Regional Fed Surveys Show Improving Expectations

The results of the Philadelphia Fed’s Manufacturing Business Outlook Survey were mostly weak in May, especially for the current conditions indexes. In general, respondents were quite downbeat about current conditions but significantly more optimistic about the future. Overall, the survey still suggests contraction for manufacturing in the Philadelphia area.

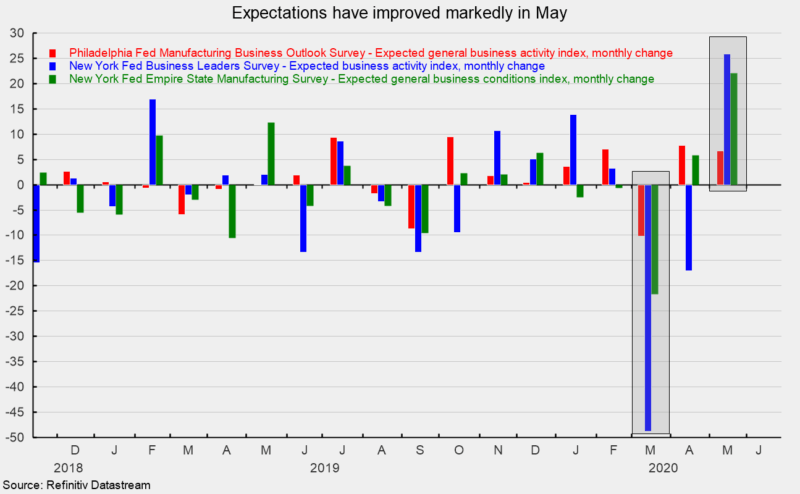

Among the forward-looking indicators, monthly changes were mixed but most indexes remained solidly above the neutral zero threshold. The future general-business-conditions index rose to 49.7 in May from 43.0 in April, a gain of 6.7 points (see chart) That is the second monthly gain after a 10-point drop in March.

The future new-orders index rose to 54.7 versus 36.5 in the prior month. Both the future prices-paid index and the future prices-received index fell slightly in May while the two future labor market indicators, number of employees and average work week, posted somewhat larger declines. The expectations for capital spending increased, registering 15.2 versus 12.4 in the prior month.

Among the survey’s current-conditions indexes, general business activity contracted less quickly with the index rising to -43.1 from -56.6 while new orders rose to -25.7 from -70.9 and shipments rose to -30.3 from -74.1 in the prior month. Labor indicators were sharply higher but still negative with the number-of-employees index increasing to -15.3 from -46.7 while the average-workweek index rose to -7.1 from -54.5.

The Empire State Manufacturing Survey shows similar results. Among the forward-looking questions, expectations six months ahead for general business conditions posted a substantial gain, rising 22.1 points (see chart) to 29.1, the highest reading since July 2019 and well into positive territory. The expected new orders index and expected shipments index both posted 20+ point gains as well.

The number of employees six months ahead index also posted a gain, adding 5.2 points to 10.4 though the average employee workweek edged down fractionally, dropping 0.3 points to 8.1.

The current general business conditions index was less negative in May, posting a -48.5 percent reading versus -78.2 in April, a rise of 29.7 points. New orders and shipments had similar improvements, rising 23.9 points to -42.4 and 29.1 points to -39.0, respectively. While these negative readings still suggest very weak conditions, the improvements are positive developments.

The current labor indexes, critically important to a recovery, both had substantial improvements as well. The number of employees index gained 49.2 points to -6.1 while the average workweek index rose 40.0 points to -21.6.

Like the manufacturing survey, the forward-looking indexes for the Business Leaders survey (covering services businesses) showed significantly less negative results in May with every index posting a solid gain. The expected business activity index rose 25.8 points (see chart) to -4.9 while the expected business climate index gained 32.8 points to -8.0. The expected number of employees index moved into positive territory with a 29.7-point gain to 2.3.

The current activity index remained near a record-low level however, rising just 0.7 points to -75.8, while the current business climate index was an extremely weak -92.9, up 1.4 points from -94.3 in April. Other current indexes also remained at very weak levels.

The three surveys suggest a similar development. Current conditions remain extremely weak under the shelter-in-place policies. Regardless, businesses show improving expectations about the future. Easing of policies will help economic activity, but the path to full recovery is extremely uncertain.