Private Payrolls Rose By 906,000, But Are Still Down 9 Million Since February

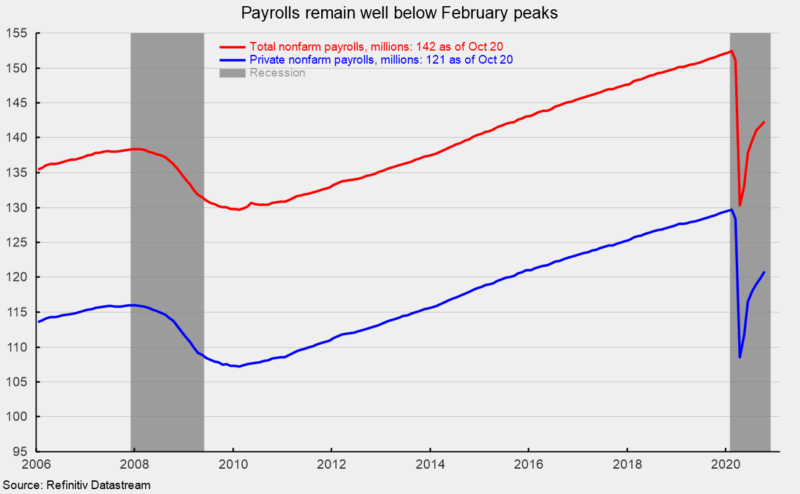

U.S. nonfarm payrolls added 638,000 jobs in October, the sixth monthly gain since posting massive drops in March and April. However, the latest gain is the slowest so far in the recovery, and the six-month total gain of 12.07 million is far from offsetting the 22.16 million loss in March and April (see first chart).

Private payrolls added a more impressive 906,000 jobs in October and brings the six-month total gain to 12.32 million versus a loss of 21.19 million in March and April. Total payrolls remain 10 million below the February peak while private payrolls remain 8.9 million below the February peak (see first chart).

The report suggests that the labor market recovery is continuing as restrictive government policies are lifted. However, the pace of gain and large gaps to full recovery reinforce concerns that a sizable portion of the job losses may be very slow to return or may not return at all.

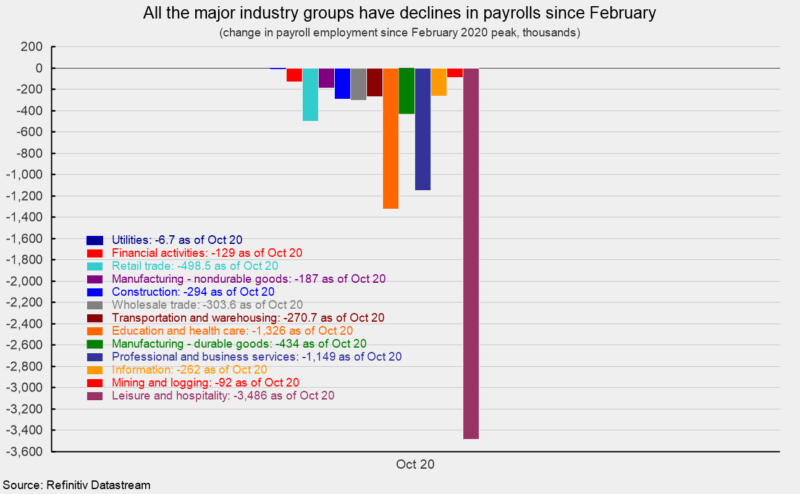

Within the 906,000 gain in private payrolls, private services added 783,000 while goods-producing industries gained 123,000. For private service-producing industries, the gains were led by a 271,000 increase in leisure and hospitality followed by professional and business services with a gain of 208,000, retail with the addition of 104,000, and health care and social-assistance industries with a 79,000 increase.

Within the 123,000 gain in goods-producing industries, construction added 84,000 jobs, durable-goods manufacturing increased by 21,000, nondurable-goods manufacturing rose by 17,000, and mining and logging industries added 1,000 jobs. Despite the gains over the last six months, every industry group had fewer employees in October than in February. The net losses range from about 6,700 in utilities workers to a devastating 3.5 million in leisure and hospitality (see second chart).

The government sector cut 268,000 employees in October, with local government payrolls dropping by 65,000, state government also eliminating 65,000 positions, and the federal government cutting 138,000 workers.

Average hourly earnings rose 0.1 percent in October, putting the 12-month gain at 4.5 percent. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.9 percent in October following a 1.1 percent gain in September. The index is still down 0.9 percent from a year ago.

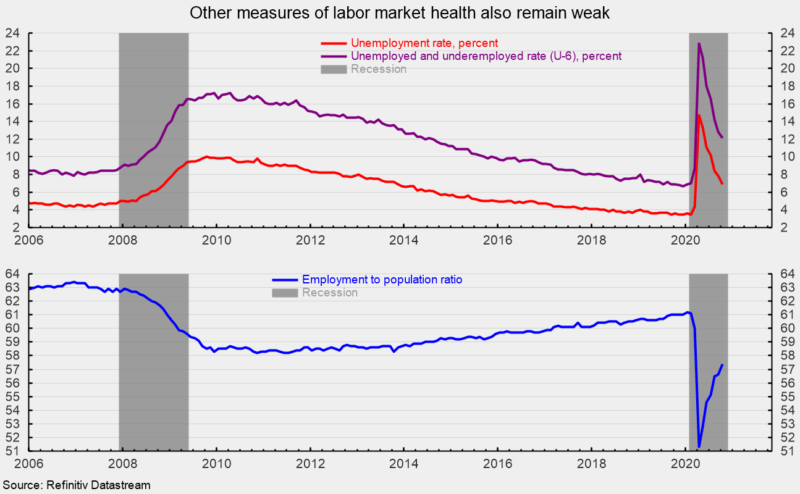

The total number of officially unemployed fell to 11.06 million in October, a drop of 1.52 million from September. The number of officially unemployed in February was just 5.8 million.

The unemployment rate fell to 6.9 percent from 7.9 percent in September while the underemployed rate, referred to as the U-6 rate, fell from 12.8 percent in September to 12.1 in October; the peak was 22.8 percent in April (see top of third chart).

The participation rate rose to 61.7 percent from 61.4 percent. The participation rate was 63.4 percent in January 2020 and fell to a low of 60.2 in April during the lockdowns. The employment-to-population ratio, one of AIER’s Roughly Coincident indicators came in at 57.4 for October, above the 51.3 ratio in April but still well below the 61.2 ratio from January 2020 (see bottom of third chart)

The October jobs report shows that the labor market is recovering from the devastating effects of government lockdowns. However, the pace of recovery and large gaps to full recovery suggest it may be quite some time before pre-pandemic conditions are reached. Furthermore, the longer businesses are closed or restricted and the longer the labor market remains weak, the more likely that financial strains such as debt delinquencies, debt defaults, and bankruptcies will hamper economic recovery.