Retail Spending Hits New High in July but Gains Are Not Consistent Among Categories

Retail sales and food-services spending posted another gain in July, rising 1.2 percent from the prior month following an 8.4 percent jump in June and an 18.3 percent record surge in May. The gains come after two devastating declines in March and April. The gains likely reflected the continued easing of restrictions on consumers and many businesses across the economy as well as the amazing adaptability and resilience of consumers and some businesses. However, with tremendous uncertainty around the country regarding COVID-19 and government policies, the emerging recovery remains at significant risk from consumer and business retrenchment.

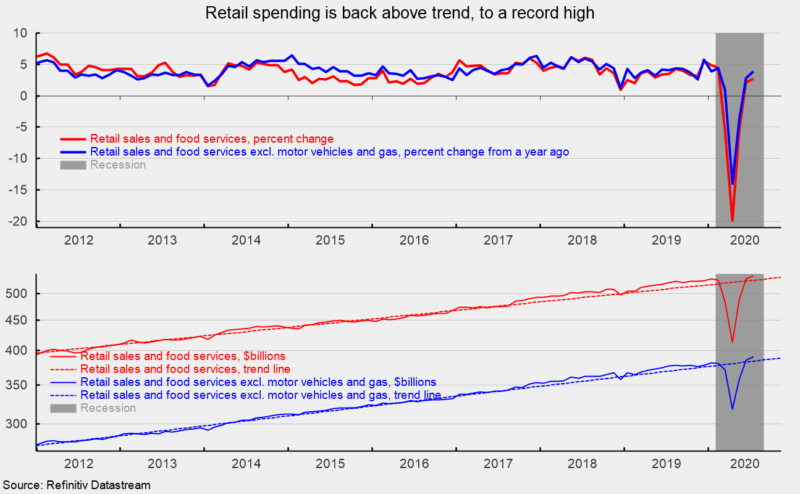

Excluding motor vehicle and gas categories, core retail sales and food services were up 1.5 percent in July after a 7.7 percent jump in June. The gains over the past three months have completely offset the declines from March and April, leaving the July tally for total retail sales and food services 2.7 percent above the July 2019 level while core retail sales and food services are 3.9 percent above year ago levels (see top of first chart). The July gains put total and core retail sales above their eight-year trends and at new record highs (see bottom of first chart).

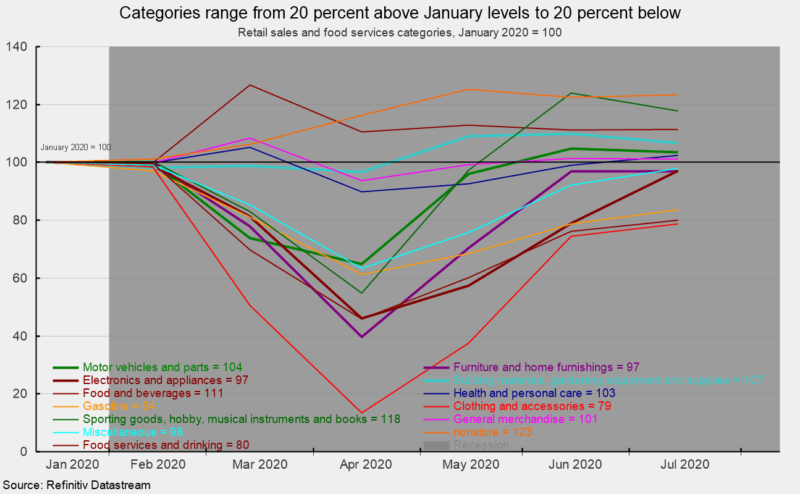

However, results across the various categories were mixed. The outbreak of COVID-19 and government lockdown policies implemented to slow the spread of the virus have impacted industries very differently. Among the 13 categories within the retail sales report, seven are above their January 2020 level while six are below. Nonstore retail sales rose 0.7 percent in July and is up 25.8 percent from July 2019. This category has also been one of the most successful during the pandemic and lockdowns, with sales 23 percent above January 2020 levels (see second chart).

Sporting-goods, hobby, musical-instrument, and bookstores saw a 5.0 percent decline in July but are still up 18.9 percent from a year ago and are 18 percent above January 2020. Food and beverage store sales posted a 0.2 percent rise for the month, leaving sales 12.8 percent above July 2019 and 11 percent above January 2020. Building materials, gardening equipment and supplies dealers sales had a 2.9 percent drop in July but are up 16.0 percent from a year ago and 7 percent from January while motor vehicles and parts dealers sales fell 1.2 percent for the latest month leaving sales 7.0 percent higher than a year ago and 4 percent higher than January. Health and personal care stores and general merchandise stores both had sales above year ago and January 2020 levels.

Categories that are below their January 2020 levels include clothing and accessory stores (up 5.7 percent in July but down 19.7 percent from a year ago and 21 percent below January 2020), food services (up 5.0 percent in July but down 17.5 percent from a year ago and 20 percent below January), gasoline stations (up 6.2 percent for the month but down 14.8 percent for the year and 16 percent since January). Electronics and appliance stores, furniture and home furnishings stores, and miscellaneous stores were all still below their January 2020 levels. Despite still being below their pre-pandemic sales levels, all six are above their April 2020 lows.

Retail sales overall rose again in July as the effects of widespread quarantines and lockdowns were eased. Businesses and consumers are coming out of the policy-induced economic coma and while aggregate retail spending is at a new high, results vary greatly by industry. A full return to pre-pandemic conditions for the overall economy and the labor market is likely many months, and possibly many quarters, away. Furthermore, uncertainty about the progression of the virus and government policies is creating heightened uncertainty and remains a significant threat to the emerging recovery.