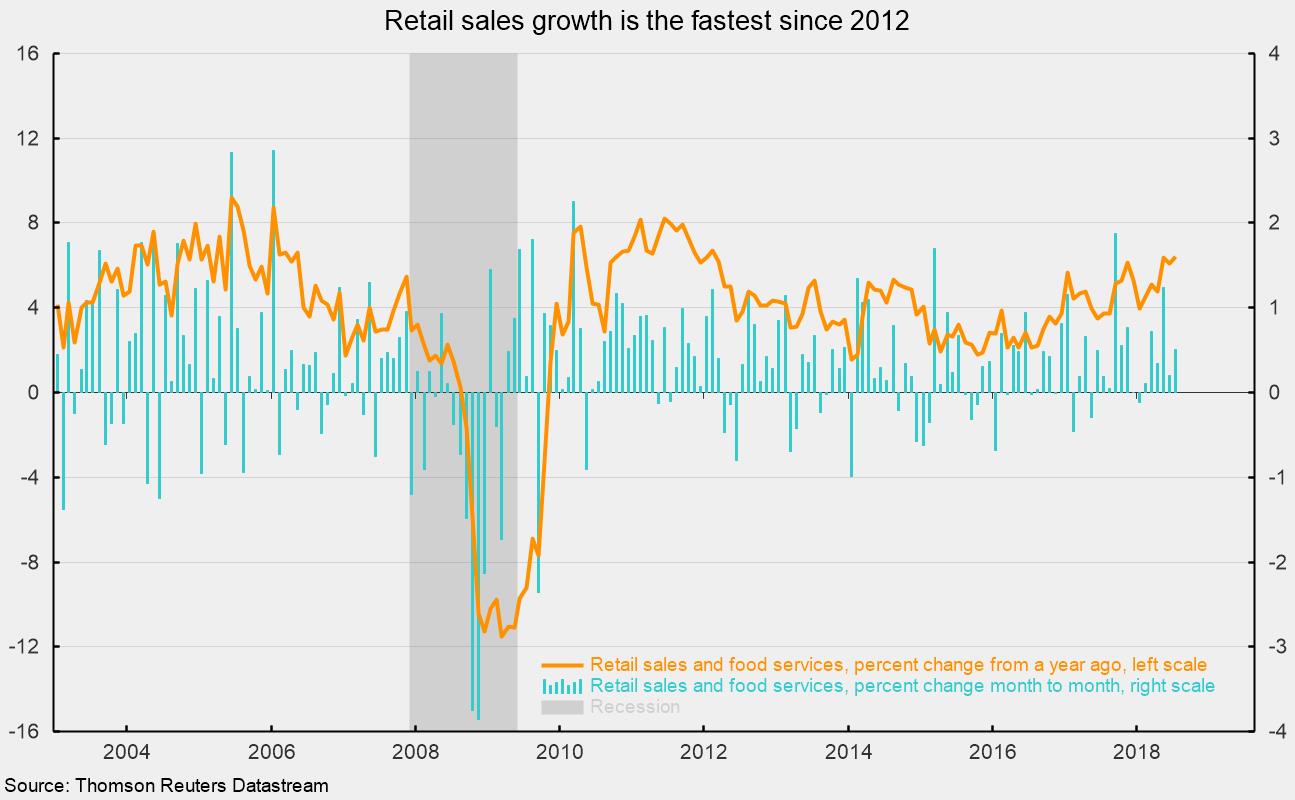

Retail Sales Easily Beat Expectations in July

Retail sales for July rose 0.5 percent, substantially beating the 0.1 percent consensus expectation and marking the sixth consecutive month of gains. Over the past 12 months, retail sales are up 6.4 percent, the fastest pace since 2012 (see chart). The details of the report suggest that U.S. economic growth is maintaining strong momentum, supported by consumer spending and a robust labor market.

The July gain in retail sales was led by strong increases in clothing stores (1.3 percent), restaurants (1.3 percent), non-store retailers (0.8 percent), gasoline stations (0.8 percent), general-merchandise stores (0.7 percent), and grocery stores (0.6 percent). Month-to-month volatility in gasoline sales is often driven by the volatile price of gasoline. Non-store retail sales, the category that includes the rapidly growing online-sales segment, now account for 11.2 percent of total retail sales and 15.7 percent of retail sales excluding vehicle and gas sales.

Among other categories with gains, motor vehicles and parts dealers saw sales rise 0.2 percent for the month while electronics stores’ sales rose 0.1 percent. Building-materials and garden-equipment store sales were unchanged for July versus June.

The weakest categories for July were sport-goods, hobby, and book stores (−1.7 percent), furniture and home-furnishings stores (-0.5 percent), health and personal-care stores (−0.4 percent), and miscellaneous store retailers (-0.3 percent).

Over the past year, retail sales gains have been led by gasoline (up 22.2 percent; driven primarily by price increases), restaurants (9.7 percent), non-store retailers (predominantly online shopping; up 8.7 percent), clothing stores (up 6.4 percent), and health and personal-care stores (up 5.0 percent). Only one category — sporting-goods, book, hobby, and music stores — shows a decline in sales over the past year, dropping 4.9 percent.

Consumer spending overall appears well-supported by a strong labor market. Employers continue to add to payrolls, having created an average of 219,000 new jobs over the six months through July. Those new jobs have helped push the unemployment rate down to 3.9 percent and average hourly-earnings growth up to 2.7 percent. Furthermore, initial claims for unemployment insurance are near a four-decade low and the number of open jobs is near an all-time high. The combination of a strong labor market and solid wage gains has helped boost consumer confidence to a very high level. In aggregate, these data all suggest strong support for further gains in consumer spending and solid growth for the economy overall.