Stronger Jobs Gains, But Likely Not Enough for Fed

The latest jobs report from the Bureau of Labor Statistics, released this morning, shows improved job creation in February and employee earnings growth in line with recent trends. But the reduction in manufacturing jobs is worrying. Given these mixed signals, the report is not likely to give the Fed reasons for raising rates later this month.

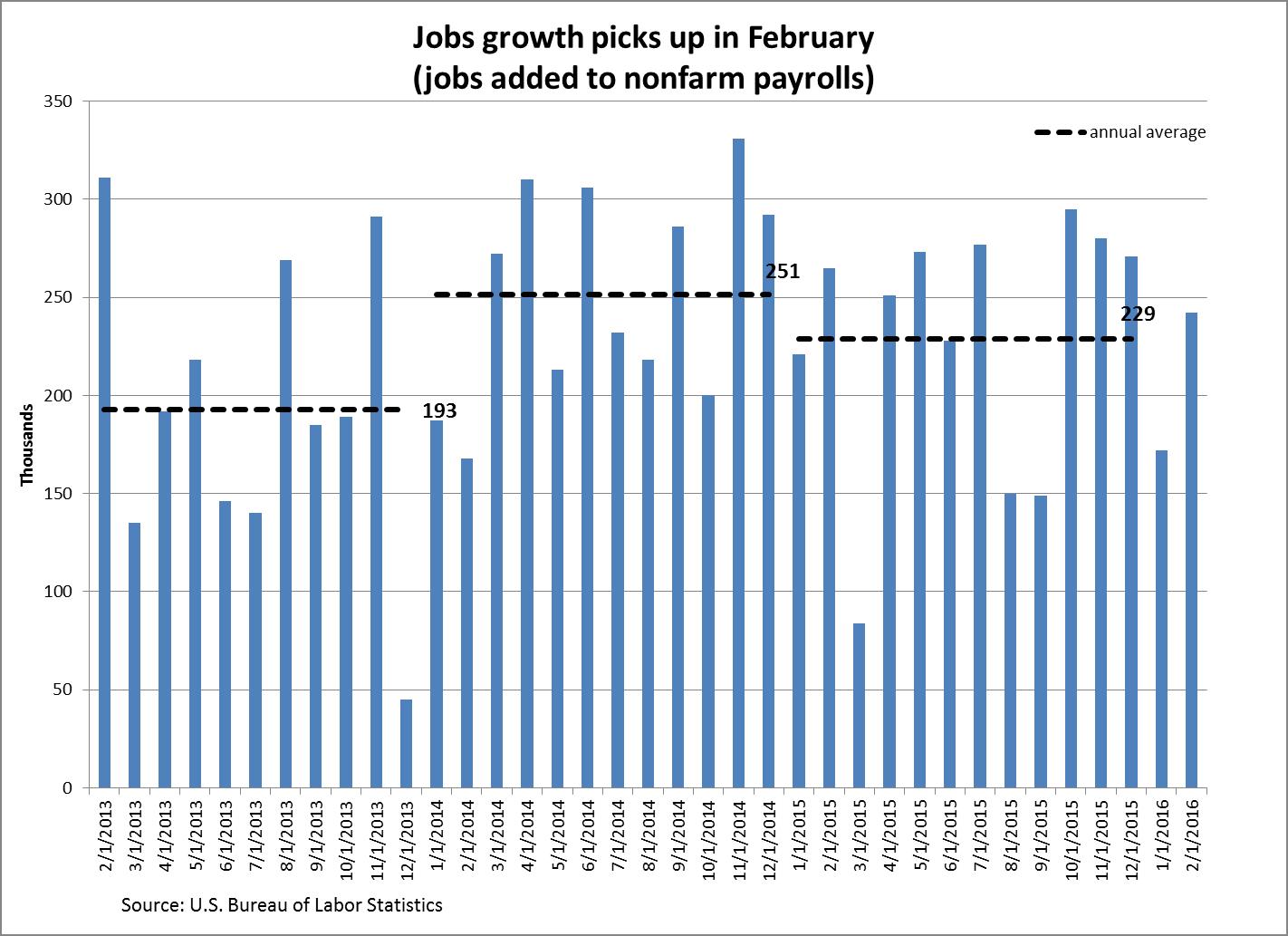

The U.S. economy added 242,000 jobs in February, according to the report. January’s jobs gains were revised up to 172,000 (from 151,000 reported last month). The private sector added 230,000 jobs, and the government added 12,000.

February’s jobs growth is above the average annual growth in 2015 (see chart 1). If this faster pace of job gains persists, it would represent a noticeable improvement in job creation compared to last year. A persistently higher rate of jobs growth, which would indicate significant improvements in the labor market, may lead the Fed to raise interest rates again. Whether such a rate increase would happen at the Fed’s meeting later this month remains uncertain, however, since one month of strong jobs data is not sufficient to conclude that a new trend has emerged.

