Blockchain Basics: Bitcoin, Lightning, and Ripple

Social media is abuzz with talk of blockchain technology. Discussions of public ledgers, distributed-payment systems, and cryptocurrency mining are fascinating but often fail to clarify the technology being discussed. In this article, I will consider the different structures of the Bitcoin, Lightning, and Ripple networks and how those different structures affect the networks’ efficiency and security.

What Is a Blockchain?

A blockchain is an accounting system in which transactions on the system must be recognized as legitimate by some minimum proportion of nodes in the system. I will consider two means of legitimating a change on the blockchain ledger. In one type of system, this can be accomplished by mining, where competing users attempt to solve for a value that, when algorithmically transformed, matches the code required by the system. These miners are rewarded with either newly generated cryptocurrency or a fee. Other systems, as we will see in discussing the Ripple Network, use a decentralized process that guarantees the legitimacy of transactions through interwoven layers of democratic approval of some minimum threshold.

Blockchain technology provides the benefit that no trusted third party is required for confirming the legitimacy of transactions. Without blockchain, the asset of concern must actually be transferred to the third party, who can then confirm that the asset has not been promised to someone else, or, in other words, has not been double spent. The ability of blockchain technology to solve this problem justifies its description as a trustless system, meaning individuals who otherwise would not trust one another can trust the truth of transactions recorded on the blockchain.

Bitcoin Network

Bitcoin is the most popular blockchain network and was an innovator in blockchain technology. It is a public blockchain, meaning no single entity owns it. A majority of blocks whose keys have been mined must agree on the legitimacy of each transaction registered on the blockchain. This translates to a democratic standard of “one CPU, one vote.” Only if a majority of the solutions to the algorithmic puzzles hold claims that corrupt the ledger can false accounting be registered as true. This democratic process allows nodes to assume the branch with the longest history of transactions approved by this process represents the truth, and therefore that branch is adopted as the appropriate branch on which to record transaction histories.

The difficulty of acquiring a solution to an encrypted key on the Bitcoin blockchain increases as the processing speeds of miners increase: “To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases” (3).

Thus, the speed of processing payments with Bitcoin can only increase if the size of blocks increases or if a new technology is innovated to work in tandem with the existing system. BitcoinCash, a fork in the Bitcoin blockchain, increased the blocksize from 1 to 8 MB. Those who preferred to maintain Bitcoin’s original structure have elected for a different solution: SegWit and the Lightning Network.

Lightning Network

In August 2017, SegWit (Segregated Witness) was launched. This protocol allows for witness data (user identification) to be separated from data held in each official block. The witness data are then stored on an adjacent block. This reduces the amount of data required to record each exchange on the official block by about three-quarters. Thus, about four times as many transactions can be recorded on each block, meaning SegWit potentially increases the speed of transactions on the Bitcoin blockchain by a factor of four. It also allows for off-chain transactions such as those that occur on the Lightning Network.

The Lightning Network is a blockchain that operates adjacent to the existing Bitcoin blockchain. Lightning Network users make off-chain transactions between one another denominated in Bitcoin. Those members who participate in the Lightning Network agree not to broadcast their transactions to the official Bitcoin ledger until an agreed-upon time. For every exchange, both parties create encrypted contracts recognizing the terms of the exchange. Each must sign the other’s contract. In this manner, the two parties can participate in an unlimited number of transactions before the agreed-upon date when they will both upload the updated ledger to the official Bitcoin blockchain. The Lightning Network also allows Bitcoin to be used in smart contracts even though the original Bitcoin structure does not allow for this. Over the last year, vulnerabilities in the Lightning Network have been revealed. While even with correct functioning of the Lightning Network, technical problems still remain, it holds many promising applications.

Ripple Network

The final structure we will consider is the Ripple Network’s consensus model. Unlike Bitcoin’s blockchain, which relies on limitations in block-processing speed described above, Ripple’s blockchain relies on consensus within and between groups in the network. Unlike Bitcoin, it is a privately owned blockchain.

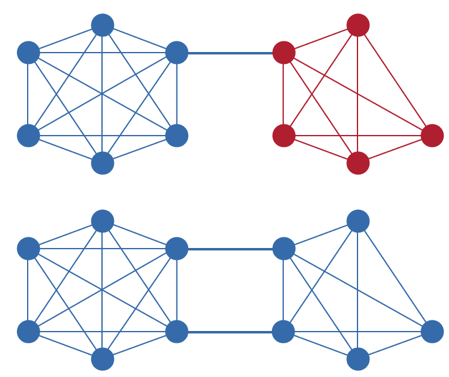

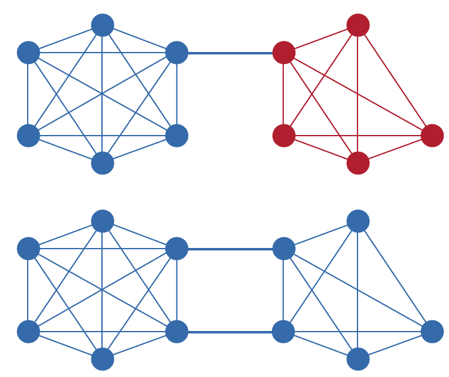

Source: “Ripple Protocol Consensus Algorithm.”

The update of Ripple’s blockchain occurs through affirmation by and between trusted nodes. In their description of consensus, Schwartz, Youngs, and Britto consider the case of two cliques only connected by a single link between a single member of each clique. A clique is a group of users all connected to one another. This redundancy in connection ensures that every user recognizes the same ledger updates. For a subset of the Ripple Network to update their ledgers, at least 80 percent of the members of the subnetwork must recognize a transaction as legitimate. The creators of the network wish to prevent a situation in which two cliques accept as valid ledgers that cannot be mutually reconciled. If 20 percent of the users in each clique are connected to nodes in the other clique, the two cliques cannot “reach consensus on conflicting transactions since it becomes impossible to reach the 80% threshold.” In reality, most subnetworks do not consist of a single clique, so the problem of a fork in the ledger where two cliques legitimate conflicting accounts is “much more difficult to achieve, due to the greater entanglement” of nodes. This structure of communities of nodes and the process of decentralized updating allow for transactions to be processed securely and at an especially high rate. Ripple also relies on several other security protocols including detecting the splitting of cliques and identifying and removing malicious nodes. The Ripple blockchain does include a cryptocurrency, XRP, but allows for transfer of assets other than XRP, including major currencies and even gold.

Conclusion

An understanding of the structure of the blockchain and the benefits and limitations associated with each can facilitate a discussion of the implications of blockchain for money and commerce. The speed and security of each technology guide potential use and development. As development of blockchain technology is occurring at a fast pace, it is necessary for researchers, policy makers, and other interested parties to develop an understanding of the many unique features of different blockchains.