Positive Signs for the Manufacturing Sector but Employment Remains Weak

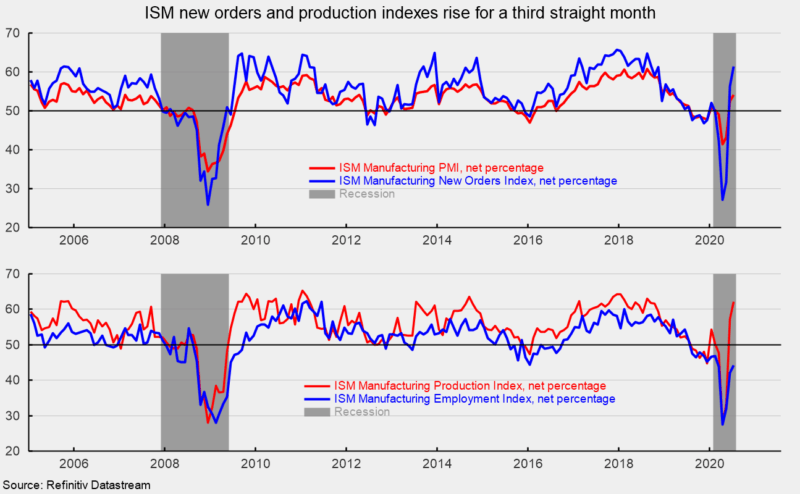

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index showed another improvement, registering a 54.2 percent reading in July, up from 52.6 percent in June and the second reading above the neutral 50 threshold since February. The July result follows three months in a row in the 40s (see top chart). Overall, the report notes, “In July, manufacturing continued its recovery after the disruption caused by the coronavirus (COVID-19) pandemic. Panel sentiment was generally optimistic (two positive comments for every one cautious comment), continuing a trend from June.” The report continues, “The PMI signaled a continued rebuilding of economic activity in July and reached its highest level of expansion since March 2019, when the index registered 54.6 percent.”

Among the key components, the New Orders Index came in at 61.5 percent, up from 56.4 percent in June, and the highest result since September 2018 (see top chart). Thirteen of eighteen industries in the survey reported growth in new orders in July. The New Export Orders Index came in at 50.4 percent in July, up 2.8 percentage points from a 47.6 percent result in June. The Backlog-of-Orders Index came in at 51.8 percent in July, up from 45.3 percent in the prior month.

The Production Index registered a 62.1 percent result in July, up from 57.3 percent in June and the highest reading since October 2018. Sixteen industries reported growth in the latest month while none reported contraction.

The Employment Index rose a modest 2.2 percentage points to 44.3 percent in July, versus 42.1 percent in June (see bottom chart). The employment index remained below neutral for a 12th consecutive month suggesting labor dynamics in the manufacturing sector remain weak. The Bureau of Labor Statistics’ Employment Situation report for July is due out on Friday, August 7. Despite the weak reading from the ISM survey, consensus expectations are for a gain of 1.6 million nonfarm-payroll jobs including the addition of 250,000 jobs in manufacturing. The unemployment rate is expected to fall to 10.5 percent from 11.1 percent in June.

The Supplier Deliveries Index, a measure of delivery times from suppliers to manufacturers, eased back, falling to 55.8 percent from 56.9 percent in June. Slower supplier deliveries are usually consistent with stronger manufacturing activity. However, the slower deliveries in recent months have been more a result of supply chain and logistical constraints. According to the report, “Suppliers continue to struggle to deliver, although at a slower rate compared to June. Plant interruptions, transportation challenges and continuing difficulties in supplier labor markets are still factors. The Supplier Delivery Index continues to reflect a healthier supply/demand balance compared to spring and early summer.”

The Prices Index rose to 53.2 percent in July from 51.3 percent in June. Higher prices were reported for: plastics, lumber, aluminum, copper, and petroleum products. While the price index posted its second month above neutral, the results are generally modest by historical comparison.

Customer inventories in July are still considered too low, with the index remaining below 50 at 41.6 percent versus 44.6 percent in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 46 consecutive months. Insufficient inventory may be a positive sign for future production.