need to take some financial responsibility post-graduation. Budgeting and keeping track of how much money they are going to owe per month after they graduate (including interest) is the first step toward financial responsibility. Students need to be able to understand finances and make a plan in order to pay back the old and purchase the new. Most Americans will need to take it upon themselves to become literate in finance to start living life as comfortably as possible despite post-grad debt.

The $1.5 trillion student-debt crisis is ongoing but can certainly be mitigated if the three groups listed above work together. To at least slow down the rate of increase of college debt, the government must stop trying to help with student debt, because their efforts have caused more harm than good. Students also need to take a step back and keep track of the debts they are going to owe. If the three responsible parties work together, money is sure to be saved.