Private Job Openings Increase to the Highest Level in a Year

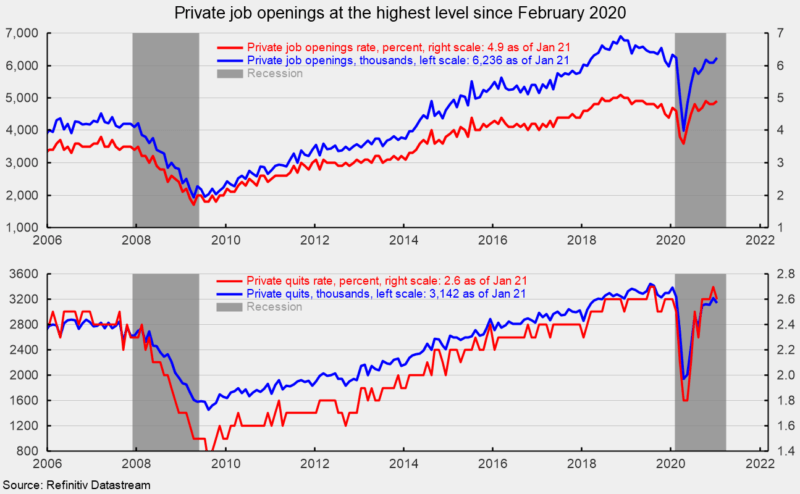

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the total number of job openings in the economy rose to 6.917 million in January, up from 6.752 million in December. The number of open positions in the private sector increased to 6.236 million in January, the highest level since February 2020 (see top of first chart). Private-sector openings are well above the low of 3.996 million in April 2020 at the height of government-imposed lockdowns, posting gains in seven of the last nine months, but are still below the pre-pandemic peak of 6.336 million in January 2020. The private-sector job-openings rate, openings divided by the sum of jobs and openings, was 4.9 percent, up from 4.8 percent in December and well above the low of 3.6 percent in April (see top of first chart).

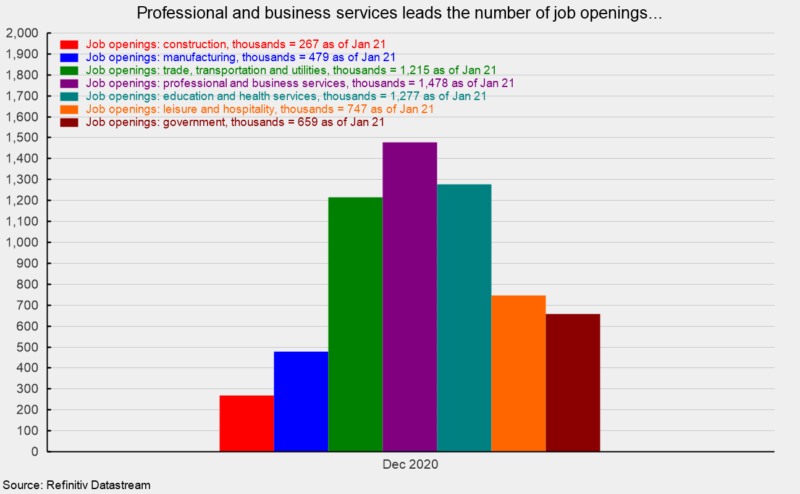

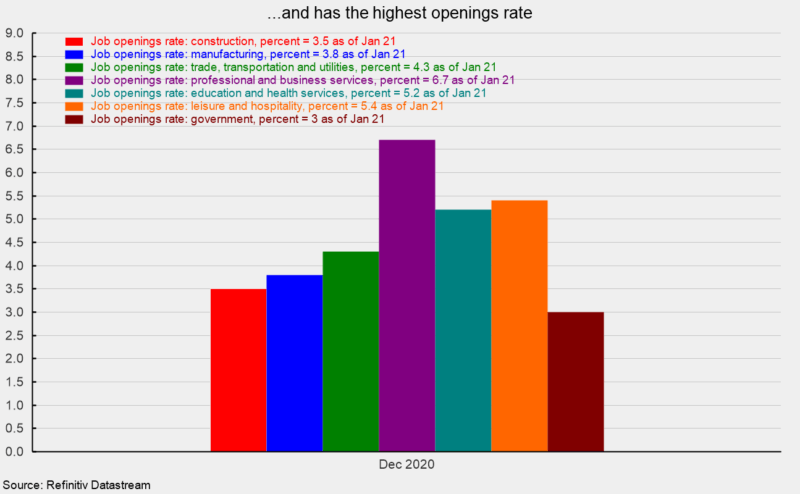

The industries with the largest number of openings were education and health care (1.356 million), professional and business services (1.355 million), and trade, transportation, and utilities (1.239 million; see second chart). The highest openings rates were in professional and business services (6.2 percent), education and health care (5.5 percent), and leisure and hospitality (5.3 percent; see third chart).

The rise in private job openings was a function of hires, separations and changing labor requirements. Private hires in January fell to 4.965 million from 5.072 million in December, a drop of 107,000. At the same time, the number of private-sector separations fell to 4.983 million in January, down 253,000 from December’s 5.236 million. Within separations, private quits were 3.142 million (versus 3.224 million in December) and layoffs were 1.592 million, down from 1.734 million in the prior month. The total separations rate fell to 3.7 percent with the private sector experiencing a rate of 4.1 percent, down 0.1 percentage points from December.

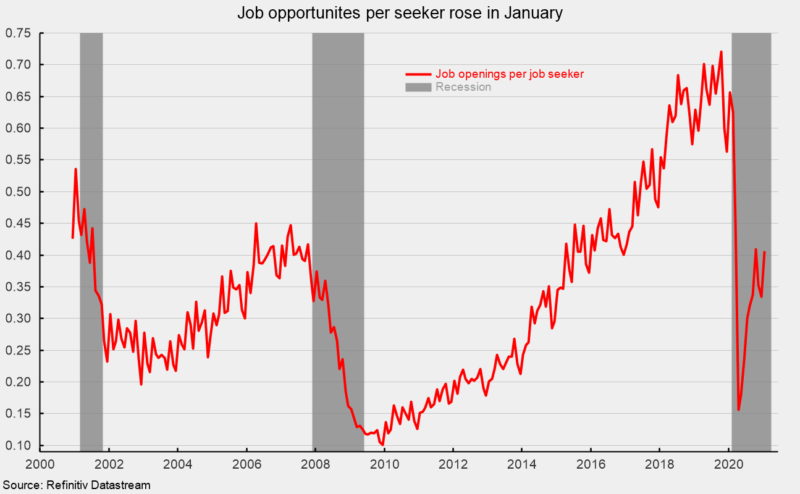

From the worker perspective, labor market conditions improved a bit in January but remain challenging. The number of openings per job seeker (unemployed plus those not in the labor force but who want a job) rose to 0.406 in January, up from 0.334 in December, well above the April 2020 low of 0.156 but still well below the 0.721 peak in October 2019 (see fourth chart).

Overall, the data relating to the labor market have improved modestly. Today’s data on job openings and turnover along with a somewhat stronger jobs report for February and decline in the latest number of weekly initial claims for unemployment insurance provide some basis for optimism. Furthermore, while the impacts of government lockdowns linger and vary widely among industries, the ongoing distribution of vaccines gives hope for continued reductions and eventual elimination of restrictive government lockdown rules and the resumption of economic activity free from lockdown distortions.