Purchasing Managers Suggest Solid Growth but Lingering Concerns in January

Surveys of purchasing managers from the Institute for Supply Management suggest support for continued economic expansion but also highlight a range of concerns, from ongoing uncertainty over trade policy and tariffs to lingering effects from the government shutdown. On balance, the results are positive but suggest a more challenging business environment in 2019.

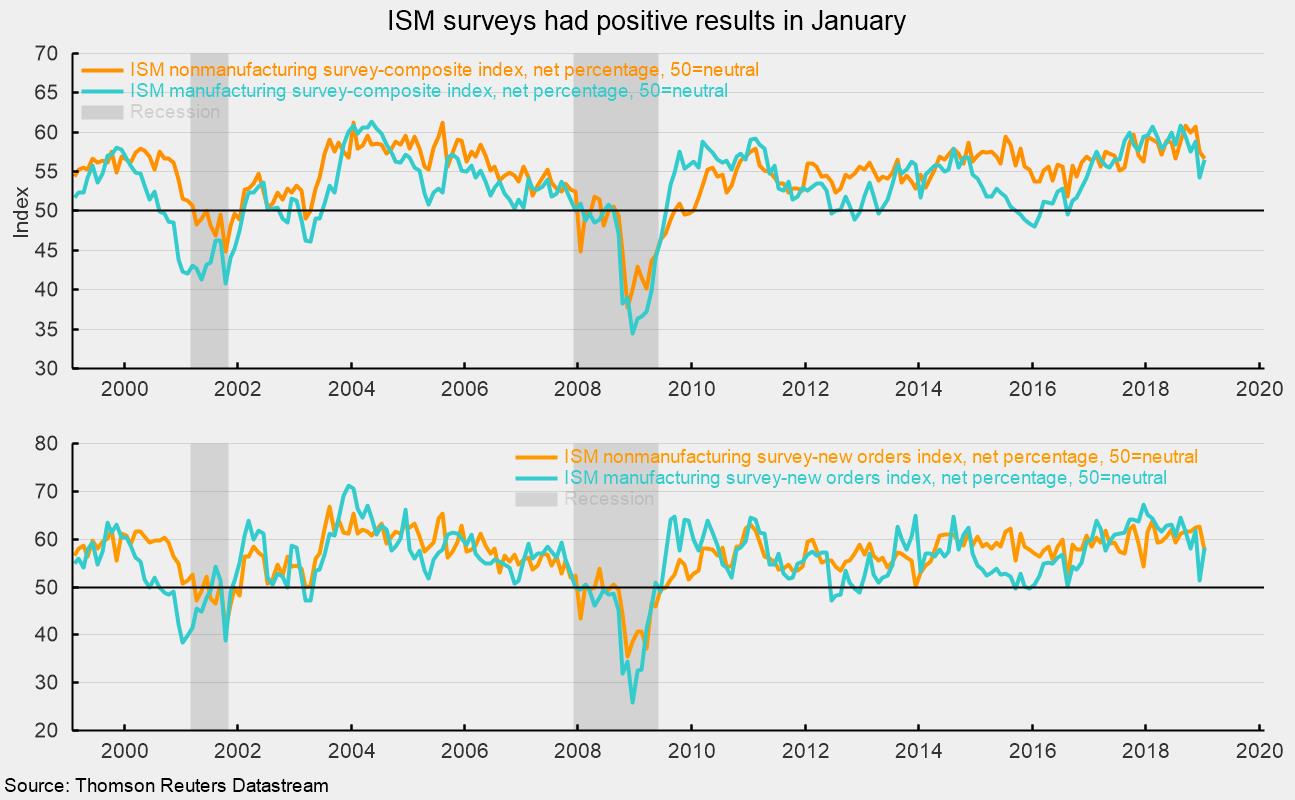

Overall, results for the key indexes were similar for the two surveys though manufacturing generally showed improvements from the prior month while nonmanufacturing showed some softening. The manufacturing PMI composite index registered a 56.6 percent reading in January, up 2.3 points from 54.3 in December (see top chart). January is the 29th month in a row above the neutral 50 level and the 117th above the 42.9 percent threshold consistent with expansion in the overall economy.

Among the key components of the Purchasing Managers Index, the New Orders Index rebounded to 58.2 from 51.3 in December, a rise of 6.9 points (see bottom chart). The result was the 37th consecutive month with readings above 50. New export orders ticked down slightly, losing 1.0 point to 51.8. The backlog of unfilled orders remained close to a neutral reading of 50.0, coming in at 50.3 versus 50.0 in the prior month.

The production index was at 60.5 percent in January, up from 54.1 in December. January marks the 29th month in a row above 50. Historically, readings above 51.7 are consistent with growth in the industrial-production index from the Fed. In January, 14 industries surveyed reported growth while just one reported a decrease in production.

The employment index fell to 55.5 percent in January, down from 56.0 in December. The January employment report from the Bureau of Labor Statistics showed manufacturing industries added a net 13,000 new employees, with durable-goods manufacturing adding 20,000 but nondurable goods losing 7,000.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 56.2, down from 59.0 in December. January was the 35th consecutive month above 50, and the results suggest suppliers delivering to manufacturers are still falling behind but at a somewhat-slower pace.

The prices index eased again, dropping below 50 for the first time since February 2016. The index fell 5.3 percentage points to 49.6 in January from 54.9 in December. The survey noted a mixed of price increases and decreases reported among the various manufacturing industries. Some volatility is related to tariffs.

Customer inventories in January are still considered too low, with the index rising to 42.8 from 41.7 in the prior month (index results below 50 indicate customers’ inventories are too low). This index has been below 50 for 28 consecutive months.

The ISM’s nonmanufacturing index fell to a reading of 56.7 from 57.6 in December (see top chart). The January result is the 108th consecutive reading above 50. Among the key components of the NMI, the business-activity index (equivalent to the production index in the ISM manufacturing report) was 59.7 in January, down from 59.9 in December. For January, nine industries in the nonmanufacturing survey reported growth while eight reported contraction.

The nonmanufacturing new-orders index came in at 57.7, down from 62.7 in December (see bottom chart). January was the 114th month with readings above 50. The new-export-orders index, a separate index that measures only orders for export, was 50.5 in January, down sharply from 59.5 in December.

The nonmanufacturing employment index increased to 57.8 in January, versus 56.3 in December. The favorable readings are broadly consistent with the strong 224,000 new employees in private service-producing industries reported by the BLS in the January employment report.

Supplier deliveries, a measure of delivery times for suppliers to non-manufacturers, came in at 51.5, unchanged from December. It suggests suppliers are falling farther behind in delivering supplies to non-manufacturers, but the pace of slippage has stabilized versus the prior month.

The price index rose to a reading of 59.4 in January versus 57.6 in the prior month. January was the 20th month in a row that the prices index has been above 50. This result suggests non-manufacturers are still experiencing materials-costs increases.

Today’s reports from the Institute for Supply Management suggest a bit of a rebound for the manufacturing sector but a bit of a deceleration for nonmanufacturing. However, on balance, most of the component indexes are above the neutral 50 level. Comments from the respondents suggest that industries within manufacturing and nonmanufacturing are experiencing different combinations of effects from a wide range of sources but the general message is still-solid levels of current activity with elevated levels of uncertainty regarding the future.