Most of the jobs growth came from the private sector, which added 230,000 jobs. Goods producing industries lost 15,000 jobs, with all sectors within this category losing jobs, except construction, which added 19,000 jobs. Among the private service providing sectors, which collectively added 245,000 jobs, the health care and social assistance sector added the most jobs, at 57,400.

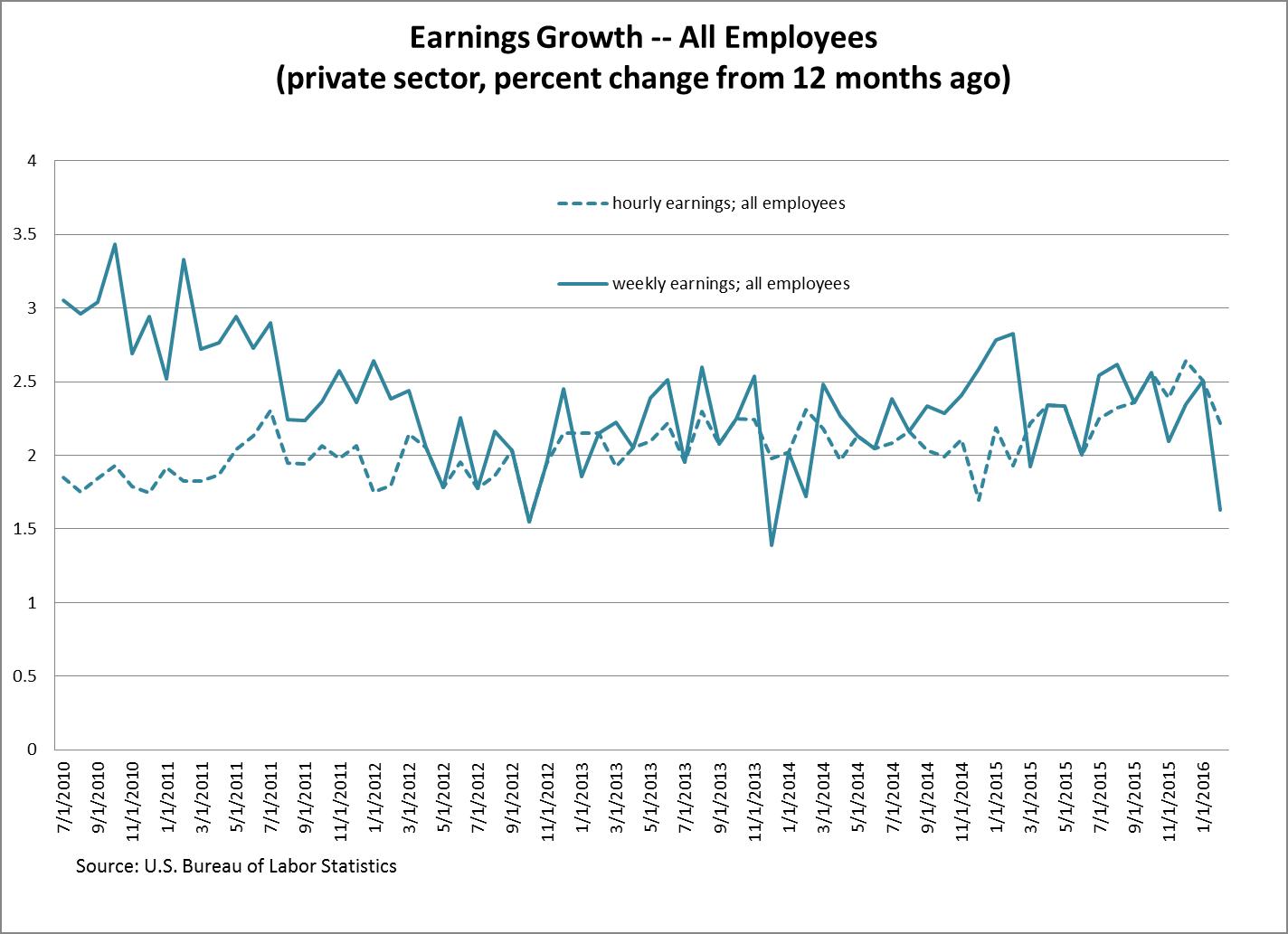

Average hourly earnings of all employees in the private sector in February were 2.2 percent higher than a year ago. Average weekly earnings, which take into account the variation in hours worked and represent a better measure of the income employees receive, were only 1.6 percent higher. This is a slower pace of growth in weekly earnings than was seen since the start of 2014. (See chart 2).

