People Are Using Their Credit Cards More

Here’s one more bit of data that backs up the storyline of the U.S. economy continuing its trajectory of growth.

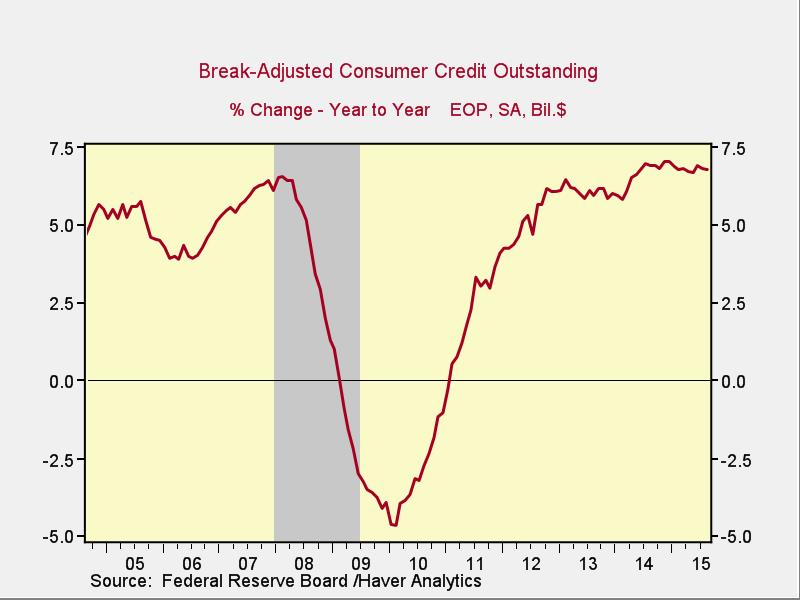

The Federal Reserve on Wednesday released its consumer credit report, showing that the trend of 6 to 7 percent annual growth that started in early 2014 continued in August. The major driver recently has been credit card usage, noted Bob Hughes, senior research fellow at the American Institute for Economic Research.

Revolving, or credit card, credit was only growing at about 1 percent going into 2014, but as of August 2015 it was growing at a clip of 4.2 percent, its highest rate since August 2008, Hughes noted.

“Consumers seem to be taking on more debt. It could be a positive sign of more confidence,” Hughes said.

Non-revolving credit hasn’t been quite as robust, Hughes said. The two biggest components of non-revolving credit are student and auto loans, and there’s been a slowdown in the growth of student loans in recent quarters, Hughes said. Although it’s hard to know for sure why, perhaps with the labor market doing better, fewer people are going back to school, he said.

But auto loans have been picking up since the end of the Great Recession, and they have continued their growth rate of about 8.5-9 percent, he said. This is reflected in increased auto sales, which in September were an annualized 18.2 million units, more than this year’s average of 17.2 percent. “That’s a very healthy number,” Hughes said.