Small-Business Survey Shows Mixed Expectations in October

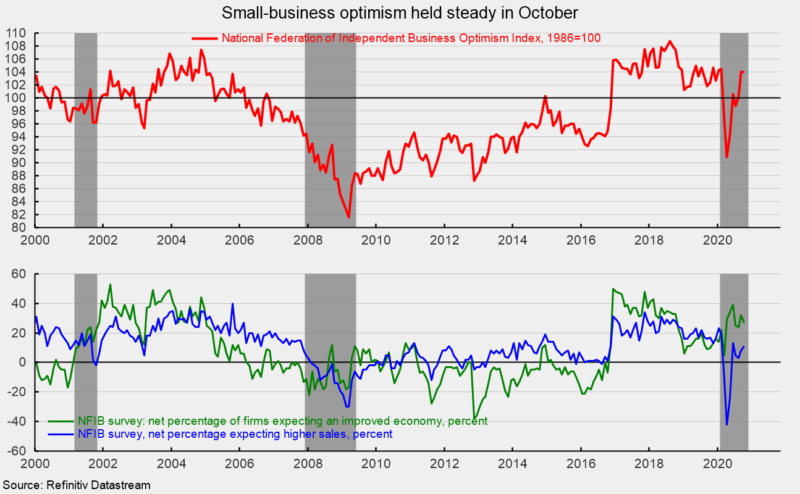

The small-business-optimism index from the National Federation of Independent Business was unchanged at 104.0 in October (see top of first chart). The latest result is about in line with results from 2019 and reflects a substantial recovery from the 90.9 reading in April 2020. Details within the report suggest that small-business owners remain fairly optimistic about future general economic conditions but somewhat less optimistic about their own business.

Within the details of the small business survey, the net percentage of respondents expecting better economic conditions (“better” minus “worse”) fell to 27 in October versus 32 in September. While the monthly decline suggests some deterioration in expectations, the index remains at a reasonably favorable level (see bottom of first chart).

However, a net 11 percent expect higher sales over the next three months versus the prior three months, an improvement from the net 8 percent in September. The 11 percent result is generally weak compared to results from 2017 through 2019, suggesting a significant amount of caution (see bottom of first chart). A net 6 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up 12 points from a -6 percent in September.

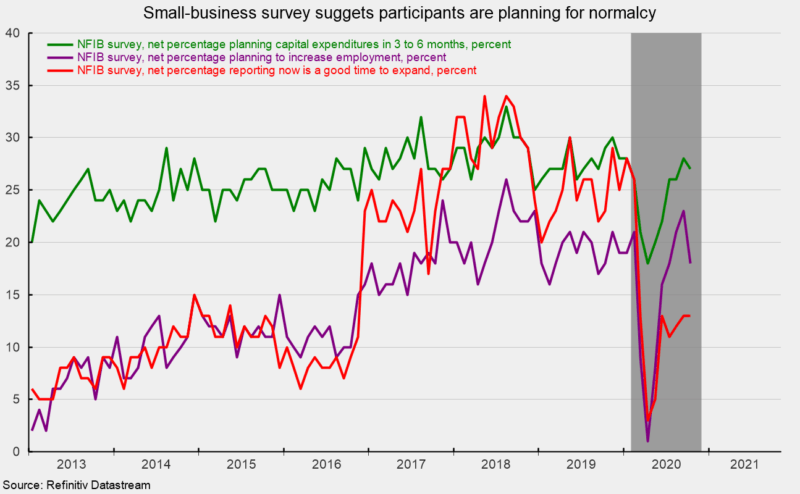

Along with the somewhat contrasting results from the expectations for the economic outlook (generally favorable) and the outlook for sales (generally weak), the percentage of respondents believing now is a good time to expand came in at 13 in October, unchanged from the previous month, and a generally weak result compared to the 2017 through 2019 results (see second chart).

Twenty-seven percent of firms have plans for capital expenditures over the next three to six months, down from 28 percent from the prior month but about in line with 2019 (see second chart). Fifty-three percent of small businesses have made capital expenditures during the past six months. That is below the typical percentage in the upper 60s during the late 1990s but above the mid-40s percentages during the 2008-09 recession. The most popular type of expenditure was equipment (36 percent) followed by vehicles (20 percent) and building/land improvement (16 percent). The most popular outlay range was $10,000 to $49,999.

The percentage of firms planning to increase employment fell to 18 percent in October versus 23 percent in September, matching the result from July and about in line with the results from 2017-2019 (see second chart). Surprisingly, 33 percent of firms (down from 36 percent in September) still report having openings they are not able to fill at the moment despite the elevated level of unemployment. The percentage of firms reporting few or no qualified applicants for job openings was 48 percent, down from 50 percent in September but still a high level. The results suggest there is a skills shortage in the U.S.

That skills shortage has 23 percent of firms saying they have already increased compensation over the past three months while 18 percent intend to increase worker pay over the coming months.

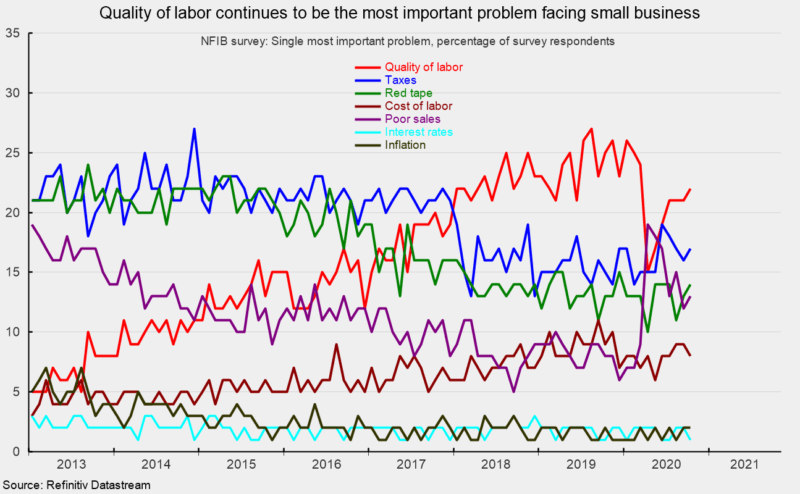

The skills shortage is keeping quality of labor at the top of the most important issue for small businesses. Among the 10 issues listed in the survey, quality of labor again ranks first at 22 percent, 5 points below the survey high of 27 percent. Taxes were second at 17 percent while government regulation (red tape) was third at 14 percent and poor sales was fourth on the list at 13 percent (see second chart).

Overall, the survey suggests that the small-business sector of the economy remains somewhat optimistic about the outlook for the economy but remains a bit more cautious about its own future. Still, while small businesses may not believe it’s a good time to expand, they are looking to hire employees and make some capital expenditures. Finally, despite the weak labor market, a shortage of skilled workers continues.