Small-Business Optimism Remained High in February but COVID-19 Increases Uncertainty

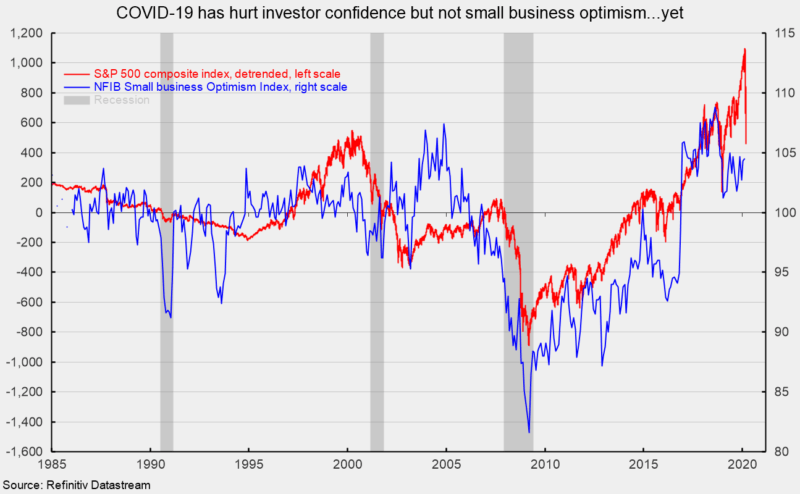

The small-business-optimism index from the National Federation of Independent Business rose to 104.5 in February, up 0.2 points from 104.3 in January and it is now 4.3 points below the all-time high of 108.8 in August 2018 (see chart). The latest result extends a run of 39 consecutive months above 100, averaging 104.8 over the period, a very high figure by historical comparison.

Among the key take aways are concern over the tight labor market and the difficulty in finding qualified workers. The persistent high level of optimism stands in sharp contrast to investor optimism as reflected in the performance of the S&P 500. The popular benchmark index has declined sharply in recent weeks over fears over COVID-19 spread (see chart). The effects of the COVID-19 outbreak remain fairly limited for the small-business sector.

Within the details of the small business survey, the percentage of respondents believing now is a good time to expand came in at 26, down from 28 in January. However, the net percentage of respondents expecting better economic conditions (“better” minus “worse”) came in at 22, up from 14 in January.

A net 19 percent of respondents expect higher sales over the coming months, down from 23 in January, while a net 5 percent report higher sales for the most recent three months versus the prior three months.

The percentage of firms planning to increase employment rose to 21 percent in February. A near-record 38 percent (versus a record 39 percent) of firms report having openings they are not able to fill at the moment. At the same time, the percentage of firms reporting few or no qualified applicants for job openings was 52 percent, up from 49 percent in January and now 5 points below the record 57 percent from August.

The combination of healthy labor demand and weak supply has a near-record net 36 percent of firms saying they have already increased compensation over the past three months while 19 percent intend to increase worker pay over the coming months.

The labor-market dynamics have made quality of labor the most important issue for small businesses. Among the 10 issues listed in the survey, quality of labor ranks first at 25 percent, two points below the survey high of 27 percent. Taxes were second at 14 percent while government regulation and red tape was third on the list at 13 percent. Inflation along with financing and interest rates were at the bottom of the list with just 1 percent and 2 percent of respondents identifying them as the single most important problem, respectively. Inflation has been at the bottom of the list for several years, reflecting the slow pace of price increases over the current economic cycle.

Capital expenditures by small businesses also remain solid, with 62 percent of such businesses having made capital expenditures during the past six months. That is slightly below the typical percentage in the upper 60s during the late 1990s but well above the mid-40s percentages during the last recession. Twenty-six percent of firms have plans for capital expenditures over the next three to six months, down slightly from 28 percent from the prior month. The most popular type of expenditure was equipment (43 percent) followed by vehicles (26 percent) and building/land improvement (18 percent). The most popular outlay range was $10,000 to $49,999.

Overall, the survey suggests the small-business sector of the economy remains relatively robust, with labor-market concerns holding front and center. The direct impact of the COVID-19 virus remains relatively limited for now.