Paul Krugman’s Incorrigible Monetary Keynesianism

You know what I would like? I would like Paul Krugman to call me right now on video. I would talk him through how to download a cryptocurrency wallet. Then he could hold up his phone. I would scan the QR code for his public address. I would send him a token of his choosing.

He would see and experience how this works. He might still hate it, as he has and does now, but at least he would have skin in the game and experience the reality of a modernized money and payment system, instead of writing silly things about it.

The Shift

The twittersphere devoted to Bitcoin and the like has been blowing up about Krugman’s latest swipe against Bitcoin. What’s gone unnoticed is that his position has moved subtly from his “Bitcoin is Evil” column of December 28, 2013. He once found the whole thing ridiculous. Now he finds it unwise and unviable as a monetary system.

That’s a big difference. It’s progress. His current position on the topic is exactly what one would expect from a Keynesian of his pedigree, which is to say that he is resolutely opposed to any money not created and managed by the state, whether gold or Bitcoin.

The first piece in 2013 was written as the price had touched $1,000 and had begun to fall. In typing that sentence, I’m profoundly aware of what an extraordinary price that was for the time. Earlier in 2013, it had floated around $14, a level it had touched briefly in 2011 when hardly anyone paid attention to it. It was easy to dismiss as pure nonsense, and Krugman did exactly this.

This Isn’t Real

I get it. I did the same back in 2010. It took me two years finally to come around and realize that not only is cryptocurrency the real thing; it represents a great innovation. By the time I did realize it, there still weren’t many mainstream articles out there on the topic. Most available resources were not written for economists.

So it was a big deal that Krugman finally weighed in.

“Can this actually work?” he asked in 2013. “I’m still deeply unconvinced. To be successful, money must be both a medium of exchange and a reasonably stable store of value… And it remains completely unclear why BitCoin should be a stable store of value.”

Now, this requires a bit of tweaking. Ludwig von Mises, in his definitive 1912 treatise on money and credit, described the “store of value” function of money as a secondary feature of the primary utility of money. There are many sources for storing value; money can be one but this is a use case, not a test of fundamental functionality.

“As soon as the practice of employing a certain economic good as a medium of exchange becomes general, people begin to store up this good in preference to others. In fact, hoarding as a form of investment plays no great part in our present stage of economic development, its place having been taken by the purchase of interest-bearing property.”

In short, the “store of value” use case is a stage in the evolution of moneyness, not a persistent practice over time. Keep in mind that Mises wrote this more than 100 years ago. Already, people had found other ways to store wealth besides stuffing money in mattresses. And today, the idea that Bitcoin should be judged as to whether or not it is a store of value, much less a stable one, is absurd.

