Retail Spending Remains Close to Trend in January

Retail sales and food services spending rose 0.3 percent in January following a 0.2 percent gain in December. Over the past year, total retail sales and food services were up 4.4 percent through January.

Excluding the volatile energy category, retail sales and food services excluding gasoline were also up 0.3 percent in January after being unchanged in December. From a year ago, retail sales and food services excluding gasoline were up 3.9 percent.

Excluding both motor vehicles and gasoline, core retail sales and food services were up 0.4 percent in January after a 0.5 percent rise in December. Core retail sales have posted a year-over-year gain of 3.3 percent.

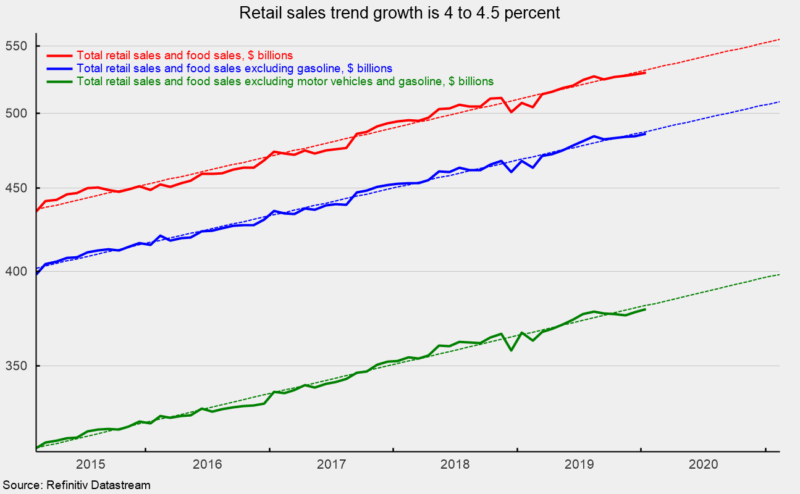

Over the last 5 years, total retail sales and food services have been growing at a trend rate of 4.3 percent while retail sales and food services excluding gasoline has a trend growth of 4.1 percent and core retail sales, total retail sales and food services excluding motor vehicles and gasoline has a trend growth of 4.3 percent. As of January, all three measures were less than 0.5 percent below trend (see chart).

Details of the January retail sales report were generally positive with gains in nine retail-spending categories, while four categories posted declines. Gains were led by a 2.3 percent increase in miscellaneous store sales and a 2.1 percent rise in building-material, garden-equipment, and garden-supplies dealers. Also posting gains were food services (1.2 percent), furniture stores (0.6 percent), and general merchandise stores (0.5 percent).

Motor vehicle and parts dealers had a 0.2 percent gain in January. The rise is consistent with the slightly stronger unit-auto sales for the month. Unit sales rose to 16.84 million at an annual rate in January versus 16.65 million in December. The gain in unit sales was driven by an increase in light-truck sales (12.64 million in January versus 12.16 million in December) while car sales declined (4.21 million versus 4.49 million). Over the past six and a half years, car sales have sharply trailed light truck sales. For January, light trucks accounted for 75 percent of vehicle sales, a record high, while cars were just 25 percent.

Nonstore retailers, predominantly online shopping, had a 0.3 percent decline for the month. This category has been growing very robustly for years, posting a gain of 8.4 percent over the last 12 months. It’s highly likely this category will continue to post strong gains in the future.

Clothing stores led the decliners with a 3.1 percent drop. Gasoline station sales fell 0.5 percent for the month reflecting a 0.8 percent drop in average retail prices of gasoline. Other decliners include electronics and appliances (-0.5 percent) and health and personal care stores (-0.4 percent)

The solid data for January suggests that consumer retail spending continues on a solid trend path, supported by a strong labor market and rising incomes. Other areas of the economy are less certain. For now, economic expansion is the most likely path, but caution is warranted.