Regional Fed Manufacturing Surveys Plunge Again in April

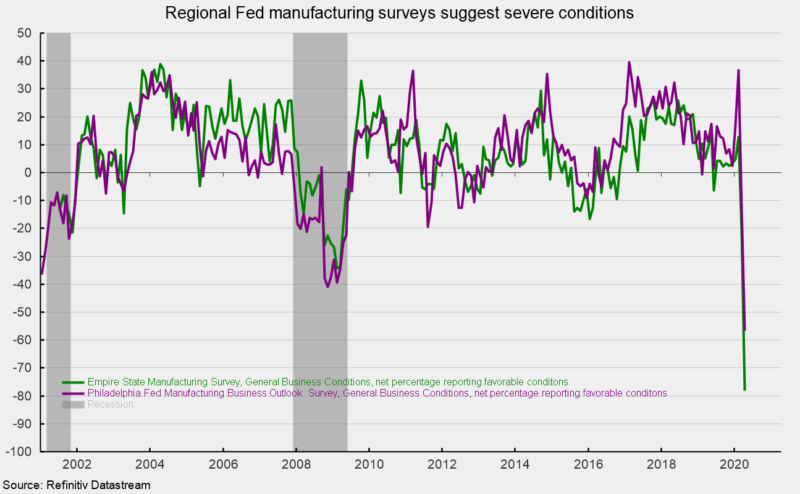

The Empire State Manufacturing Survey from the New York Federal Reserve shows general business conditions deteriorated sharply again in April with the index posting a record 56.7-point drop to a -78.2 percent reading versus -21.5 in March. That is the lowest result on record since the survey began in 2001 (see chart).

Among the key components, the new orders index sank 57.0 points to -66.3 while the shipments index was -68.1 percent in April, down from -1.7 in March, a drop of 66.4 points.

The number of employees index fell to -55.3 percent in April, down from -1.5 in March while the average workweek index fell to -61.6 from -10.6. The delivery time index came in at 11.0, up from 2.2 in March and the unfilled orders index fell to -16.8 from 1.4 in the prior month.

The prices paid index moved closer to neutral, coming in at 5.8 versus 24.5 in the prior month but the prices received index dropped to -8.4 from 10.1 in March.

Among the forward-looking indexes (questions asking about expectations six months ahead), the general business conditions index rose to 7.0 from 1.2 as the expectations for new orders fell to 11.7 from 17.6 in March.

The indexes for future shipments, delivery times, prices paid, prices received, number of employees, capital expenditures, and technology spending all had declines in April.

The results of the Philadelphia Fed’s Manufacturing Business Outlook Survey were generally in line with the New York Fed’s Empire State Manufacturing Survey.

Among the Philadelphia Fed survey’s current-conditions indexes, the general business activity index dropped to -56.6 from -12.7 (see chart) while the new orders index fell to -70.9 from -15.5. The shipments index, number-of-employees index, and average-workweek index all posted sharp declines. Other indexes posted less severe declines while the delivery times index rose to 4.1 from -9.1 in March.

Among the forward-looking indicators, results were more positive with a mix of small increases and small decreases for the month. Many indexes remained solidly above the neutral zero threshold.

Today’s reports provide additional evidence of the effects of the outbreak of COVID-19. There are widespread disruptions to economic activity which are certainly going to cause a drop in aggregate output. It is likely the U.S. economy entered a recession in March, ending the record-long expansion. The duration of the downturn and path of recovery is dependent on the progression of the COVID-19 outbreak, extent of policies intended to protect public health, and fiscal responses intended to mitigate some of the economic damage.