Strong Dollar a Burden on Corporate Profits From Abroad

In February we analyzed the impact of the stronger dollar on the various sectors of the U.S. economy, as part of our new report, Business Conditions Monthly.

In it we noted, “The surging dollar may be a boon for consumers who reap the benefits of potentially cheaper imports, but it can be a burden for U.S. corporations.” This has proven to be true as the ensuing months unfolded.

We said the companies most likely to feel the negative effects of a rising dollar are those that do a lot of business abroad. These are more likely to be big multi-national corporations that you are likely to see in indices such as the Dow Jones Industrial Average and the Standard & Poor’s 500 Index.

Standard & Poor’s estimated that as of 2012, more than 46 percent of S&P 500 member sales come from foreign markets.

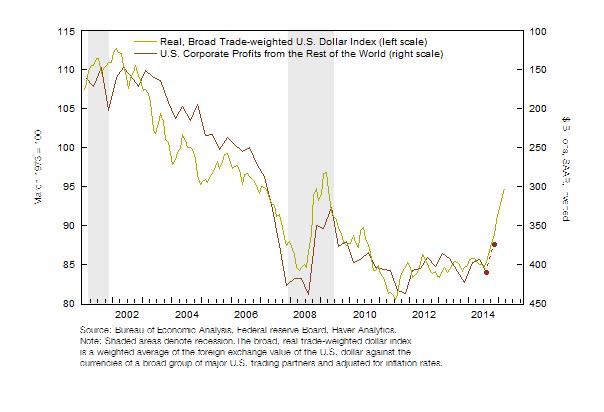

In the report, we examined the components of U.S. corporate profits and showed that corporate foreign profits in the third quarter of 2014, the last available data point at that time, were estimated to be more than $400 billion.

However, given the historical relationship between the dollar and total corporate profits derived from the rest of the world, we expected to see a decline to somewhere in the $300 to $350 billion range over the coming quarters.

Among the possible reasons we noted for the decline were:

• With a strong dollar, exports generate relatively less revenue. If corporations maintain prices in foreign currencies, once it is converted to dollars, it creates a price cut or discount on the value of those sales. If corporations want to maintain dollar revenue from abroad without increasing sales, they would need to raise prices in local currencies, which could slow demand. Either way, corporations can expect reduced foreign revenue, tighter margins, or both.

• As the dollar gains against the local currency used in a foreign market, locally based competitors’ prices become cheaper in that currency relative to U.S.-produced goods. Foreign corporations that transact within their own markets will not need to make the same sacrifices as their American counterparts. As locally made products become relatively cheaper than U.S.-produced goods, global demand for U.S. products may weaken.

• A strong dollar may signal weak global demand irrespective of exchange-rate fluctuations. One of the reasons that the dollar has surged is because expected global growth lags U.S. growth forecasts.

Data for the fourth quarter are now available and show that corporate foreign profits fell to $374.3 billion, in line with our expected pace of decline (see chart). With the dollar still showing strength against most trading partners, we continue to expect downward pressure on corporate foreign profits over the coming quarters.