Real Estate and the Wealth of a Nation

Financial market commentators tend to focus on the price of bonds and stocks but the majority of the wealth of individuals in developed nations is skewed towards residential property. In the US, the largest residential real estate market, that asset value is around $34trln, about the same as the capitalization of the entire US stock market. For the majority of workers, the single largest asset they own, notwithstanding the encumbrance of mortgage debt, is their home. They may have pension savings and other stores of value but these pale into insignificance beside their investment in property.

In terms of the economic health of a nation, the level of private debt and the value of private assets has an enormous influence on household spending patterns. During the last decade, interest rates have fallen to among the lowest levels ever recorded. This has made debt easier to finance and has driven stock, bond and property prices higher. Economists refer to this boost to prices resulting from the lowering interest rates as a raising of the present value of assets. The same process can, of course, be reversed by a raising of interest rates; this will lower the present value of assets causing asset prices to fall.

There are, of course, other factors which influence the price of residential real estate. Supply has always been important. As Mark Twain is said to have advised, ‘Buy land, they ain’t making it anymore.’ Demand is an equally important driver of prices. In this respect demographic forces play an important role. The ‘baby-boom’ generation, which drove the price of housing during the 1980s and 1990s, is an obvious example of demand outstripping supply. A nation’s immigration policy can also influence the equilibrium price. Government policy with regard to housing in general – and affordable housing in particular – is another important factor. The transactional costs of buying and selling property have remained stubbornly high (especially in the US) and, whilst property technology has reduced some of the costs, real estate fees have not mirrored that of the stock market where transaction costs have been falling for several decades.

Aside from transaction fees, labour force participation, the unemployment rate and average earnings are additional influences on the fortunes of the housing market. The post-financial crisis rise of the part-time employee, saddled with all the uncertainties that entails, has tempered the positive effect of a lowering of interest rates. This decline in job security has been offset by the increasing number of older workers who have chosen to continue in employment. Their steady stream of income means that the debt-servicing capacity of the market has increased in aggregate. Older workers are generally less indebted but the overall effect of higher labour force participation is supportive of asset prices. If older workers do not need to draw down so aggressively on savings, or seek equity release from their property assets, then demographers’ predictions of a wave of generational dissaving are postponed.

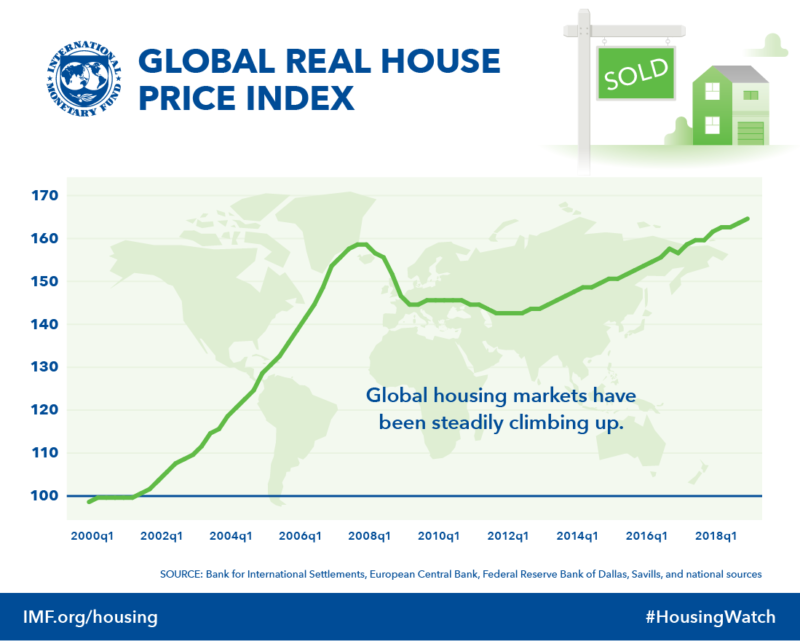

A glance at the IMF Global Real House Price Index since 2000 shows the impact of the financial crisis; unsurprisingly, the inflection point coincided with the economic downturn:

