Philadelphia Fed Manufacturing Survey Jumps in September

Manufacturing firms in the Philadelphia area showed a substantial increase in current business conditions as well as expectations for future conditions six months ahead. The index for general business conditions jumped to 23.8 versus 18.9 in August. Readings below zero tend to be associated with recessions so the current survey is consistent with continued economic expansion.

Among the other survey questions, the index for new orders rose to 29.5 from 20.4 while the index for shipments increased to 37.8 from 29.4. The shipments index is at the second-highest level since mid-2004 while the new orders index is at the third-highest level since 2011. Both are consistent with robust economic activity.

Prices paid and prices received both increased in September with the prices-paid index increasing to 34.4 from 21.1 and the prices-received index moving up to 22.8 from 13.5. The relatively weaker results in the report came from the labor market questions. The number of employees index pulled back to 6.6 from 10.1 while the average workweek index eased back to 11.9 from 18.8. Both indexes remained above zero, suggesting continued expansion but at a less robust pace.

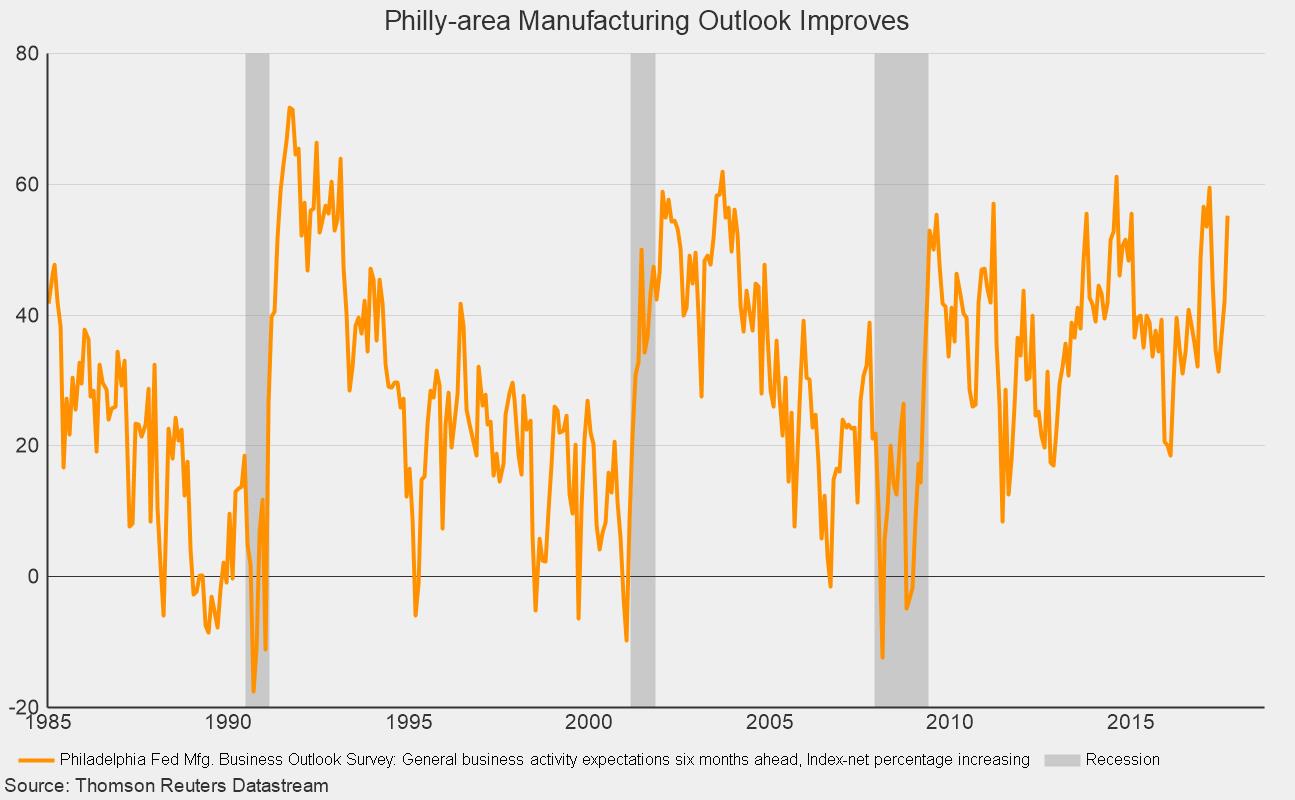

Even more impressive than the results for the questions related to current conditions were the results for the questions related to the outlook six months ahead. The index for general business activity six-months ahead surged to 55.2 in September from 42.3 in August. Historically, readings in the mid-50s and higher are associated with strong growth in the initial phase of economic recovery occurring immediately after a recession, not with economic growth eight years into an economic expansion (see chart).

Other strong results from the forward-looking questions include new orders jumping to 56.9 from 49.1 and shipments rising to 55.8 from 44.1. Strong reading also came from capital expenditures which registered a 39.0 reading, down slightly from 39.2, number of employees at 30.1, down from 33.1, and average workweek at 18.1 up from 15.3 in August. The expectations for prices paid jumped to 46.2 from 34.8 while expected prices received fell to 31.7 from 40.4.

Also reported today were the latest filings for new unemployment claims. Claims came in at 259,000, down from 284,000. The four-week average, used to help smooth out weekly volatility, came in at 268,750, up from 262,750 in the prior week. Initial claims had been running at record low levels until Hurricanes Harvey and Irma began to distort the data.

Overall, today’s data point to continued economic expansion and suggest that both manufacturing in the mid-Atlantic region and the labor market continue to have favorable outlooks.