Policy Trajectory and Investor Expectations

Market structure is not only determined by present conditions. It is formed in light of expectations of future conditions. These expectations drive present investment decisions. Thus, volatility in expectations can drive volatility in markets. For this reason, Milton Friedman suggested that the best monetary policy is a predictable monetary policy. A predictable policy can anchor expectations. In another post, I showed how this argument leads many theorists to support rules-based policy. Likewise, monetary authorities and other policy makers strive to anchor expectations by suggesting or conveying commitment to future policy.

Alan Greenspan was a master of leading market expectations, typically ensuring investors that the Federal Reserve would support demand for liquidity through purchases of short-term bonds during a crisis. Regarding Y2K, which had to do with changing date formats from representing the year in two digits to representing it in four, many investors were concerned that records of financial accounts would be disrupted.

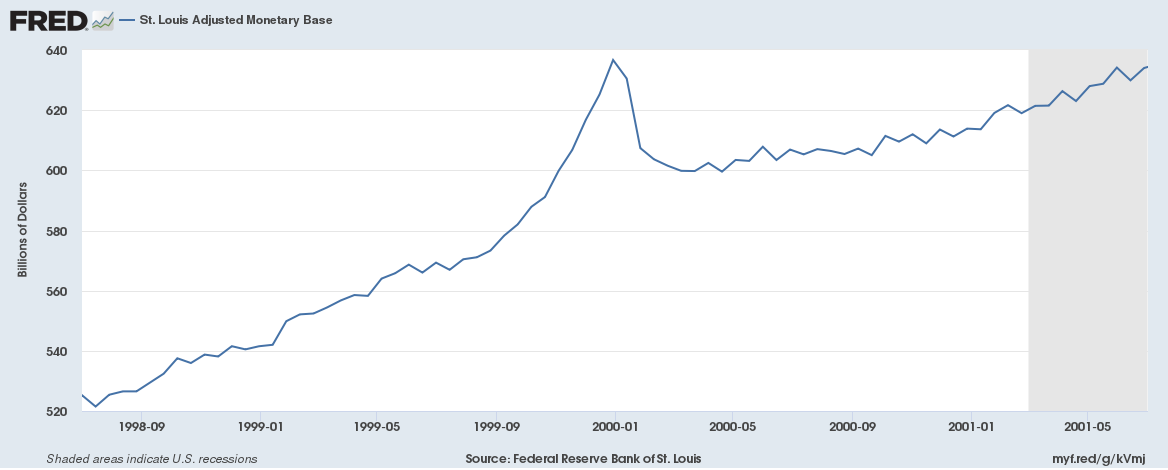

To alleviate that concern, Alan Greenspan temporarily deviated from what had been a relatively steady growth path for the monetary base. The Fed also increased the quantity of physical currency to satisfy worried investors’ desired increases in cash holdings. By showing a willingness to accommodate market demand for liquidity due to a potential technological crisis, the Greenspan Fed assuaged most investors. The year 2000 rang in without a crisis, though some do blame Greenspan’s accommodation for the Nasdaq bubble that followed. Soon after, the Federal Reserve allowed the growth path of the base money stock to return to the norm of the Greenspan era.

“Open mouth operations” is a term that has been used to describe part of the monetary authority’s role in leading investor expectations. When the Federal Reserve announces a change in its federal funds rate target, the market often moves the rate before the Federal Reserve attempts to implement the target. The logic is easy to understand if you imagine the position of an investor at the time that officials announce a change in the target.

Suppose Jerome Powell announces that the new federal funds rate target will increase by 100 basis points. If the current target is 2 percent, the new target will be 3 percent. Before the Federal Reserve began to pay interest on excess reserves, this would necessarily haveimplied that it would reduce the rate of growth of the money stock by buying less or selling more existing government bonds. This would then impact rates in the overnight lending market, which is the object of the federal funds rate target. If investors expect that this will be the course of events, they will immediately adjust the prices of assets to reflect the future change. This means banks will begin to charge more for loans and investors will be unwilling to purchase securities that do not reflect the expected increase in interest rates. It is by this process that markets play a predictive function.

Monetary authorities are not the only policy makers that impact investment decisions. Any policy change expected to affect returns on investment will have this impact. Recent comments from President Donald Trump have strongly impacted markets. A title of an article written at the start of the Trump presidency makes this clear: “Trump’s ‘Open-Mouth Operations’ Make Twitter Key for Currency Traders.” Immediately after Trump tweeted that the strong dollar was hurting the ability of the United States to compete with foreign producers, the dollar took a sharp, if brief, fall.

Unlike an announcement by Federal Reserve officials, the president’s tweets do not provide a clear forecast of future policy, but rather convey a disposition. More recently, Trump tweeted that he had “authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward,” adding, “Our relations with Turkey are not good at this time!” The tweet has been followed by further weakening of the lira against the dollar. The tweet clarified a change in policy, but the comment concerning “relations with Turkey” is open to interpretation as it is unclear in what manner the comment is intended to influence future relations with Turkey.

Whether it is the chair of the Federal Reserve or the president, policy makers have powerful influence over investors’ expectations and, therefore, decisions. Concerning monetary authorities, Milton Friedman observed that “by setting itself a steady course and keeping to it, the monetary authority could make a major contribution to promoting economic stability.”

Monetary authorities tend to do a good job of maintaining stable expectations, at least during periods of calm. Other policy makers would do well to apply Friedman’s advice to their own actions. Weaponizing one’s influence over expectations can certainly shake up a political scene, but it also serves to shake markets, the source of material prosperity. Political maneuvering has real effects on prosperity. A calming of the political climate and political rhetoric will tend to be a positive influence on economic growth at home and abroad.