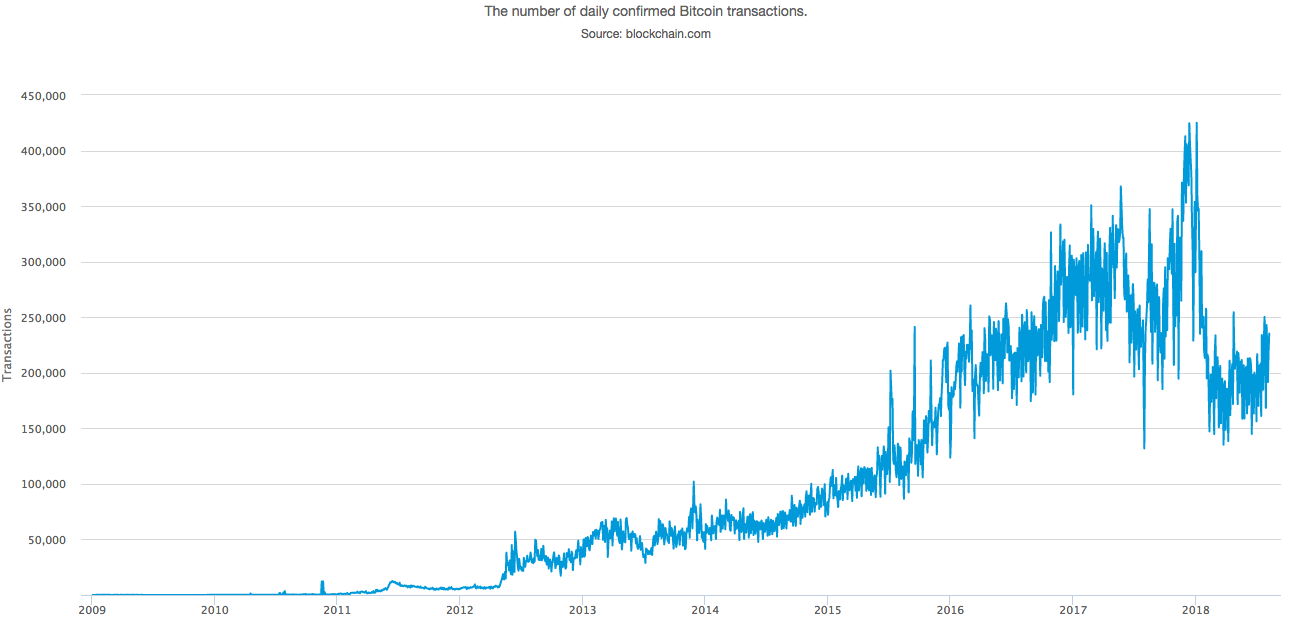

The irony deepens when you look at the data on Bitcoin velocity: it has slowed to a crawl following the crash in price after December 2017.

Plus, Krugman then (and now) entirely bypasses the key monetary innovation that is cryptocurrency: its peer-to-peer network that enables final settlement is a built-in part of the monetary unit, thus making the problems of storage, geography, and trust disappear entirely. It’s a completely different way of conceptualizing money, a money and payment system in one.

The value of the token itself traces to its settlement service. If there were a way to split Bitcoin from its distributed ledger, it would be destroyed and be useless.

Even if Krugman did not and does not understand this, how do we get from that to the headline’s claim that “Bitcoin is evil”? Maybe it was the headline writer who put the fine point on it. But it has stuck for 5 years. We can conclude from this piece that Krugman thought the innovation had absolutely no redeeming value and was a malicious fake.

Then and Now

Today, his views on the technology itself are more nuanced.

Instead of near-frictionless transactions, we have high costs of doing business, because transferring a Bitcoin or other cryptocurrency unit requires providing a complete history of past transactions. Instead of money created by the click of a mouse, we have money that must be mined — created through resource-intensive computations…. The high costs — making it expensive to create a new Bitcoin, or transfer an existing one — are essential to the project of creating confidence in a decentralized system.

I’m going to pass over that he is completely wrong that using Bitcoin requires the personal hosting of a full node registering all transactions. It does not. As for the supposed glories of “money created by the click of a mouse,” Bitcoin is a scarce commodity, as money necessarily must be in order to obtain and sustain its value (if a good is nonscarce, it is necessarily unpriced absent legislation.)

Krugman’s latest analysis is an exercise in comparative institutions, which is to say that he now realizes that cryptocurrency is real but now he wants to talk about it as a monetary system. He likes fiat money more because it costs much less to print paper than to mine cryptocurrency.

To be sure, “Governments have occasionally abused the privilege of creating fiat money,” he writes, “but for the most part governments and central banks exercise restraint.”

That’s a heck of a way to dismiss the horrors of inflation that have led to revolutions, political upheavals, cultural calamities, and tyrannies for ages and ages. The amount of human suffering caused by central bank control plus paper money is immense. And even when obvious disaster hasn’t been traced to nationalization of money, there are other effects: unlimited government debt, uncontrolled spending, vast increases in government power, all made possible by a “money created by the click of a mouse.”

Digital Gold

Krugman’s subtle shift is from “it can’t work” to “this is not as good as central banking and fiat money.”

I count this as progress. His negative outlook toward cryptocurrency is exactly what we would expect from a theorist schooled in Keynesianism. Keynes despised the gold standard because of its resources costs, the limits it places on political dreams, and the way it keeps reality in check. Bitcoin is nowhere even close to being a competitor to the dollar as a money and yet he attacks it for the very same reason that Keynes attacked gold

We sometimes see arguments between supporters of gold vs crypto. My debate with Peter Schiff is an example. But as this Krugman column shows, from the point of view of economic theory, the real division will always be between those who support sound money and those who want full government control of money, which is to say unsound money.

For now, this technology need not be judged based on some imagined future in which it fully replaces national money. I don’t believe we’ll see that in our lifetime. Right now the question should be: does it serve a useful purpose as judged by the market?

Meanwhile, my offer stands. If Paul Krugman wants to experience what a modernized P2P exchange of sound money feels like, my offer stands. I’m willing to help.

A version of this article appeared at Forbes.