Your Guide to Understanding Real vs. Nominal GDP

You may hear macroeconomists referring to nominal GDP and real GDP, and feel that the conversation is shrouded in mystery. Why do these experts believe that the level of GDP we observe is merely nominal and that something called real GDP exists that one cannot observe directly?

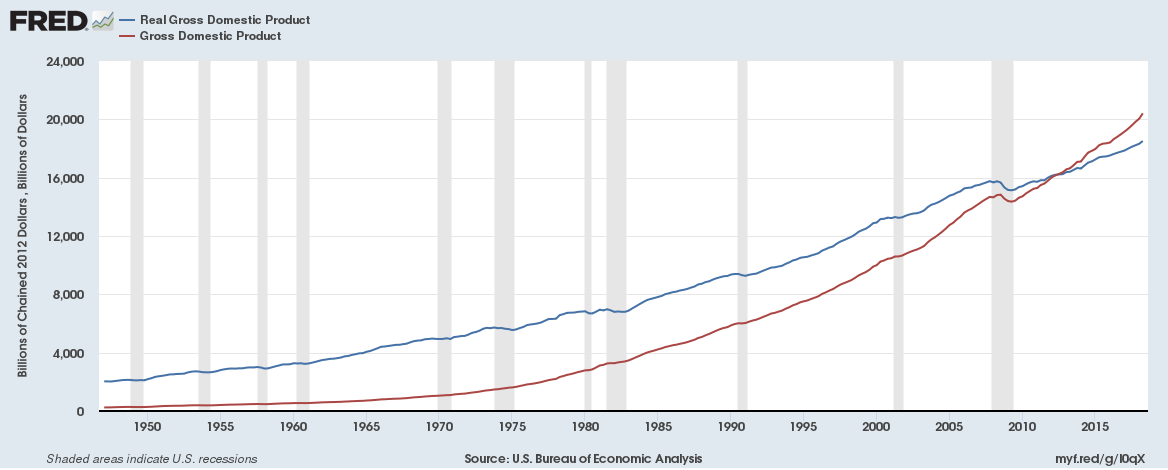

For those unacquainted with macroeconomic theory, the growth of nominal GDP, often just called GDP, may seem beneficial. It may be, but it may also be evidence of changes in the demand for or supply of money. We cannot know without more information.

In what follows, I will clarify the meaning of the terms “nominal” and “real” GDP. I will highlight problems that can arise if one does not distinguish between the short-run and the long-run effects of changes in money demand or supply by using the logic implied by the equation of exchange that value in the form of total expenditures can be represented by estimates of the price level and real income.

To understand how the real-nominal dichotomy sheds light by separating changes in value from changes in average prices, imagine your boss gives you a 20 percent raise. This seems like a fantastic development. Then you go to the store and see that the price of your favorite cheese has increased from $6 per pound to $12 per pound. A gallon of the milk you usually buy has increased from $3 to $5. All across the store, the prices of most goods seem to have doubled. Now your 20 percent raise no longer heralds the good news you had at first thought it did. It is actually a sign that prices are tending to increase. Worse, your wages are unable to keep pace with the increase in prices. What appeared to be an increase in income is actually a loss of real income.

Including real GDP in the analysis allows us to account for changes in the value of money. If the value of money falls, nominal GDP rises. However, real GDP will be little, if at all, affected by the change. Why? The devaluation of money is typically the result of excessive money creation or people’s expectations of it. When new money is printed, there are no new goods added to the economy. To be sure, high levels of uncertainty might lead investors to hold more currency, in which case the creation of new money would relieve an excess demand for it. In this case, the loss of income for money holders that would have resulted from the money creation will tend to be diminished. But this scenario is the exception, not the rule.

Real GDP is an estimate of the inflation-adjusted value of goods and services in an economy. It is an estimate of value in the economy as measured by a currency unit with stable purchasing power. It would be a mistake to think real GDP represents these goods and services themselves. Although real GDP accounts for the creation of goods in the economy, attempts are made to account for shifts in preferences that evidence themselves as shifts in prices. Real GDP represents the value attributed to these goods by individuals capable of purchasing them.

Imagine we live in a world with only three goods. One of these goods is pizza. The other two goods are water and brandy. Now suppose people like brandy so much that they spend, on average, 30 percent of their incomes on it. If GDP is $1 million, then brandy represents $300,000 worth of income.

One day, nearly everybody who liked brandy before now prefers to live in soberness. That $300,000 of brandy becomes worth $50,000, and drunk by only a few. Without any change in the money supply or in the existing stock of goods, GDP has suddenly fallen from $1 million to $750,000. What happens to the remaining money? If we assume it is all spent on pizza and water, then total spending does not change. If no new pizza or water has been created, then the prices of these goods simply rise. Nominal GDP remains $1 million. At the other extreme, consumers prefer to hold all the unspent money, in which case nominal GDP falls to $750,000, evidencing an indisputable loss of value.

Individual preferences lie somewhere along this spectrum. In the case in which the money formerly spent on brandy is left unspent rather than spent on pizza and water, the economy experiences a drop in real GDP without a change in the available goods and services. Even if the nominal value of GDP remains the same as the result of the shift in expenditures, the change in consumer preferences cannot meaningfully be described with aggregate statistics. Alternatively, the price of pizza would adjust in the short run if consumers preferred to spend money on existing goods rather than increase money holdings. Only after the quantities supplied of pizza and water increased in response to the shift in demand would the price of pizza fall. Then the goods produced in the economy would correspond with consumer preferences. In the long run, the unwanted brandy would be replaced by more pizza and water.

Part of the beauty of macroeconomics is its simplicity. Part of this simplicity lies in the assumptions that preferences are constant and that deficiencies in capital structure are usually not great enough to hinder analysis. There are cases, as shown above, where traditional analysis falls short. This is not reason to abandon aggregate analysis, as such analysis reveals aspects of the economy that would otherwise remain unobservable. These shortcomings merit a cautious approach, one that does not depend solely on aggregate analysis.