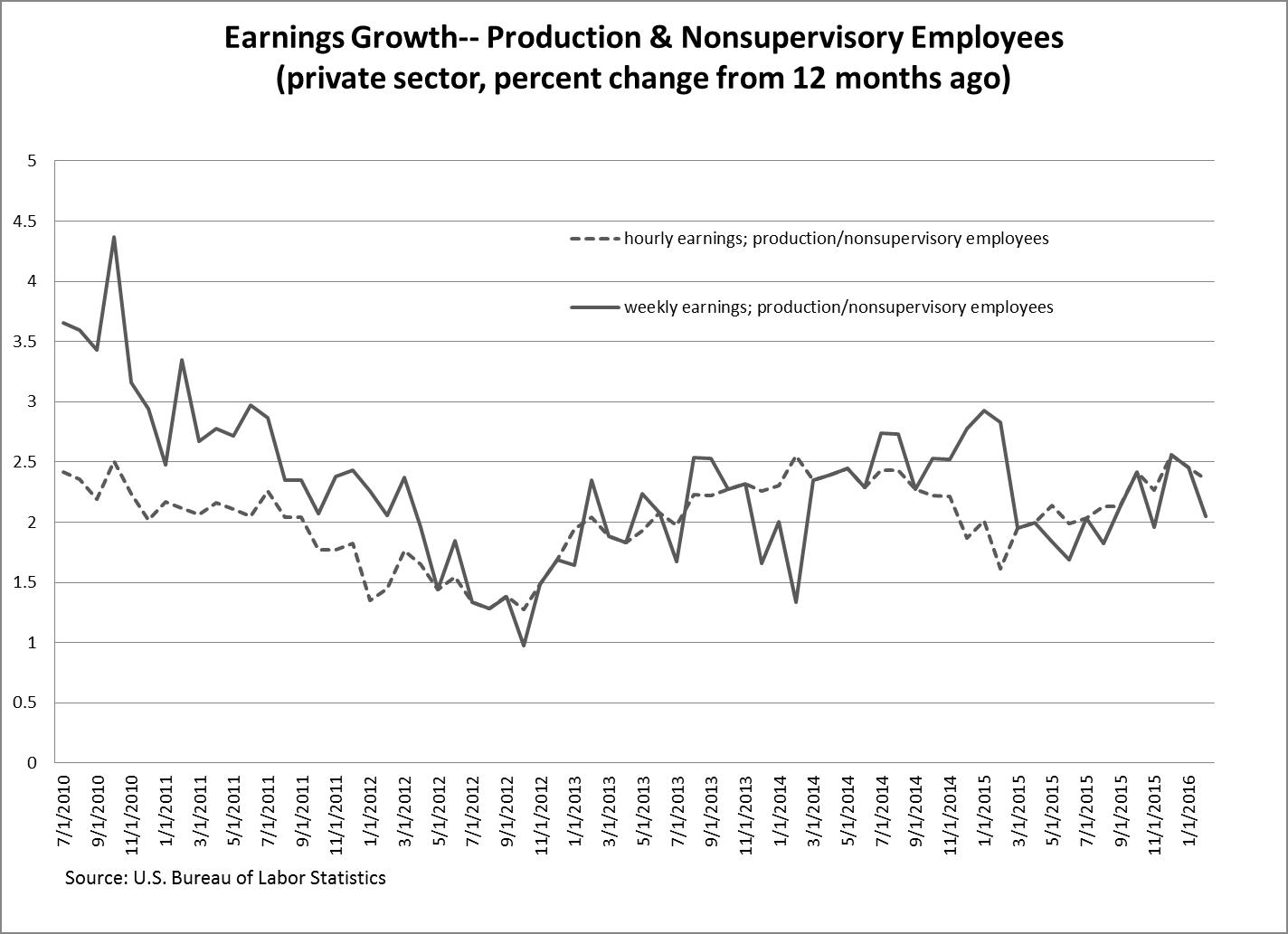

However, the earnings of all employees mix together the pay of hourly workers with that of highly paid supervisors and executives. To get a better sense of the evolution of incomes of ordinary workers, one should look at earnings of production and nonsupervisory employees. In February their hourly earnings were 2.4 percent higher than a year ago, and their weekly earnings (a better measure of income) were up 2 percent compared to a year ago. This is close to the average pace of growth seen in 2015, but below the growth seen in 2014. (See chart 3.)

Chart 3:

The unemployment rate remained unchanged in February, at 4.9 percent. Most economists consider such a low unemployment rate to be consistent with the U.S. economy being close to full employment, which is a situation where not much slack exists in the labor market.

More people seem to joining the labor force – a positive sign. In February, the labor force grew by 555,000 people and the number of those employed by 530,000, leading the employment-to-population ratio to edge up to 59.8 percent in February, from 59.6 percent in January. However, the number of the unemployed also rose by 24,000. The labor force participation rate rose to 62.9 percent in February (up from 62.7 percent the month before), which usually indicates that people see improved chances of getting a job.

The duration of unemployment rose somewhat. In February, half of the unemployed have been out of work for 11.2 weeks or less, up from 10.9 weeks in January. This might mean that people who have been unemployed for shorter periods of time are finding jobs more easily than those who have been unemployed longer. In fact, the fraction of unemployed who have been out of work for half a year or more increased in February – from 26.9 to 27.7 percent of all unemployed.