Real Gross Domestic Product Posted A Solid Gain in the Fourth Quarter, but Remains Below Trend

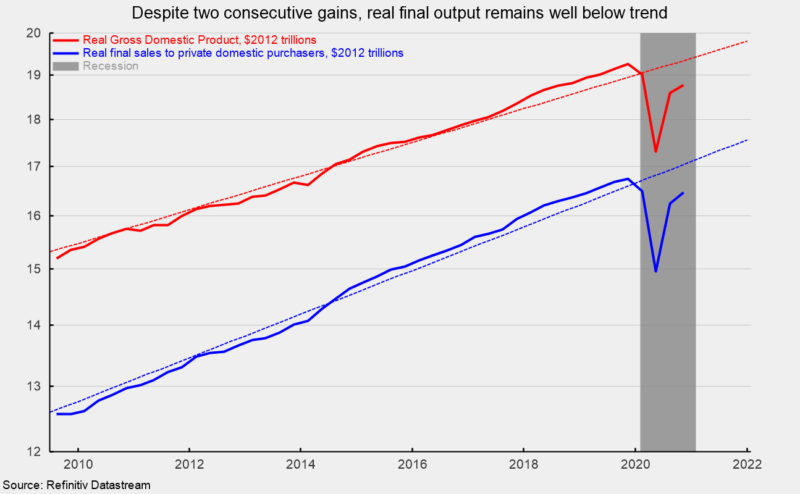

Real gross domestic product rose at a 4.0 percent annualized rate in the fourth quarter, down from a 33.4 percent pace in the third quarter, according to the Bureau of Economic Analysis. The two increases follow drops of 5.0 percent and 31.4 percent at annualized rates in the first and second quarters, respectively. Despite the two gains, real gross domestic product remains 2.7 percent, or more than $500 billion in real terms, below trend (see first chart).

Measured from fourth quarter 2019 to fourth quarter 2020, real gross domestic product decreased 2.5 percent. For calendar year 2020, real gross domestic product fell 3.5 percent versus calendar 2019.

Real final sales to private domestic purchasers, a key measure of domestic demand, rose at a 5.6 percent pace in the final quarter of 2020 following a 39.0 percent annualized gain in the third quarter. This important gauge is still 3.1 percent, or more than $520 billion (in real terms), below trend (see first chart).

The Gross Domestic Product price index rose 2.0 percent in the fourth quarter, at an annualized rate while the personal consumption expenditures prices index rose at a 1.5 percent pace, and the core personal consumption expenditures prices index (personal consumption expenditures excluding food and energy) rose at a 1.4 percent annual rate. Measured from fourth quarter to fourth quarter, the overall price index increased 1.3 percent, the personal consumption expenditures prices index rose at a 1.2 percent pace, and the core personal consumption expenditures prices rose at a 1.4 percent annual rate.

