Retail Sales Rise in April

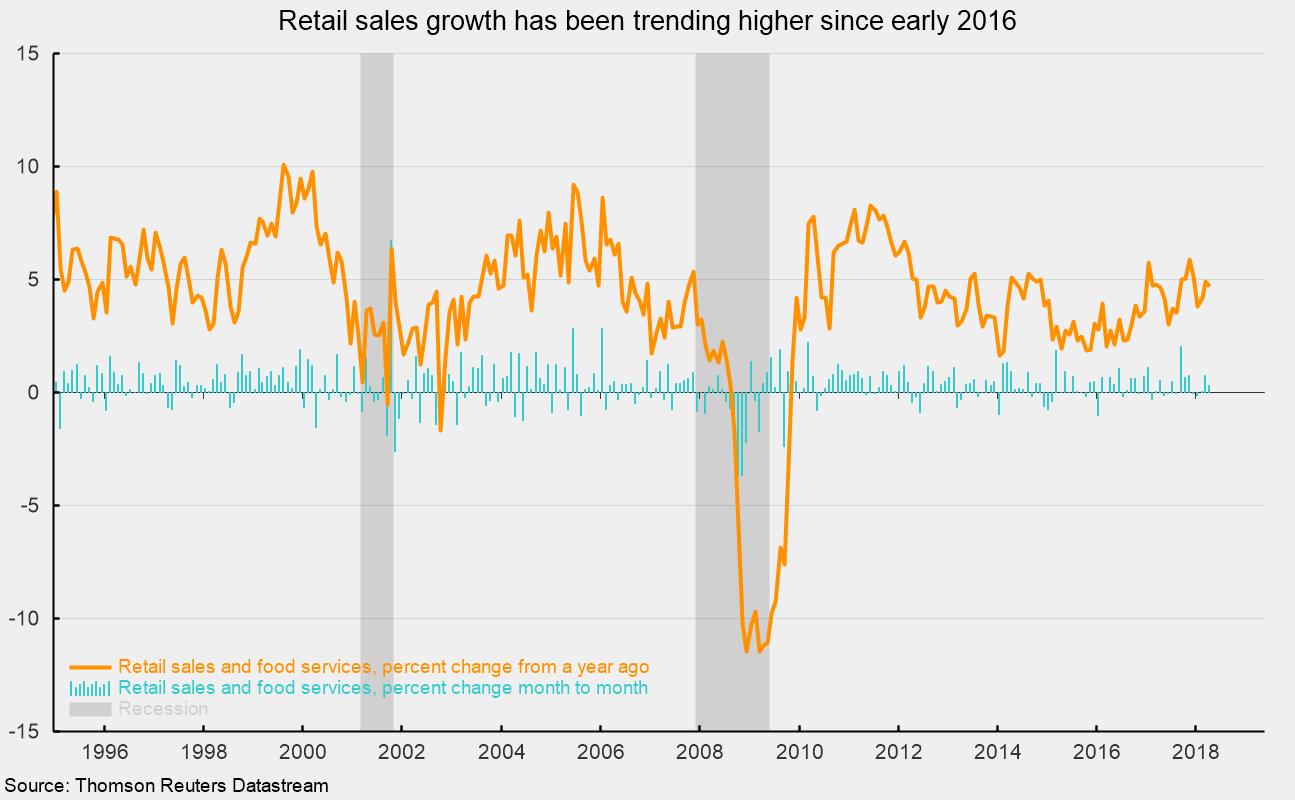

Retail sales data released today suggest that U.S. economic growth was solid in the last three months. Retail sales rose 0.3 percent in April following a 0.8 percent increase in March. Over the past three months, retail sales have risen 0.5 percent compared to the prior three months and 4.6 percent compared with the same three-month period last year.

The April gain in retail sales was led by strong increases in clothing stores (1.4 percent), miscellaneous store retailers (0.9 percent), non-store retailers (0.5 percent), and gasoline stations (0.8 percent), though this latter category often reflects the volatile price of gasoline. Non-store retail sales now account for just over 11 percent of total retail sales and 15.8 percent of retail sales excluding vehicle and gas sales.

Among other categories, general-merchandise stores rose 0.3 percent for the month while building-materials and garden-equipment store sales rose 0.4 percent, the same gain as grocery stores.

The weakest categories for April were health and personal-care stores (−0.4 percent), restaurants (−0.3 percent), sport-goods, hobby, and book stores (−0.1 percent), and electronics stores (−0.1 percent).

Over the past year, retail sales gains have been led by gasoline (up 11.7 percent), driven primarily by price increases, non-store retailers (online shopping; up 9.6 percent), furniture store sales (up 6.1 percent), auto sales (up 4.8 percent), building-materials and garden-equipment stores (up 4.4 percent), and miscellaneous store sales (up 4.1 percent).

Consumer spending overall appears well-supported by a strong labor market. Employers continue to add to payrolls, having created 168,000 new private sector jobs in April, bringing the 12-month total to 2.3 million. Those new jobs have helped push the unemployment rate down to 3.9 percent, the lowest since 2000. Furthermore, initial claims for unemployment insurance are near a four-decade low and the number of open jobs is at an all-time high. The tight labor market has helped push wage increases to a 12-month gain of 2.6 percent, near a cycle high but still moderate by historical comparisons. The combination of a strong labor market and solid wage gains have helped boost consumer confidence to a high level. In aggregate, these data all suggest solid support for further gains in consumer spending and solid growth for the economy overall.