The sluggish period in 2000-2001 was a hangover from the bursting of the technology stock bubble. Once markets cleared, most of the subsequent growth in prices between 2002 and 2008 was driven by an expansion of bank credit – interest rates actually rose after 2004. In the US this was the era of covenant-lite loans and the proliferation of an alphabet soup of securitised mortgage products. That bubble also burst and in a spectacular fashion. The two years following the financial crisis saw a sharp reduction in the availability of mortgage products and an even sharper reduction in interest rates. The Eurozone debt crisis of 2011 held residential property prices back for a little longer, and the prospect of a large Eurozone bank default – and the associated systemic risk to the global financial system – acted as a brake to credit expansion. The world changed in July 2012 when the then-President of the European Central Bank, Mario Draghi, announced that he would do, ‘whatever it takes,’ to avert another financial crisis. Markets regained confidence, stocks rallied, credit spreads narrowed and the global housing market renewed its upward trajectory.

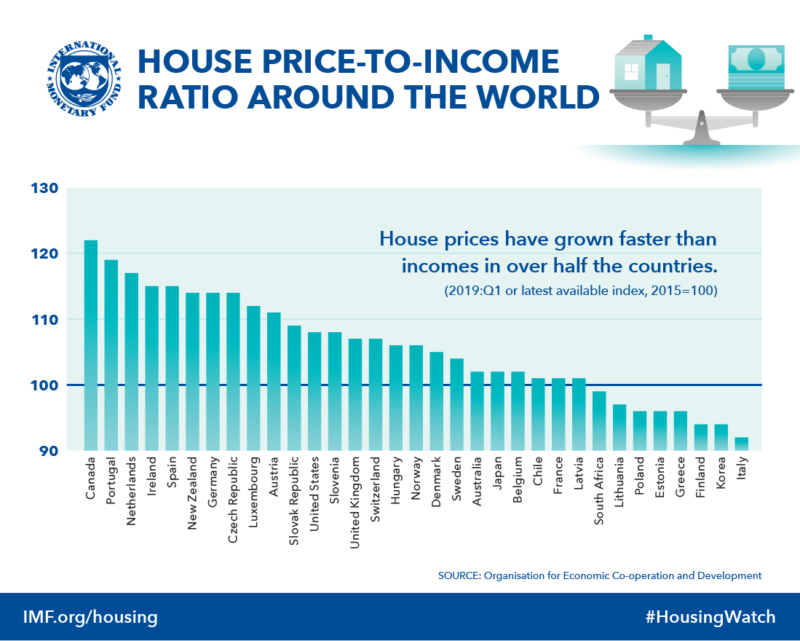

So much for the history of housing prices; where do we stand in terms of housing affordability and what should we expect looking ahead? To begin to answer this question it is essential to understand housing affordability:

As the chart above reveals, between Q1 2015 and Q1 2019 house prices have outstripped growth in income in half the countries monitored by the OECD. The US, which is the largest economy in the group, has seen prices run around 8% ahead of incomes.

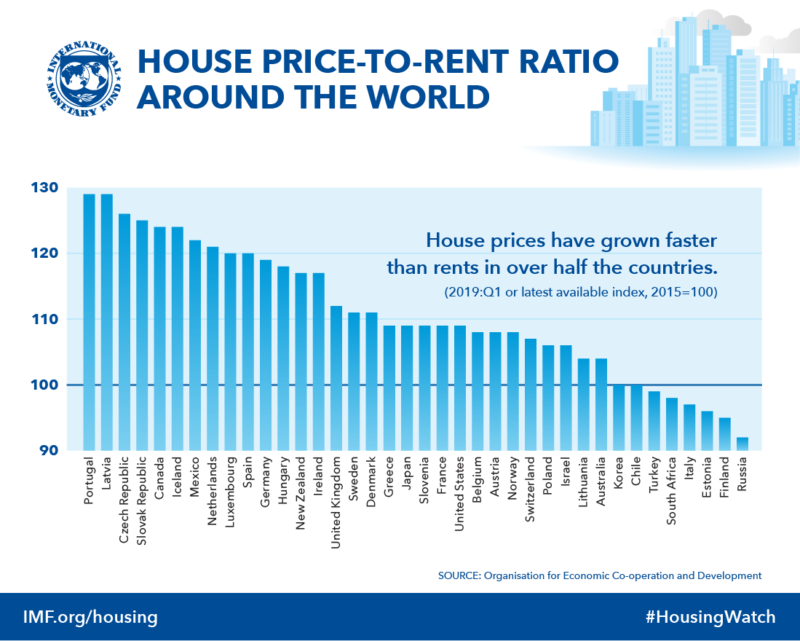

Nor has the rise in housing prices been matched by rental income:

