Slowing Growth Raises Questions

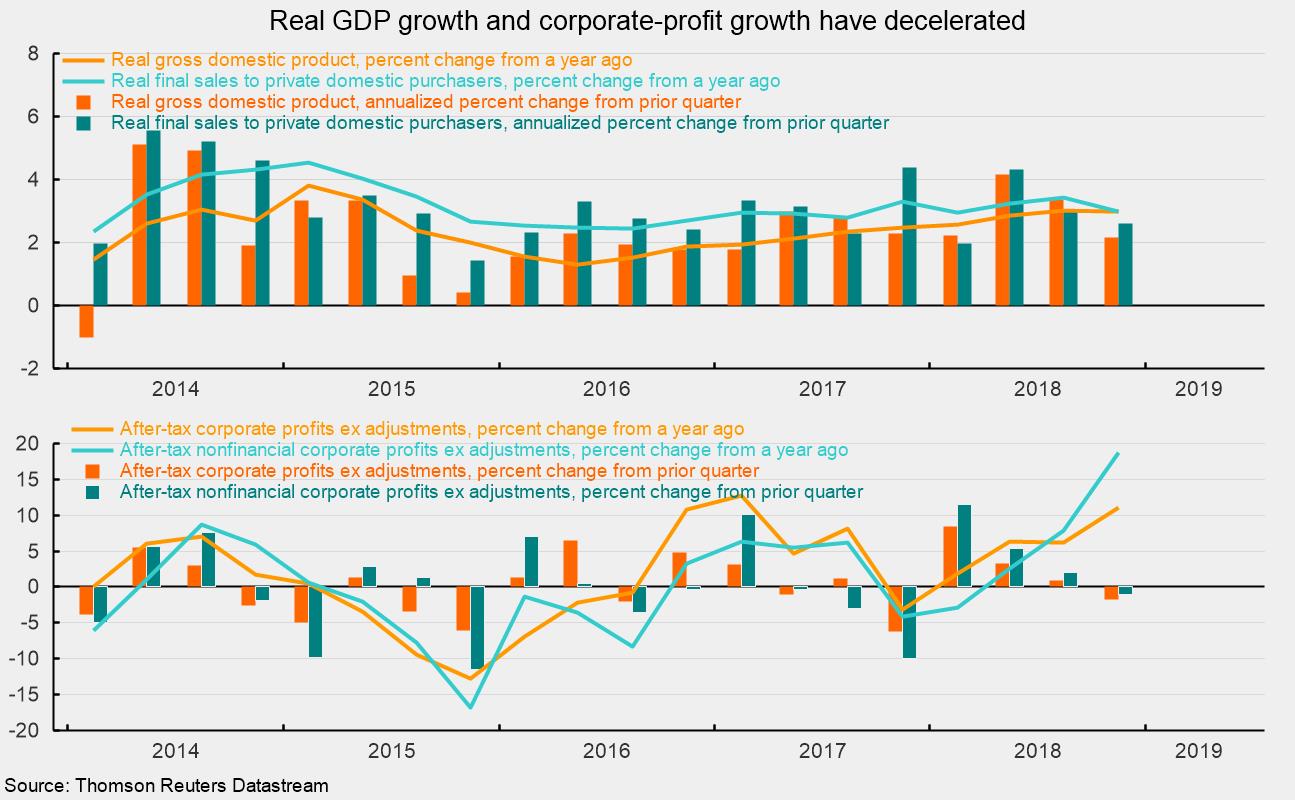

Real gross domestic product rose at a 2.2 percent annualized rate in the fourth quarter, down from a 3.4 percent pace in the third quarter, according to the Bureau of Economic Analysis. The final quarter of 2018 marks the second consecutive deceleration in quarterly growth. Measured from fourth quarter 2017 to fourth quarter 2018, real GDP increased 3.0 percent (see chart). For calendar year 2018, real GDP grew 2.9 percent, the highest rate since 2015. Growth in the fourth quarter was driven primarily by solid gains in consumer spending and business investment. Consumer-price increases remained below 2 percent. Corporate profits declined in the fourth quarter from the third quarter but are still up versus a year ago. Overall, the report raises some questions about the durability of the current expansion, but continued expansion remains the most likely path.

