Trump’s Economy?

President Donald Trump is quick to take credit for positive economic performance. The state of the economy has improved since he took office, with annual real GDP growth edging above 3 percent in recent quarters. Emblematic of this attitude, he tweeted in September:

Improved economic growth appears to be be the result of Trump’s recent tax cuts and a generally positive stance toward business in the United States.

Should a president claim credit for improvements in economic performance? If Trump takes credit for economic growth, perhaps he should also take responsibility for less fortunate news. This is not his inclination. After the recent elections, Trump claimed that “the prospect of Presidential Harassment by the Dems is causing the Stock Market big headaches!” For Trump, Democrats or uncooperative administrators are responsible for bad economic outcomes. The reality is, of course, more complicated.

I have no doubt that the stance of the president affects markets. The more a Big Player like Trump can promote conditions and expectations of economic growth, the more efficiently can entrepreneurs manage their businesses and pursue the creation of wealth. The president can lower costs for business by reducing efficiency-reducing regulations and taxes.

The converse is also true. Trump has overseen an increase in deficit spending with no clear plan for a reversal. Trump has raised tariffs in hopes of bargaining for better terms of trade with other countries. But success on this front is far from guaranteed. Indeed, the immediate result has been increased uncertainty for import and export businesses. This strategy can quickly devolve into the choosing of winners and losers, winners being protected industries and losers being those businesses that rely on imports impacted by the tariffs or who are affected by retaliation. Trump’s support of immigration restriction further increases costs borne by businesses who typically hire these immigrants.

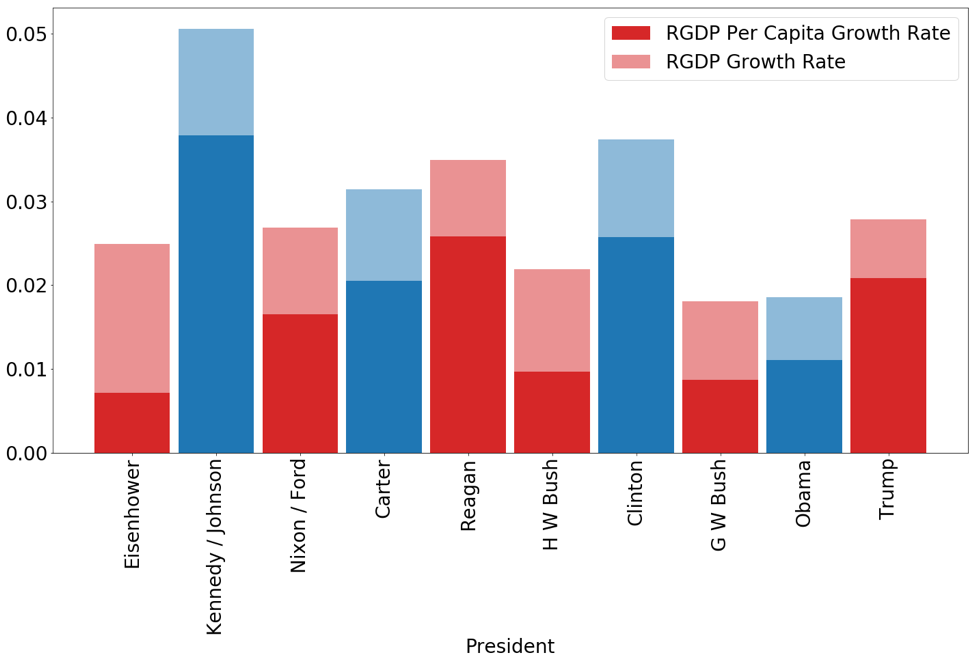

Is economic growth under a Trump presidency unprecedented? Compared to other presidents since Eisenhower, the Trump administration has performed about average. In terms of real GDP growth, Trump ranks 5th out of the last 10 presidents. He ranks 4th in real GDP per capita. To be fair, growth of an economy appears to slow as it matures, much as an adolescent grows more slowly than a newborn. But in 1950, near the start of Eisenhower’s administration, the U.S. economy was not exactly nascent. It has been a leader in growth compared to other nations perhaps since the American Civil War and certainly since the end of World War I.

We need only look back to the Clinton presidency to see a higher rate of real GDP growth than we have seen under Trump. The Clinton administration oversaw three years of fiscal surplus, arguably making it the last fiscally conservative administration. Clinton’s reappointment of Greenspan was likely a boon to economic growth, as was his willingness to work with a Gingrich-led Republican party in implementing reform. While not a paragon of laissez-faire policy, the Clinton administration provided a stable policy environment. Growth of industry during his presidency suggests that the current growth is far from unprecedented.

Long-term stability in economic growth owes to the robustness of economic organization in the United States. A single president might transform the economic landscape, but that transformation is necessarily constrained. The policy of a president can impact the rate of growth of real GDP somewhat, but it is unlikely that a given administration would lead economic growth to vary greatly from average. We might hope that if Trump cut all tariffs to zero, reduced federal expenditures, and opened immigration to any non-criminal who would like to work in the United States, long-run growth of real GDP would significantly improve. Conversely, we would expect that the implementation of burdensome regulation, dramatic increases in the level of federal expenditures in light of an already-existing large federal debt would lead to poorer economic outcomes. But such extreme shifts in policy seem unlikely. Hence, deviations from the median rate of growth will probably be modest.

The economy preexists any regime entering power. The restructuring of the economy takes time, as does substantial change in a policy environment. Instead of looking to presidents for economic leadership, let’s first be thankful for a culture and organizational structure that promotes economic growth by protecting private property and limiting interference by the ruling elite. This is the key to economic prosperity. The value of presidents’ leadership ought to be judged by their impact on the institutions that protect and sustain this organization.