The lagged behaviour of rental income is unsurprising; rental yields are closely correlated to bond yields which in turn are influenced by the monetary policies of central banks. As official rates have fallen and quantitative easing has driven bond yields lower, so rental yields have stagnated or fallen – why rent, when it is so inexpensive to borrow and buy? In Portugal, for example, absolute rental costs have actually fallen relative to income.

Notwithstanding the other factors alluded to above, the greatest influence on the direction of global residential real estate prices over the past decade has been a combination of the cost of finance and the availability of credit:

The period shown in the chart above is Q1 2018 to Q1 2019. The decline in credit growth seen in a small number of countries is mostly a hangover from previous, mostly domestic, crises.

The charts above might give the impression that real estate valuations are stretched, but a different approach to affordability is to compare mortgage interest payment costs to house prices. This is the day-to-day cost to individuals of owning property using borrowed money.

Official interest rates have fallen in all developed countries, government bond yields have followed suit, but as interest rates approached the zero-bound many banks became reluctant to reduce their mortgage lending rates by the same degree. This is understandable since banks traditionally take sight deposits from current account holders, on which they pay little or no interest, and lend longer term at a spread over central bank base rates.

In Europe, banks have traditionally lent at a variable rate of between 1.5% and 3% above the central bank official rate. For the Eurozone’s commercial banks times are hard, as the current average variable rate for a mortgage rate has come down to 1.4%. Historical Europe-wide mortgage data is difficult to source but the average German Bank Lending Rate provides a reasonable surrogate. The chart below tracks the rate since 2003:

The current Bank Lending Rate is 2.1%, which is just under half a percent higher than the average German Mortgage Rate (1.63%). For simplicity, let us assume that the spread between the Bank Lending Rate and the Mortgage Rate has been stable – credit spreads have tended to compress as rates have approached zero. On this basis, the cost of borrowing to buy a property has fallen from around 5.75% in 2008 to 1.63% today, an effective reduction in interest payments of 72%. Put another way, the interest payments on a Eur100,000 mortgage in 2008 would cost the same as a mortgage of Eur352,000 today. Eurozone property prices have not tripled in the last decade. The debt service cost of buying Eurozone property is therefore substantially lower today than it was a decade ago.

The US mortgage market is different from that of the Eurozone since the majority of US mortgages are long-term (30 years) and fixed rate. Whilst the magnitude is less extreme, the chart below shows a similar pattern to Europe. US mortgage rates have fallen from around 6.5% to 3.5% over the post-financial crisis period. The interest cost of a $100,000 mortgage in 2008 would cover $186,000 of borrowing today:

Similar calculations could be made in Japan, although a monetary policy which targets a 10-year government bond yield to maturity of zero begins to make a mockery of the extrapolations above. If one were able to secure a mortgage at a negative interest rate, as it has recently become possible to do in Denmark, by this warped logic it would make economic sense to borrow the absolute maximum a bank would be prepared to lend. Why then have Danish property prices not exploded to the upside? To misquote Coleridge, it is the suspension of belief on the part of the average Dane. If a bank is willing to pay you to borrow, something is rotten in the State of Denmark.

Overpriced or Bargain Basement

After this short review of global residential real estate it is tempting to conclude that, so long as interest rates do not rise substantially and demand outstrips supply, prices should continue to increase. The problem with this logic is that the current level of interest rates is distorting the nature of global economic growth.

Government borrowing has been a key driver of the economic expansion of the past decade. Although some would argue that government debt is heading to infinity and beyond, at some point we should expect this debt to be repaid. But why repay at all when interest rates (and even some mortgage rates) are negative? This brings to mind another quote from Hamlet, Polonius’s advice to his son:

‘Neither a borrower nor a lender be,

For loan oft loses both itself and friend,

And borrowing dulls the edge of husbandry.’