State and Local Governments Should Not Get a Bailout – either from Congress or the Federal Reserve

For years, public finance experts have been warning about fiscal irresponsibility by state and local governments.

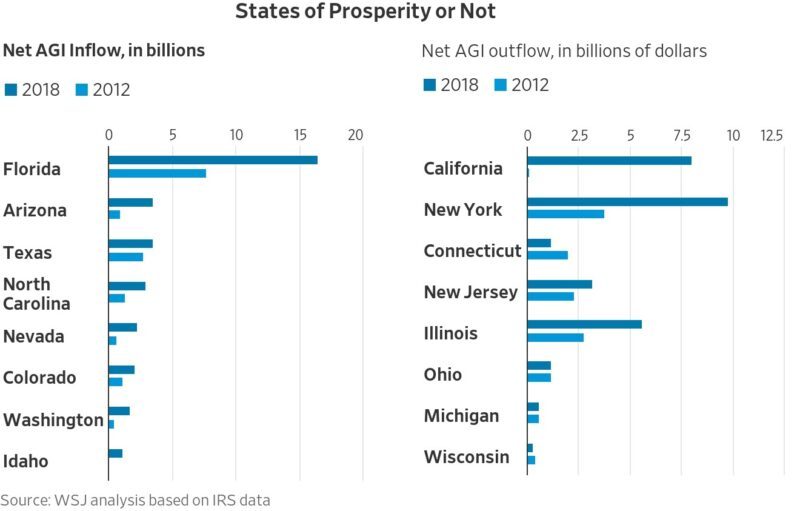

Many of those governments have been spending too much money and making overly expensive promises to interest groups such as government employees. Combined with the fact that these jurisdictions are driving away taxpayers, this leaves them vulnerable to potential crisis if the economy falters.

Which, of course, is exactly what happened with the coronavirus.

As is so often the case, Washington responded in an imprudent manner. As part of multi-trillion dollar emergency legislation (the CARES Act), Congress directly funneled hundreds of billions of dollars to state and local governments.

That legislation also gave the nation’s central bank, the Federal Reserve, the authority to steer money to those same governments.

Notwithstanding all this generosity, state and local politicians are now asking for even more money. In part, this is a fight over the provisions of a potential new “stimulus” bill from Congress.

But it’s also a battle over the fate of the Federal Reserve’s ability to interfere with the allocation of capital by directing money to state and local governments.

In a report for the New York Times, Jeanna Smialek and Alan Rappeport explain what’s happening.

A political fight is brewing over whether to extend critical programs that the Federal Reserve rolled out to help keep credit flowing to…municipalities amid the pandemic-induced recession. …Those programs expire on Dec. 31, and it is unclear whether the Trump administration will agree to extend them. The Federal Reserve chair, Jerome H. Powell, and Treasury secretary, Steven Mnuchin, must together decide whether they will continue the programs — including one that buys state and local bonds, another purchasing corporate debt and another that makes loans to small and medium-size businesses. …Mnuchin…has signaled that he would favor ending the one that buys municipal bonds. And he is under growing pressure from Republicans to allow all five of the Treasury-backed programs to sunset. …The financial terms for buying state and local debt…are not generous enough to compete in a market functioning well… Their main purpose has been to reassure investors that the central bank is there as a last-ditch option if conditions worsen.

However, economic conditions have dramatically improved since the coronavirus first hit, so there’s no longer any argument that financial markets are dealing with crisis conditions.

But that doesn’t seem to matter to politicians who want to subsidize bad fiscal policy at the state and local level.

Some Democrats had begun eyeing the municipal program as a backup option in the event that state and local government relief proved hard to pass through Congress. While the program’s terms are unattractive now, they could in theory be sweetened under a Biden administration Treasury Department. …If a coronavirus vaccine is rolled out in the coming weeks, the Treasury Department may be less inclined to extend the programs. Mr. Trump could also block a reauthorization by pressuring Mr. Mnuchin, leaving Mr. Biden with fewer economic stimulus tools at his disposal. …state and local governments are facing budget shortfalls, albeit smaller ones than some had initially projected.

Nick Timiraos reports on the issue for the Wall Street Journal.

Divisions over their future are being amplified by partisan gridlock in Congress over whether to provide more economic stimulus. Democrats, looking ahead to President-elect Joe Biden’s inauguration in January, see the programs as a potential tool to deliver more aid if Congress doesn’t act, while some Republicans are worried about relying on central bank lending powers as a substitute for congressional spending decisions. …A decision not to renew the programs…could also deprive some…governments of access to low-cost credit if market conditions worsen. …If the Trump administration decides not to extend the programs, Mr. Biden’s Treasury Department could determine whether to reactivate them in some fashion after the new administration takes office Jan. 20.

The bottom line is that a Biden Administration likely will be able to give states and localities a bailout, even if Congress doesn’t approve a new “stimulus,” and even if the Trump Administration doesn’t extend the Federal Reserve’s authority. But at least the incoming Biden people would have to jump through a few hoops.

Which is very unfortunate since it will reward the jurisdictions that behaved recklessly. A classic example of “moral hazard.”

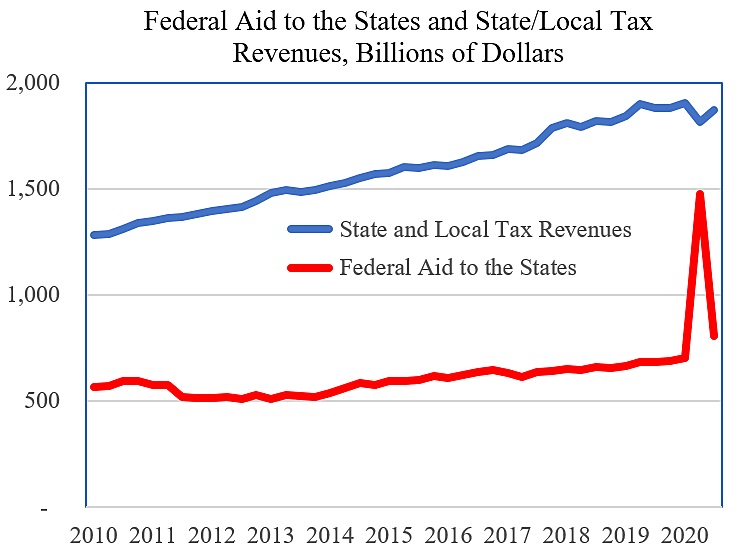

I’ll close with this critical bit of data from Chris Edwards. As you can see, state and local governments actually have profited from the coronavirus since they got far more money from the CARES Act than they lost because of diminished tax revenue.

For what it’s worth, the Federal Reserve has always had the ability to steer money to state and local governments, both as part of normal monetary policy operation and because of its vast emergency powers. The good news is that it has not gone down that path.

And the best way to make sure it doesn’t go down that path in the future is to eliminate or restrict such powers. Private markets, which reflect the preferences of consumers, should determine the allocation of capital. We don’t want to copy the mistakes of China and have government making those choices.

Reprinted from International Liberty