Private Sector Job Gains Returned to Trend, Supporting a Cautiously Positive Outlook

The labor market rebounded in March from a weak gain in February. U.S. nonfarm payrolls added 196,000 jobs in March, after an increase of just 33,000 new jobs in February. The modest February gain was revised up 13,000 from an initial estimate of 20,000 jobs. Combining the last two months with a 1,000 upward revision to January, the three-month average gain in payrolls came in at 233,000 in March.

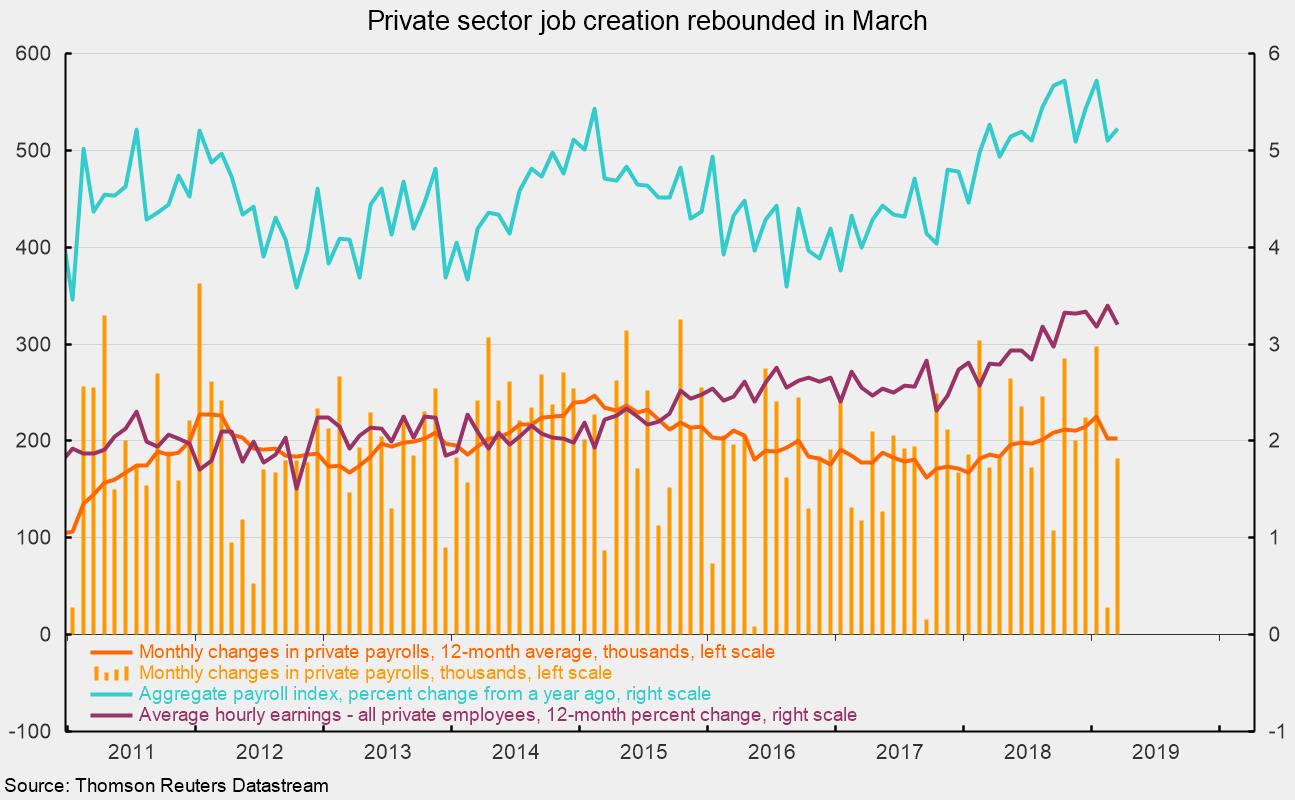

For the private sector, nonfarm payrolls added 182,000 in March following a gain of 28,000 in February. On a three-month average basis, private payrolls added 236,000, and over the past year, the average gain is 202,000 (see chart). The 12-month average is very close to the 8-year average of 200,000. Despite the poor gain in February, job creation remains on a solid trend pace. With several months of mixed results in economic data, the latest report on the labor market helps tip the scales in favor of cautious optimism for continued economic expansion.

Goods-producing industries added 12,000 jobs in March, below the monthly average gain of 42,000 over the past year. Construction led with addition of 16,000, while durable-goods industries lost 7,000. Within private service-producing industries, which typically account for the lion’s share of job creation, payrolls rose by 170,000 workers, led by a 49,000 gain in health care, a 37,000 jump in professional and business services, and a gain in leisure and hospitality industries of 33,000 jobs.

Weakness continued for the retail industry, losing 12,000 jobs for the month, worse than the average 3,000 loss per month over the past year. Wholesale-trade companies cut 2,000 jobs last month while temporary-help firms, a subset of professional and business services, reduced payrolls by 5,000.

Public sector employment rose by 14,000 in March, ahead of the 9,000 average monthly gains over the past year. The gains came entirely from state and local governments (up 4,000 and 12,000, respectively) while federal government jobs fell by 2,000.

The unemployment rate held for the second consecutive month at 3.8 percent, just above the 3.7 percent low since December 1969. The labor force participation rate fell 0.2 percentage points to 63.0 percent in March as 224,000 people left the labor force. The participation rate briefly dipped to a cycle low of 62.4 percent in September 2015 and has spiked as high as 63.2 recently but has been essentially trending flat between 62.7 percent and 63 percent since late 2013. The labor force participation rate had been as high as 67.3 percent in 2000.

Average hourly earnings rose 0.1 percent in March, pushing the 12-month change to 3.2 percent, down from a cycle peak of 3.4 percent last month (see chart). Average hourly earnings growth has been very slow compared to previous cycles, especially given the low unemployment rate, but has been accelerating gradually since late 2017. While that is good news for employees and consumer spending, it could be a problem for employers as rising labor costs squeeze profits.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose a healthy 0.5 percent in March and is up 5.2 percent from a year ago (see chart). This index is a good proxy for take-home pay and has posted relatively steady year-over-year gains in the 3 to 5 percent range since 2010 but has now been above 5 percent for 11 straight months. Continued gains in the aggregate-payrolls index are a positive sign for consumer income and spending, and are likely to support continued economic expansion.