Hayek on sensible monetary policy

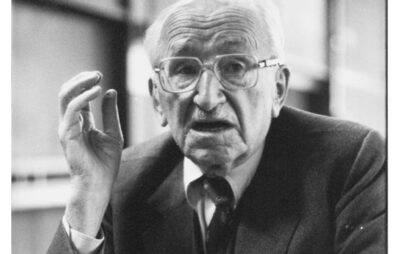

This year marks the seventieth anniversary of the publication of “Road to Serfdom”by Frederick Hayek, as well as the fortieth anniversary of the award of the Nobel Prize in Economics to Hayek. Hayek’s enduring contributions to our understanding of the “Uses of Knowledge in Society”and characterization of markets as “mutualization of knowledge”are well known.

Less well known are Hayek’s views on money, and governments’role in the provision of money. In a collection of “oral history”video tapes of various scholars interviewing Hayek in 1978 (digitized and made available by the Universidad Francisco Marroquin in Guatamala) Hayek described to Professor Axel Leijonhufvud how the writing of “The Constitution of Liberty”led him to return to questions of monetary theory.

As one of his inventions (as opposed to discoveries) Hayek told Leijonhufvud about “my new monetary scheme,”in which,

“I have come to the conclusion that it is not sufficient to deprive government of other arbitrary powers, but we can never hope to preserve a free economic order unless you take from government the monopoly of issuing money. So, this forces one back to rethink a good deal about monetary theory and I’m at the moment trying to get back to …the question, ‘is the stabilization of money compatible with its functions?…I became aware that there is no chance of effectively limiting the power of government over the economy except by depriving it (of a monopoly), plus the insight that in the present political order it is impossible for government to conduct a sensible monetary policy.”

Of course, Hayek was speaking at the time of the severe ‘stagflation’of the late 1970s during the presidency of Jimmy Carter when simultaneous high inflation and high unemployment seemed intractable problems. Recent consumer inflation has been low, but so has been economic growth. “Pedal to the metal” monetary policies–known as quantitative easing–have sent asset prices soaring in the so far futile hope that a ‘wealth effect’ will kick in and boost output and employment (before consumer prices start to soar). It is likely that Hayek would once again be calling for the end of monopoly money.