Private Payrolls Jumped in December and Wage Growth Accelerated

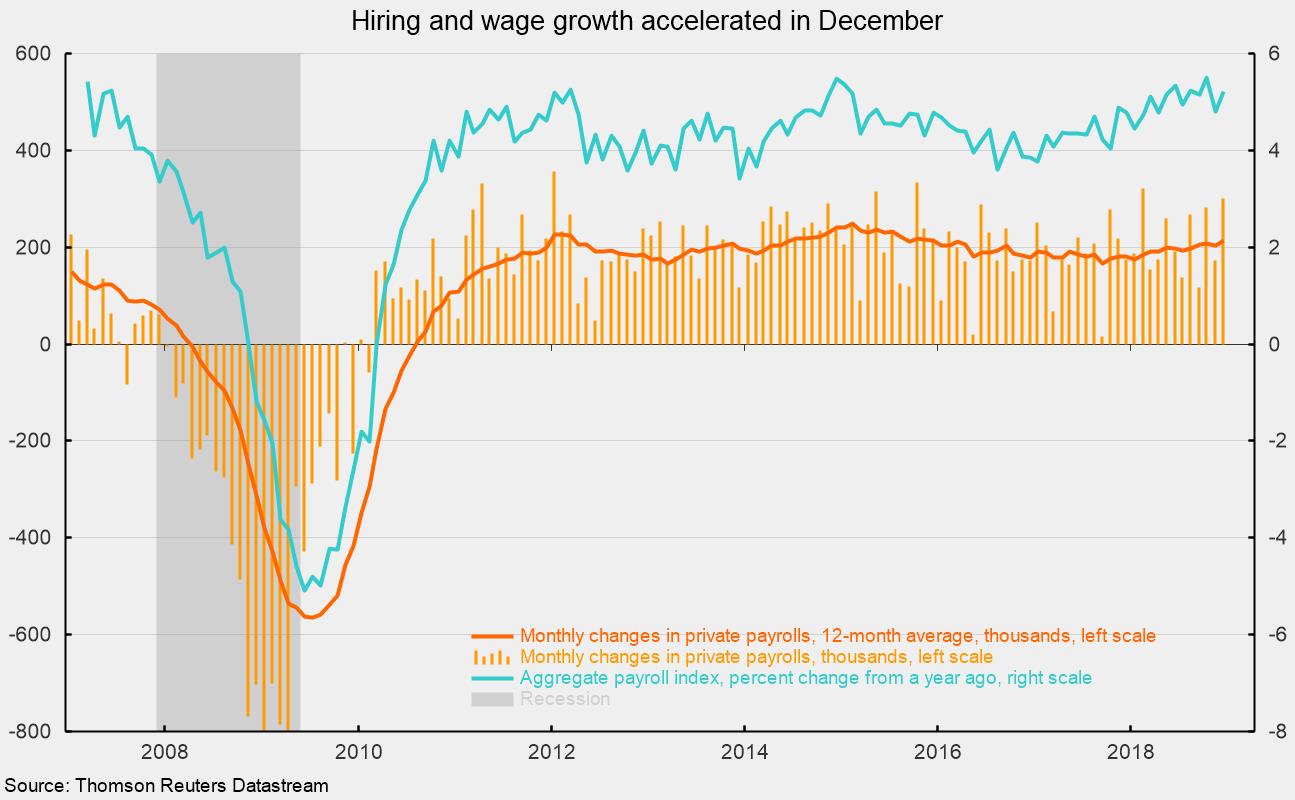

Hiring rebounded in December as U.S. nonfarm payrolls added 312,000 jobs last month, after an increase of 176,000 new jobs in November. The December gain was the largest since February 2018. For the private sector, nonfarm payrolls added 301,000 in December following a gain of 173,000 in November. On a three-month average basis, private payrolls added 252,000, and over the past year, the average gain is 214,000 (see chart).

Goods-producing industries added 74,000 in December, ahead of the monthly average gain of 52,000 over the past year. Durable-goods manufacturing and construction led with additions of 19,000 and 38,000 jobs, respectively, while nondurable-goods industries added 13,000. Within private service-producing industries, which typically account for the lion’s share of job creation, payrolls added 227,000 workers, led by a 58,000 gain in health care and social assistance and a 55,000 jump in the leisure and hospitality industries. Professional and business services posted a gain of 43,000 jobs for the latest month, below the 49,000 average over the past year, while retail added 24,000 jobs in December.

The unemployment rate rose to 3.9 percent from 3.8 percent in November. The labor force participation rate ticked up to 63.1 percent in December as 419,000 people joined the labor force. The participation rate briefly dipped to a cycle low of 62.4 percent in September 2015 but has been essentially trending flat between 62.7 percent and 63.1 percent since late 2013.

Average hourly earnings rose 0.4 percent in December, pushing the 12-month change to 3.2 percent. AHE growth has been very slow compared to previous cycles, especially given the low unemployment rate, but has been accelerating recently. That is good news for employees but could be a problem for employers.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.9 percent in December and 5.2 percent from a year ago (see chart). This index is a good proxy for take-home pay and has posted relatively steady year-over-year gains in the 3 to 5 percent range since 2010 but has now been above 5 percent for 7 of the last 10 months. Continued gains in the aggregate-payrolls index is a positive sign for consumer income and spending, supporting continued economic expansion.

The solid employment report is somewhat reassuring given the declines in equity markets, falling Treasury yields, weakness in housing, and high degree of uncertainty surrounding trade, fiscal, and monetary policy. Overall, a cautious view is warranted.