Payrolls Grew By 1.8 Million in July But the Pace of Recovery Slowed, Raising Concerns

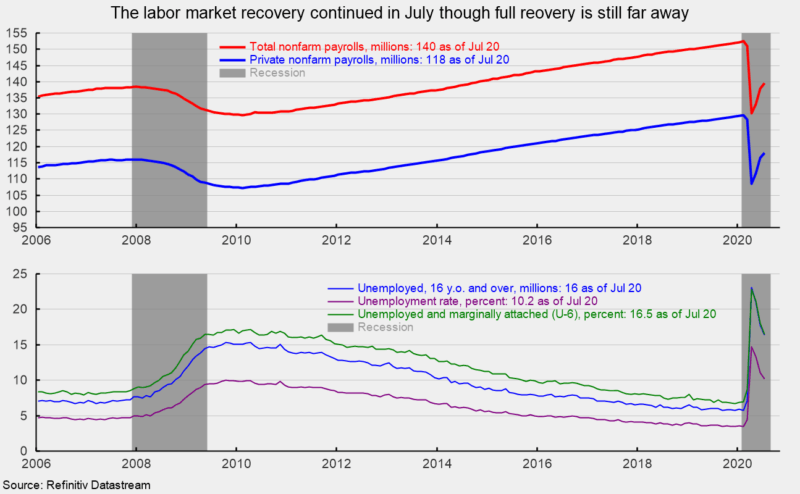

U.S. nonfarm payrolls posted a third monthly gain in July, adding 1.8 million jobs following a 4.8 million rise in June and 2.7 million in May. However, the three-month total gain of 9.3 million is far from offsetting the 22.2 million loss in March and April; payrolls remain well below prior peaks (see top of first chart).

The report suggests that the labor market recovery is continuing as restrictive government policies are lifted. However, with the number of new COVID-19 cases surging in many states, uncertainty as to consumer reactions and behavior as well as the continued lifting or possible reinstatement of lockdown policies is increasing, threatening the recovery.

The total number of officially unemployed fell to 16.3 million in July, a drop of 1.4 million from 17.8 million in June and a massive 21.0 million in May. The number of officially unemployed in February was just 5.8 million (see bottom of first chart).

The unemployment rate eased down to 10.2 percent from 11.1 percent in June (see bottom of first chart) while the participation rate ticked down to 61.4 percent from 61.5 percent. The underemployed rate, referred to as the U-6 rate, fell from 18.0 percent in June to 16.5 in July (see bottom of first chart).

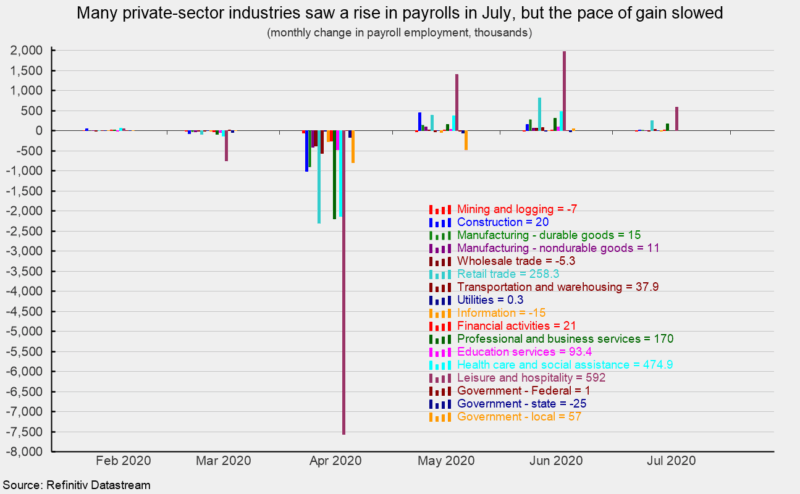

Overall, private payrolls added 1.5 million jobs in July following a gain of 4.7 million in June (see first chart). Private services added 1.4 million while goods-producing industries gained 39,000. For private service-producing industries, the gains were led by a 592,000 increase in leisure and hospitality followed by retail which added 258,000, and health care and social-assistance industries with a 191,000 increase. Within the 39,000 gain in good-producing industries, construction added 20,000 jobs, durable-goods manufacturing increased by 15,000, and nondurable-goods manufacturing rose by 11,000. Mining and logging industries lost 7,000 jobs (see second chart).

Average hourly earnings rose 0.2 percent in July, putting the 12-month gain at 4.8 percent. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 1.3 percent in July following a 2.6 percent gain in June. The index is down 3.1 percent from a year ago.

The July jobs report suggests that as government restrictions are lifted, payrolls are likely to rise. However, as COVID-19 cases spread in many states, it is possible that consumers may be reluctant to return to pre-pandemic spending patterns. In addition, as uncertainty grows, businesses may be reluctant to return to previous levels of employment, and the longer the restricted economy continues, the more businesses are likely to close permanently. Furthermore, it is possible that policymakers decide to slow down the pace of easing restrictions or possibly reinstate some lockdown measures. Any of these possible developments would be extremely detrimental to the economic recovery.