Small-Business Survey Weakens Again in January

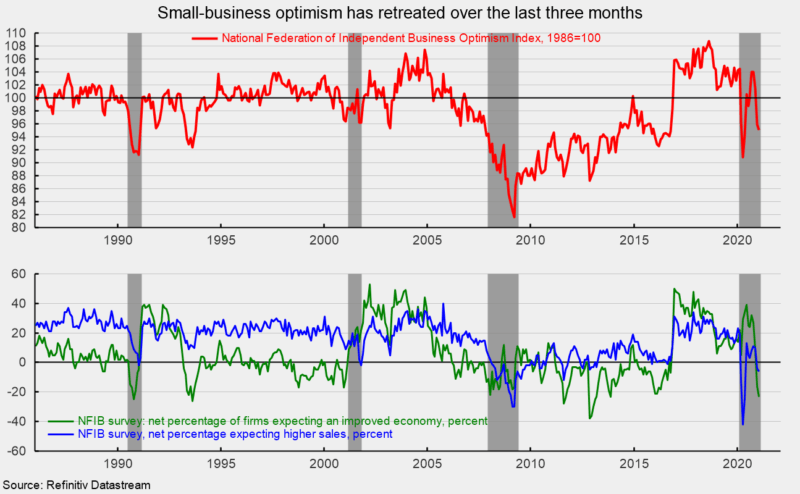

The small-business-optimism index from the National Federation of Independent Business fell 0.9 points to 95.0 in January, the third consecutive decline following back-to-back readings of 104.0 in September and October (see top of first chart). The latest result is well below the 1986 through 2006 average of 101.0. Details within the report suggest that small-business owners are concerned about future general economic conditions and about their own business.

Within the details of the small business survey, the net percentage of respondents expecting better economic conditions (“better” minus “worse”) fell to -23 in January versus -16 in December. This index had been as high as 39 in June 2020 but now is at the lowest level since November 2013 (see bottom of first chart).

A net -6 percent expect higher sales over the next three months versus the prior three months, down from the net -4 percent in December. Excluding a three-month run of negative results during the worst of the government-imposed lockdown from March through May 2020, the back-to-back negative readings are the worst results since 2011 (see bottom of first chart). A net -7 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 5 points from a -2 percent in December.

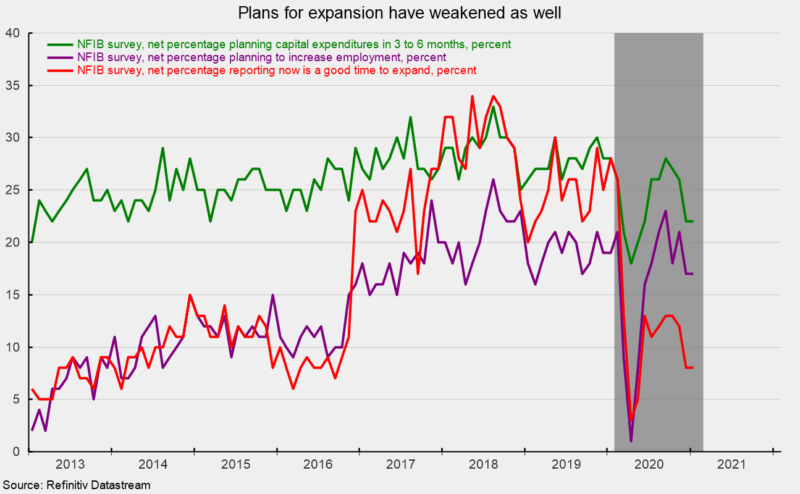

Along with the weak results from the expectations for the economic outlook and the outlook for sales, the percentage of respondents believing now is a good time to expand came in at 8 in January, unchanged from the previous month, and a generally weak result compared to the 2017 through 2019 results (see second chart).

Twenty-two percent of firms have plans for capital expenditures over the next three to six months, unchanged from the prior month and excluding the initial lockdown period, the lowest result since March 2015 (see second chart). Fifty-five percent of small businesses have made capital expenditures during the past six months. That is below the typical percentage in the upper 60s during the late 1990s but above the mid-40s percentages during the 2008-09 recession. The most popular type of expenditure was equipment (41 percent) followed by vehicles (27 percent) and building/land improvement (15 percent). The most popular outlay range was $10,000 to $49,999.

The percentage of firms planning to increase employment was unchanged at 17 percent in January, towards the lower end of the range of results from 2017-2019 (see second chart). A substantial 33 percent of firms (up from 32 percent in December) still report having openings they are not able to fill at the moment despite the elevated level of unemployment. The percentage of firms reporting few or no qualified applicants for job openings was 46 percent, down from 48 percent in December but still a high level. The results suggest there is a skills shortage in the U.S.

That skills shortage has 25 percent of firms saying they have already increased compensation over the past three months while 17 percent intend to increase worker pay over the coming months.

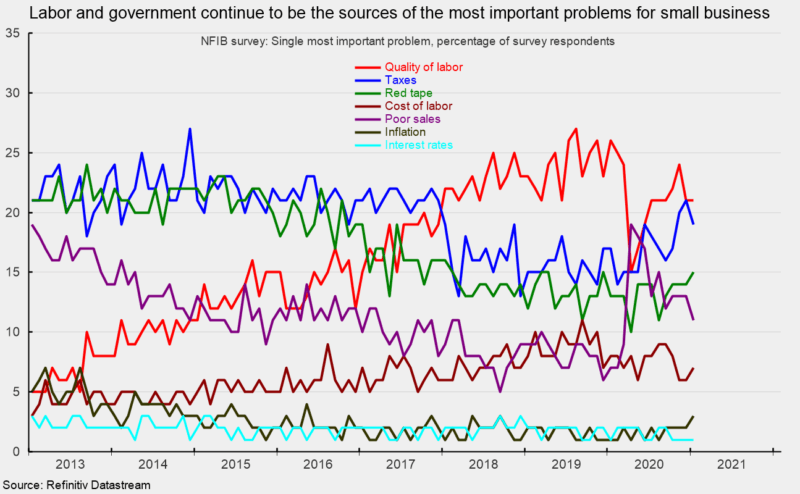

The skills shortage is also keeping quality of labor at the top of the most important issue for small businesses. Among the 10 issues listed in the survey, quality of labor again ranks first at 21 percent, 6 points below the survey high of 27 percent. Taxes were second at 19 percent while government regulation (red tape) was third at 15 percent and poor sales was fourth on the list at 11 percent (see second chart). Also noteworthy is the increase in both cost of labor and inflation in the latest survey, although they both are relatively low in the rankings.

Overall, the survey suggests that the small-business sector of the economy is a bit more cautious about the future. Still, while small businesses may be growing more cautious about the outlook, they are looking to hire employees and make some capital expenditures, though according to the report, conditions vary widely by industry. Finally, despite the weak labor market, a shortage of skilled workers continues.