Consumer spending decelerated in the fourth quarter, rising at a 2.5 percent pace following robust gains of 3.5 percent and 3.8 percent in the third and second quarters, respectively. The deceleration was concentrated in nondurable-goods spending, up 2.1 percent versus 4.6 percent in the third quarter, and services, gaining 2.4 percent versus 3.2 percent previously. Durable-goods spending rose 3.6 percent versus 3.7 percent in the prior quarter. Consumer spending contributed 1.7 percentage points of the 2.2 percent real-GDP growth rate.

Business fixed investment rose at a 5.4 percent annualized rate in the fourth quarter, more than double the 2.5 percent pace of the third quarter. At annualized rates, the gain was led by a 10.7 percent jump in intellectual property spending while spending on equipment rose 6.6 percent. Investment spending on structures fell 3.9 percent following a 3.4 percent fall in the third quarter and two quarters of double-digit growth in the first half of 2018. Real business fixed investment contributed 0.73 percentage points to overall real GDP growth versus a 0.35 percentage-point contribution in the third quarter.

Real residential investment, or housing, fell at a 4.7 percent pace in the fourth quarter compared to a 3.6 percent decline in the prior quarter. Housing has declined in six of the past seven quarters and continues to face a challenging environment, with rising home prices dragging down affordability.

Real inventory accumulation by businesses continued in the fourth quarter, adding 0.11 percentage points to fourth-quarter growth after adding 2.33 percentage points in the prior quarter. Real exports rose at a 1.8 percent pace, contributing 0.22 percentage points to growth while real imports grew at a 2.0 percent rate, subtracting 0.30 percentage points in the calculation of real gross domestic product growth.

Government spending fell at a 0.4 percent annualized rate in the fourth quarter compared to a 2.6 percent increase in the third quarter, subtracting 0.07 percentage points from growth versus adding 0.44 percentage points in the prior quarter.

Real final sales to private domestic purchasers, a key measure of private domestic demand, rose at a 2.6 percent annualized rate in the fourth quarter, down from a 3.0 percent pace in the third quarter. The fourth-quarter gain was the fourth time in the past nine quarters that growth fell below 3 percent.

Distortions from the government shutdown and elevated uncertainty surrounding trade policy and global economic conditions likely weighed on economic activity in the final quarter of 2018. Though the government shutdown has ended, the high degree of uncertainty has not, and it may influence first-quarter economic activity as well.

The underlying trend in real private domestic demand has been well-supported by continued job creation, rising wages, healthy corporate and consumer balance sheets, solid corporate-sales and corporate-earnings growth, and high levels of business and consumer confidence. Data over the first quarter suggest some of the supports have weakened somewhat. However, most metrics remain at levels consistent with economic growth, suggesting that despite some patches of weakness and elevated levels of uncertainty, continued economic expansion in the months and quarters ahead remains the most likely path.

On the prices side, consumer prices — the personal-consumption-expenditures price index — rose at a 1.5 percent pace in the fourth quarter, slower than the 1.6 percent pace in the third quarter. The rate of increase in the personal-consumption-expenditures price index has decelerated for four consecutive quarters. Over the past four quarters, the increase is 1.9 percent. For core consumer prices, which exclude volatile food and energy components, the index rose 1.8 percent, up from 1.6 percent in the prior quarter. Over the last four quarters, core consumer prices rose 1.9 percent. Core consumer-price increases have stabilized at just under 2 percent and appear unlikely to accelerate dramatically in the quarters ahead.

Corporate profits on a pretax basis including inventory valuation and capital-consumption adjustments as calculated in the national income and product accounts, fell 0.4 percent in the fourth quarter following a 3.5 percent increase in the third quarter. From a year ago, profits were up 7.4 percent. After taxes, profits were essentially unchanged in the fourth quarter versus the third quarter and up 14.3 percent versus the fourth quarter of 2017.

Excluding the inventory-valuation and capital-consumption adjustments used in national income and product accounts, after-tax profits fell 1.7 percent, the third period in a row with weaker results than the prior quarter (see bottom chart). From a year ago, however, profits were up a healthy 11.1 percent, the fastest pace since the first quarter of 2017. Excluding the financial sector, after-tax profits fell 1.0 percent versus the prior quarter and posted a very robust gain of 18.7 percent from a year ago, the fastest pace since 2012.