Philadelphia-Area Manufacturing Survey Remains Positive

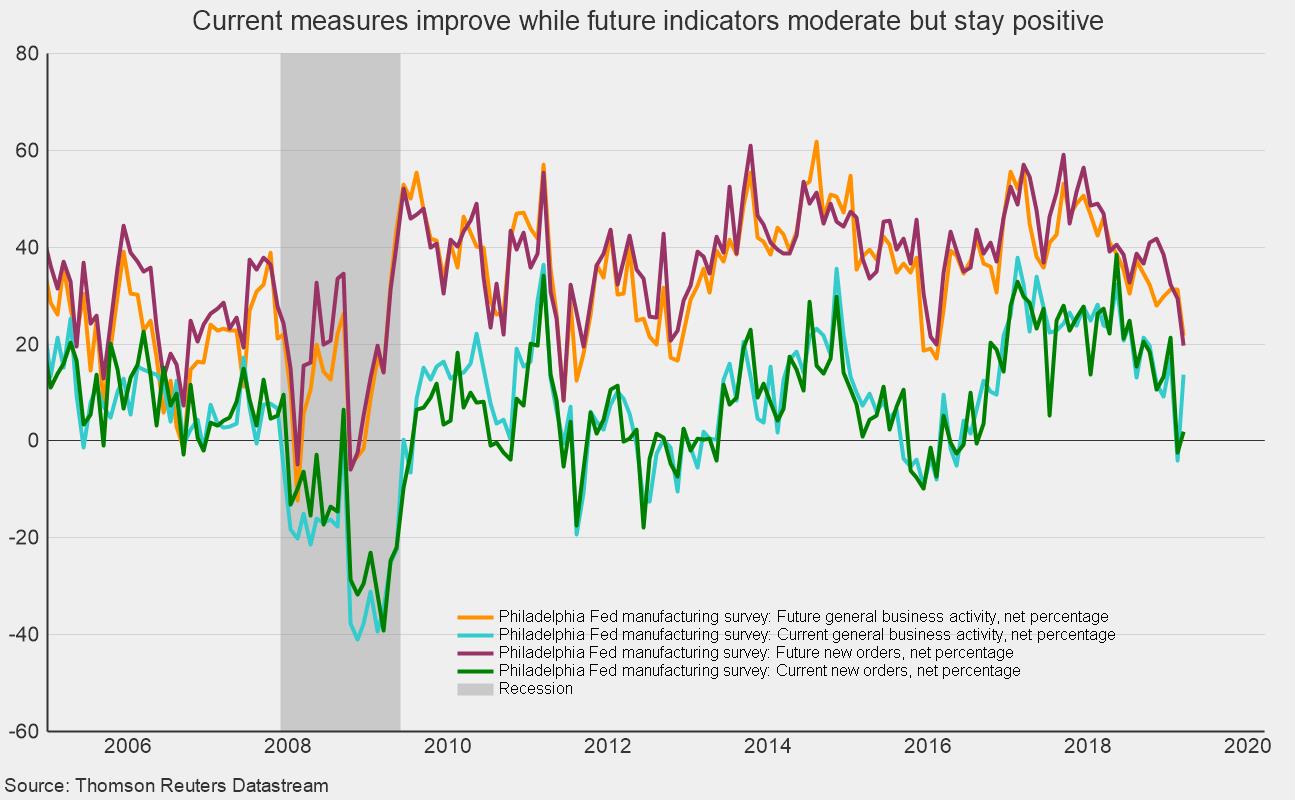

The results of the Philadelphia Fed’s Manufacturing Business Outlook Survey was generally favorable in March. In general, respondents were more upbeat about current conditions but somewhat less optimistic about the future. Overall, the survey still suggests expansion for manufacturing in the Philadelphia area.

Among the survey’s current-conditions indexes, general business activity jumped to 13.7 from -4.1 while new orders rose to 1.9 from -2.4 and shipments rose to 20.0 from -5.3 in the prior month. Labor indicators were above neutral with number-of-employees index decreasing to 9.6 from 14.5 while the average-workweek index rose to 10.6 from 4.7.

There was some positive news on prices as the index of prices paid (for input materials) fell to 19.7 from 21.8, though there was a corresponding drop in the prices-received (for goods sold) index, falling from 27.7 to 24.7. The prices-paid index is down from a high of about 60 in mid-2018 while the prices received has been trending higher of the past few years.

Among the forward-looking indicators, monthly changes were mixed but most indexes remained solidly above the neutral zero threshold. The future general-business-conditions index fell to 21.8 in March from 31.3 in February. The future new-orders index fell to 19.8 versus 29.4 in the prior month. Both the future prices-paid index and the future prices-received index rose in March while the two future labor indicators also rose. The expectations for capital spending dropped, registering 19.5 versus 31.7 in the prior month, but still well above neutral.

Also reported today were weekly initial claims for unemployment insurance. For the week ending March 16, claims fell 9,000 to 221,000. The four-week average came in at 225,000 versus 224,000 in the prior week. Though claims drifted up during most of the fourth quarter, since late January, they appear to be slowly receding again. By historical comparison, claims remain near multidecade lows, and measured as a percentage of employment, are just slightly above all-time lows.

Today’s reports provide some additional evidence that the recent weakness in economic activity may be reversing. While heightened caution is recommended, the most likely path remains continued economic expansion.