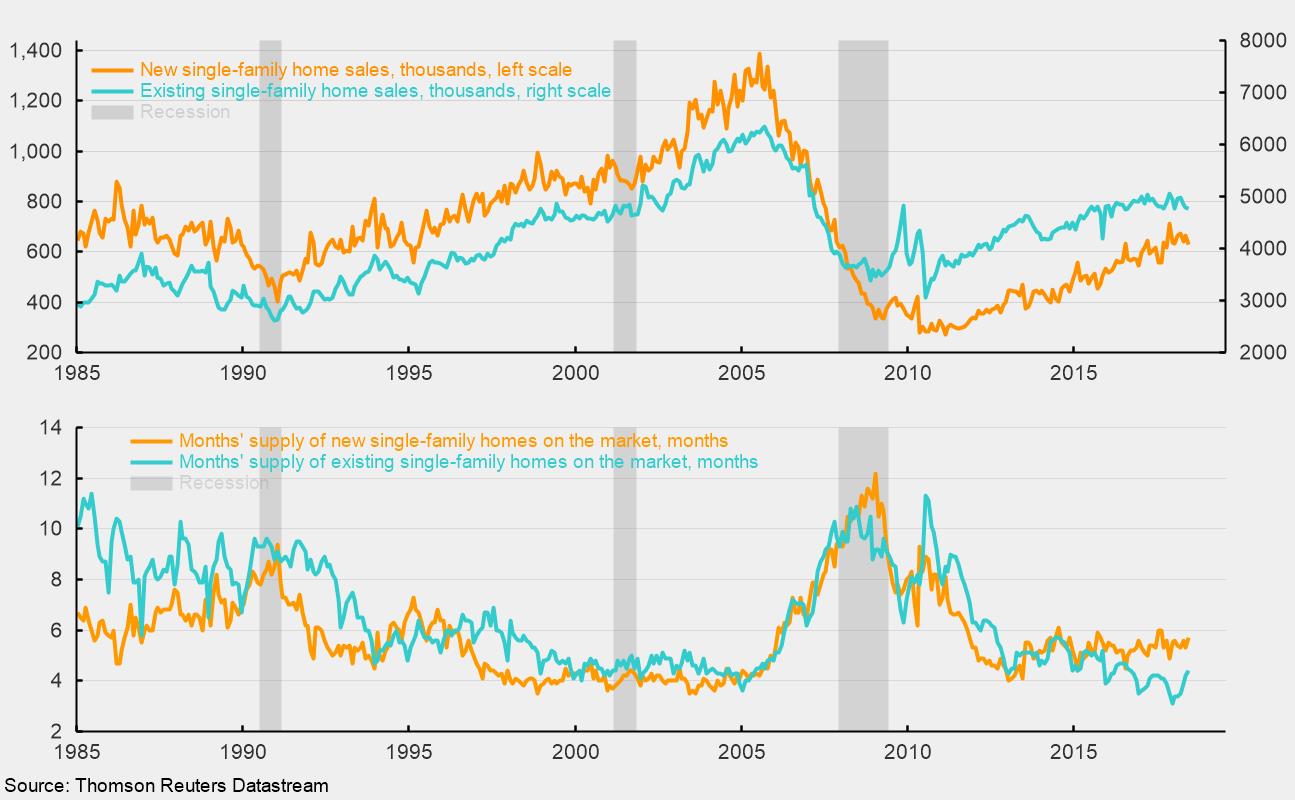

Sales of New and Existing Homes Are Slowing as Supply Rises

Sales of new and existing single-family homes fell in June, dropping 5.3 percent and 0.6 percent, respectively. While both categories have achieved significant rebounds from their post-recession lows, recent data suggest momentum may be slowing (see top chart). The slowing momentum in sales is helping boost the supply of homes on the market, measured in months (see bottom chart).

For new single-family homes, sales came in at 631,000, down from 666,000 in May. Despite the drop, sales are still up 2.4 percent from a year ago. Across the four regions, sales were up 36.8 percent to 52,000 in the Northeast but down 13.4 percent to 71,000 in the Midwest, down 7.7 percent to 361,000 in the South, and down 5.2 percent to 147,000 in the West.

Total inventory of new single-family homes for sale rose 1.7 percent to 301,000 in June, pushing the months’ supply (inventory divided by the annual selling rate times 12) to 5.7 months, up from 5.3 months in May. For new single-family homes, months’ supply has been holding relatively steady in the five- to six-month range since the end of 2013.

For the market for existing single-family homes, sales fell to a 4.76 million seasonally adjusted annual rate in June versus 4.79 million in May. From a year ago, sales are down 2.3 percent. Across the four regions, sales rose 5.2 percent in the Northeast to 610,000 from 580,000 in the prior month while sales rose 0.8 percent in the Midwest to 1.19 million. However, sales fell 2.0 percent in the South, the largest region by volume, to 1.97 million from 2.01 million in May and dropped 2.9 percent in the West to 990,000 versus 1.02 million in the prior month.

Total inventory of existing single-family homes rose 4.8 percent for the month to 1.74 million, resulting in a months’ supply of 4.4. That is 4.8 percent higher than the 4.2 months in May and up 41.9 percent from the recent low of 3.1 months in December 2017. The sharp rise in months’ supply has brought it back from ultra-low levels to the range that prevailed during the early 2000s, and close to the months’ supply in the segment of new single-family homes.

The combination of rising home prices and higher interest rates is likely weighing on housing activity in general. Home affordability overall has been trending lower after surging in the 2009–12 period because a combination of extraordinarily low interest rates and falling home prices made for a buyer’s market. For the market overall, affordability remains favorable though the declining trend is likely to continue. For first-time home buyers, affordability is less favorable. Though it did surge along with overall affordability in the 2009–12 period, it remained at much lower levels and is now close to neutral.

Declining affordability due to rising home prices and rising interest rates is likely to continue weighing on housing activity in general. Sales are unlikely to move significantly higher in the coming months, and new-home construction is unlikely to contribute significantly to growth in gross domestic product in coming quarters. Still, the economy overall remains very healthy, supported by a tight labor market, rising incomes, strong balance sheets, and high levels of consumer confidence. The main risks on the horizon are fallout from escalating trade wars and the ballooning federal deficits, which are likely to require significant funding in coming quarters and may drive long-term rates significantly higher.