Retail Sales Post Another Record Plunge in April

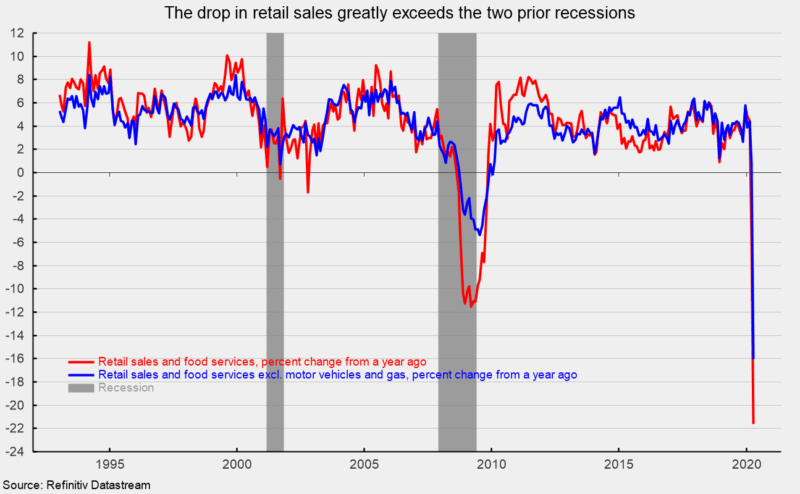

For the second month in a row, retail sales and food-services spending posted a record drop, plunging 16.4 percent in April following a revised 8.3 percent drop in March. Excluding the volatile motor vehicle and gas categories, core retail sales and food services were down 16.2 percent in April after a revised fall of 2.6 percent in March. Over the past year, total retail sales and food services were down 21.6 percent in April, the worst performance on record since data on retail sales began in 1992, while core retail sales and food services have fallen 16.0 percent, also a record drop (see first chart).

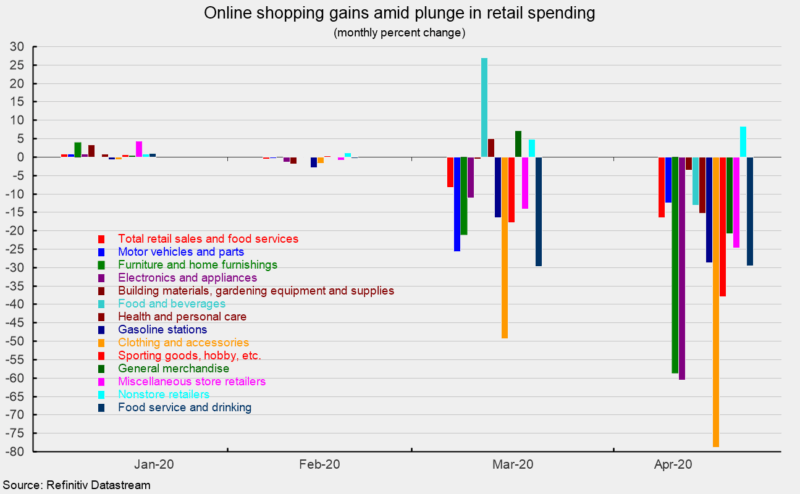

Declines were broadbased across industries with the one exception being nonstore retailers, primarily online shopping. Nonstore retail sales rose 8.4 percent following a 4.9 percent rise in March. Over the past year, nonstore retail sales are up 21.6 percent (see second chart).

There were declines in twelve retail-spending categories, with eleven posting double-digit declines (see second chart). Declines were led by a 78.8 percent drop for clothing and accessory stores, followed by a 60.6 percent fall for electronics and appliance stores, a 58.7 percent fall in furniture and home furnishings, a 38.0 percent drop in sporting-goods, hobby, musical-instrument, and bookstores, a 29.5 percent decline for food services, a 28.8 percent decline for gas station sales, a 24.7 percent decrease for miscellaneous store sales, a 20.8 percent fall for general merchandise, a decrease of 15.2 percent for health and personal care store sales, a drop of 13.1 percent for food and beverage stores, a 12.4 percent decline for motor vehicle and motor vehicle–parts dealers, and a 3.5 percent pullback for building-material, garden-equipment, and garden-supplies dealers (see second chart).

Retail sales were sharply weaker in April as the effects of widespread quarantines and lockdowns smothered economic activity. Businesses and consumers may adapt somewhat but a full recovery is unlikely to occur for several months and remains heavily dependent on the progression of the outbreak, scientific developments, and refinement of public policy.