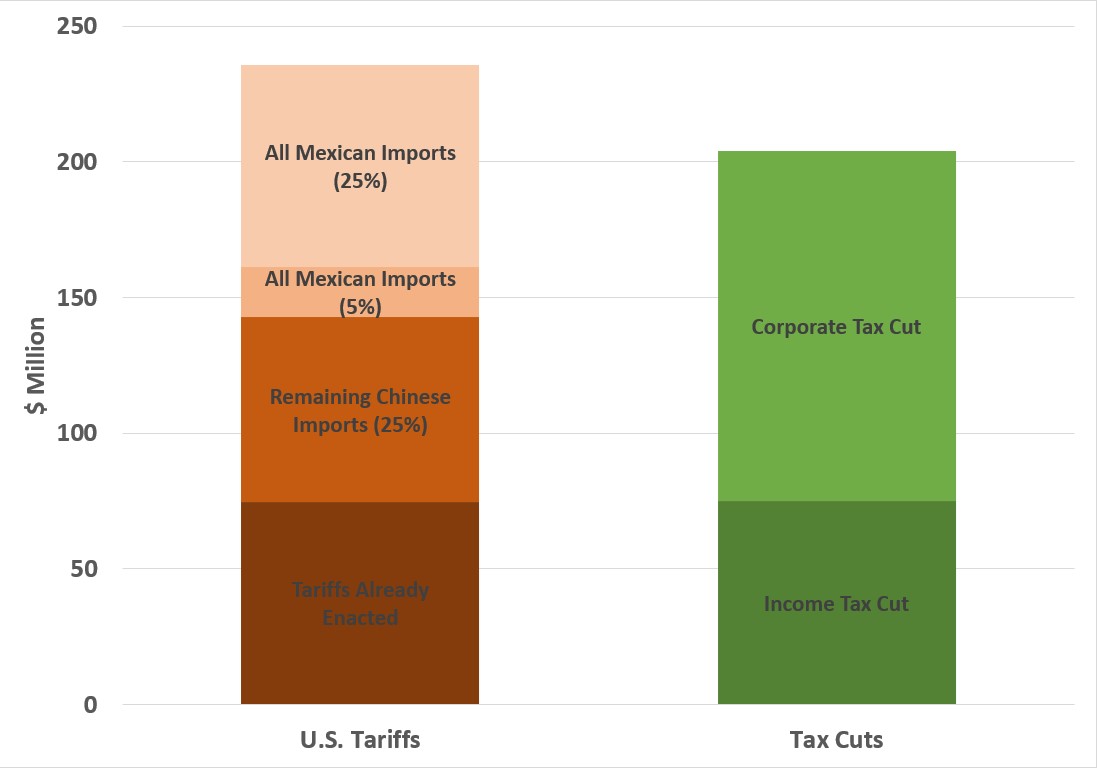

President Trump’s Threatened Tariffs Would Wipe Out 2017 Tax Cuts

If President Trump makes good on his latest threats of more tariffs on goods imported from China and Mexico, his attempts at playing hardball will result in a higher overall tax bill for Americans than when he took office.

In a report earlier this year, Pete Earle and I estimated the annual burden to Americans of the tariffs already imposed by the Trump Administration, which at the time added up to about $45 billion. At the time of that writing, a tenuous ceasefire of sorts between the U.S. and China was holding, but that truce is now a distant memory.

In recent months the Trump Administration has furiously added new and threatened tariffs, raising the burden on Americans (and yes, Americans pay these import taxes) to almost unfathomable levels. Over and above the initial $45 billion burden, the President has made the following moves:

-

Increased the tariff rate on $200 billion of Chinese imports from 10 percent to 25 percent, raising the burden of tariffs already enacted to $75 billion

-

Threatened to tax all remaining Chinese imports at 25 percent ($68 billion burden)

-

Threatened to tax all Mexican imports at a rate between 5 percent ($19 billion burden) and 25 percent (additional $75 billion burden)

The chart below puts this staggering tax increase on Americans (assuming the President makes good on his threats) into perspective. We estimate that the overall annual U.S. tariff burden is $235 billion. These tariffs would more than wipe out estimated annual savings from the 2017 income and corporate tax cuts, estimated at $204 billion.

Should these threatened tariffs come to pass, it will be hard to argue that we have seen a more anti-business U.S. President, from either party, in recent memory.