Slowing Economy Still Supported by Consumers

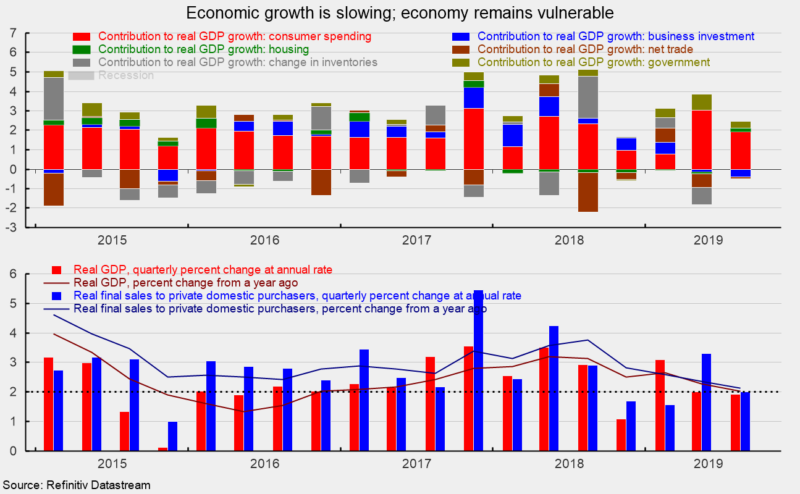

Real gross domestic product rose at a 1.9 percent annualized rate in the third quarter, down from a 2.0 percent pace in the second quarter, according to the Bureau of Economic Analysis. Growth was driven primarily by a moderate gain in consumer spending. Housing investment and government spending made small positive contributions while business investment, net trade, and inventory change made small negative contributions in the calculation of gross domestic product. Overall, the report is in line with most other economic data that suggests the U.S. economic expansion continues but the pace has slowed.

Consumer spending decelerated in the third quarter, rising at a moderate 2.9 percent pace compared to a 4.6 percent growth rate in the second quarter. The deceleration was broad-based across the major segments of consumer spending, with durable-goods spending rising 5.5 percent versus 8.6 percent in the second quarter, nondurable-goods spending up 4.4 percent versus 6.5 percent, and services gaining 1.7 percent versus 2.8 percent. Consumer spending contributed all 1.9 percentage points of the 1.9 percent real GDP growth rate versus 3.0 percentage points in the second quarter (see top chart).

Business fixed investment fell at a 3.0 percent annualized rate in the third quarter versus a 1.0 percent pace of decline in the second quarter. At annualized rates, the drop was led by a 15.3 percent fall in spending on structures while spending on equipment declined 3.8 percent. Investment in intellectual property products rose 6.6 percent continuing a run of 11 consecutive quarters of growth. Real business investment deducted 0.40 percentage points from overall real GDP growth versus a 0.14 percentage-point deduction in the second quarter.

Residential investment, or housing, rose at a 5.1 percent pace in the third quarter compared to a 3.0 percent decline in the prior quarter. The gain breaks a string of six consecutive declines for residential investment. Housing had benefited from a drop in mortgage rates over recent months. However, future activity continues to face a challenging environment with interest rates starting to rise again and home prices continuing to rise, albeit at a slowing pace.

Altogether, business and residential investment declined at a 1.3 percent pace in the third quarter, subtracting 0.22 percentage points from total GDP growth compared to a 0.25 percentage-point deduction in the second quarter.

The pace of inventory accumulation by businesses was little changed in the third quarter, slowing to a $69.0 billion pace in real terms, from $69.4 billion in the second quarter. The decelerating in inventory accumulation reduced real GDP growth by .05 percentage points in the third-quarter after subtracting 0.91 percentage points in the prior quarter.

Net trade also had a small negative impact in the calculation of overall GDP growth in the third quarter, subtracting 0.08 percentage points. Exports rose at a 0.7 percent pace while imports grew at a 1.2 percent rate. The outlook for trade remains highly uncertain given erratic trade policy and slowing global growth.

Government spending rose at a 2.0 percent annualized rate in the third quarter compared to a 4.8 percent increase in the second quarter, contributing 0.35 percentage points to growth versus a 0.82 percentage-point contribution in the prior quarter. Government spending rose in nearly every category, with federal defense spending up 2.2 percent, federal nondefense spending up 5.2 percent, and state and local spending up 1.1 percent. Exploding federal deficits remain one of the most significant risks to the medium- and long-term outlook for the economy.

Real final sales to private domestic purchasers, a key measure of private domestic demand, rose at a modest 2.0 percent annualized rate in the third quarter, down from a 3.3 percent pace in the second quarter. The third-quarter gain was the third time in the past four quarters that growth was at or below 2 percent. Those results pushed the year-over-year gain to just 2.1 percent, well below the 5-year annualized pace of 2.9 percent.

Consumer spending remains the main driver of overall economic expansion. Continued job creation, rising wages, healthy balance sheets, and favorable levels of consumer confidence provide a solid foundation, but some warning signs are emerging. The virtuous cycle between the consumer and corporate sectors could be at risk if erratic policy drags down consumer and business confidence leading to a prolonged retrenchment. The uncertain outlook is further supported by the results of the AIER Leading Indicators index, which remained just slightly positive in September.

On the prices side, consumer prices — the PCE (personal consumption expenditures) price index — rose at a 1.5 percent pace in the third quarter, slower than the 2.4 percent pace in the second quarter. Over the past four quarters, the increase is 1.4 percent. For core consumer prices, which exclude volatile food and energy components, the index rose 2.2 percent, up from 1.9 percent in the prior quarter. Over the last four quarters, core consumer prices rose 1.7 percent. Core consumer-price increases have been relatively stable over the last decade, running at or below the 2 percent level, and appear unlikely to accelerate dramatically in the quarters ahead.