Signs of Improvement in the ISM Nonmanufacturing Survey in May

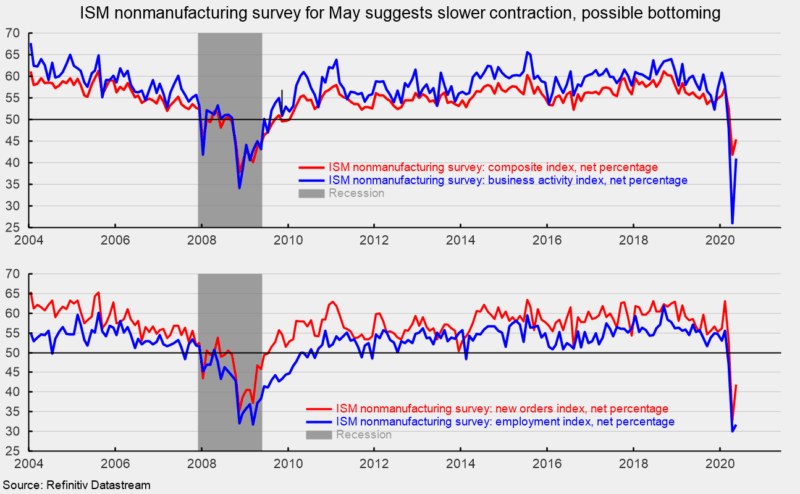

Like its manufacturing-sector counterpart, the Institute for Supply Management’s nonmanufacturing index showed improvement in May, rising to a reading of 45.4 from 41.8 in the prior month. The May result is the second consecutive month below the neutral 50 threshold but is also the first gain following two sharp declines in March and April (see top chart). The results do suggest contraction for the services sector but at a slowing pace. They are consistent with other signs of an emerging modest rebound, coming amid efforts to ease government-imposed restrictions on people and businesses implemented to slow the spread of COVID-19.

Among the key components of the nonmanufacturing index, the business-activity index (comparable to the production index in the ISM manufacturing report) was 41.0 in May, up from 26.0 in April (the lowest reading since the survey began in 1997, see top chart). For May, 13 industries in the nonmanufacturing survey reported contraction versus 17 in April.

The nonmanufacturing new-orders index rose to 41.9 from 32.9 in April (see bottom chart). Just one industry reported growth in new orders, Agriculture, Forestry, Fishing & Hunting, while 14 reported contraction (versus 16 in April). The new-export-orders index, a separate index that measures only orders for export, was 41.5 in May, versus 36.3 in April (the lowest since November 2008.) Five industries reported growth in export orders versus three in April. Eleven industries reported declines in new-export orders compared to 14 reporting declines in April.

The nonmanufacturing employment index came in at 31.8 in May up from 30.0 in April. The slightly stronger reading suggests services-sector employment likely fell for the month but at a slightly slower pace. The jobs report from the Bureau of Labor Statistics is due to be released on Friday June 5. Consensus is for a loss of 8 million non-farm jobs with 7.5 million coming from the private sector, resulting in an unemployment rate of 19.8 percent versus 14.7 percent for April. To help put these numbers in perspective, the previous cycle peak in the unemployment rate was 10 percent in October 2009 while the highest unemployment rate since 1950 came in November 1982 at 10.7 percent. Though data collection was much less reliable, the unemployment rate following the Great Depression was estimated to have peaked at about 25 percent in 1933.

Supplier deliveries, a measure of delivery times for suppliers to nonmanufacturers, came in at 67.0, down from 78.3 in the prior month. It suggests suppliers are falling further behind in delivering supplies to nonmanufacturers though the slippage has decelerated from the prior month. Typically, slower deliveries are consistent with a strong economy but in this environment, the slower deliveries are a result of production constraints and transportation difficulties, not strong economic conditions. The latest report from the Institute of Supply Management suggests that the nonmanufacturing sector and the broader economy continued to contract in May but at a slower pace. The results are consistent with the ISM manufacturing survey suggesting the economy may be bottoming and setting the stage for growth later in the year.