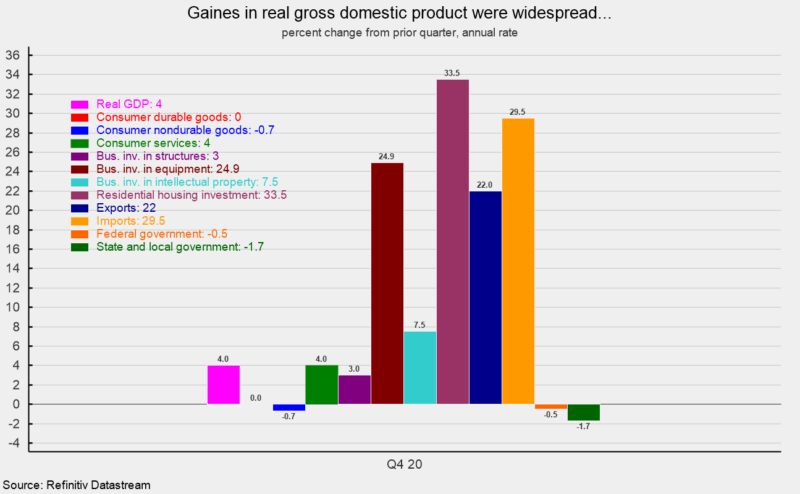

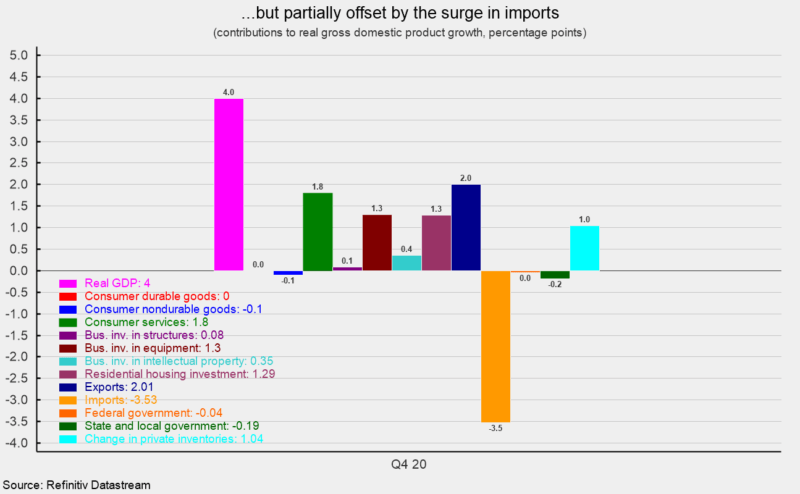

Consumer spending decelerated in the fourth quarter, rising at a 2.5 percent pace following a 41.0 percent rebound in the third quarter. Durable-goods spending was unchanged for the fourth quarter, nondurable-goods spending fell 0.7 percent, and services rose 4.0 percent (see second chart). Consumer spending contributed 1.7 percentage points of the 4.0 percent real gross domestic product growth rate (see third chart).

Business fixed investment rose at an 18.4 percent annualized rate in the fourth quarter. At annualized rates, the gain was led by a 24.9 percent jump in equipment spending while intellectual property spending rose 7.5 percent and investment spending on structures rose 3.0 percent (see second chart). Real business investment contributed 3.0 percentage points to overall real gross domestic product growth (see third chart).

Residential investment, or housing, rose at a 33.5 percent pace in the fourth quarter compared to a 63.0 percent surge in the prior quarter (see second chart). Housing contributed 1.3 percentage points to overall growth (see third chart). It has been a very strong sector of the economy, supported by ultra-low interest rates and increased demand.

Inventory accumulation by businesses resumed in the fourth quarter, adding 1.0 percentage points to fourth-quarter growth (see third chart) after adding 6.6 percentage points in the prior quarter.

Net trade had a negative impact on overall gross domestic product growth in the fourth quarter, subtracting 1.5 percentage points (see third chart). Exports rose at a 22.0 percent pace while imports grew at a 29.5 percent rate (see second chart). Imports are included as a negative (they are subtracted out) in the calculation of gross domestic product.

Government spending fell at a 1.2 percent annualized rate in the fourth quarter compared to a 4.8 percent decrease in the third quarter, reducing total growth 0.22 percentage points versus a 0.75 percentage-point reduction in the prior quarter. Federal defense spending rose 5.0 percent while federal nondefense spending fell 8.4 percent. State and local government spending fell at a 1.7 percent rate in the fourth quarter.

Real gross domestic product posted a solid gain in the final quarter of 2020 as the economy continues to recover from the devastation caused by the pandemic and government lockdowns in the first half of the year. Countervailing headwinds impacted activity in the fourth quarter as the recent surge in new Covid-19 cases sustained and renewed some lockdown efforts and public caution while the rollout of several new vaccines helped support an easing of lockdown restrictions on consumers and businesses and boosted consumer confidence in the economic outlook.

The outlook remains uncertain as new variants of the virus are starting to appear, but efforts to open the economy amid vaccine development and distribution suggest a cautiously optimist tilt.