October Employment Report Was Better Than Expected

Job creation was better than expected in October and disappointing gains in September and August were revised higher. Furthermore, October employment was held down by the strike at General Motors. Overall, job gains over the past few months appear significantly stronger than initially estimated. However, the pace of gain is still slower than the strong gains in 2018.

U.S. nonfarm payrolls added 128,000 jobs in October, after an increase of 180,000 new jobs in September and 219,000 in August. Government census workers helped boost August and September payrolls.

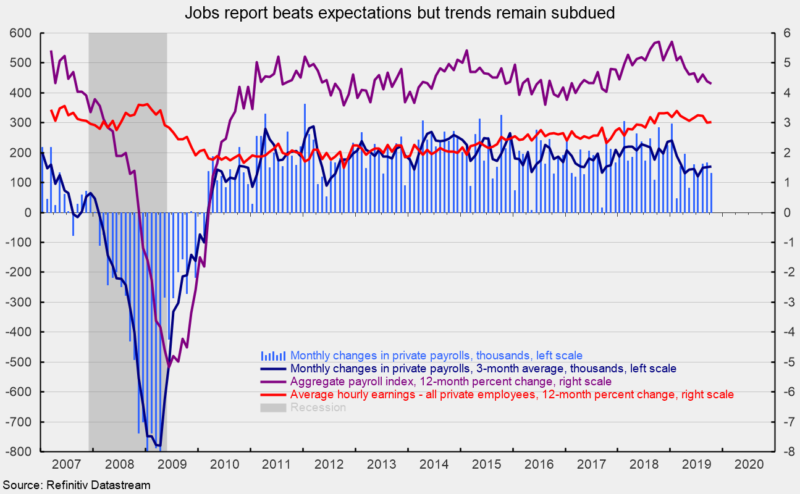

For the private sector, nonfarm payrolls added 131,000 in October following a gain of 167,000 in September and 163,000 in August (see chart). October private payrolls were also held down by 46,000 striking workers at GM. With those workers included plus the upward revisions to prior months, the three-month average gain for private payrolls was 169,000, a solid result but well below the 215,000 average for 2018.

Goods-producing industries lost 26,000 jobs in October, though 46,000 were striking workers who will return to payrolls in November. Construction led with the addition of 10,000 new employees, while durable-goods industries lost 41,000. Within private service-producing industries, which typically account for the lion’s share of job creation, payrolls rose by 157,000 workers, led by a 61,000 gain in leisure and hospitality industries. Health care and social assistance added 34,200, while professional and business services posted a gain of 22,000 jobs. Financial services added 16,000 and retail employment rose by 6,100.

Public sector employment fell by 3,000 in October after adding 130,000, or an average of 32,500 per month, over the prior four months. Information industries eliminated 4,000 positions.

The unemployment rate ticked up to 3.6 percent, just above the 3.5 percent low over the past half century. The labor force participation rate rose 0.1 percentage point to 63.3 percent in October, the highest since August 2013, as 325,000 people joined the labor force. The participation rate briefly dipped to a cycle low of 62.4 percent in September 2015 but had been essentially trending flat between 62.7 percent and 63 percent since late 2013. The participation rate may finally be drifting higher reflecting the tight labor market. The labor force participation rate had been as high as 67.3 percent in 2000.

Average hourly earnings rose 0.2 percent in October, pushing the 12-month change to 3.0 percent, down from a cycle peak of 3.4 percent in February (see chart). Average hourly earnings growth has been very slow compared to previous cycles, especially given the low unemployment rate, and now appears to be decelerating slightly from the February high.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.3 percent in October and is up 4.3 percent from a year ago (see chart). This index is a good proxy for take-home pay and has posted relatively steady year-over-year gains in the 3 to 5 percent range since 2010 but has now been decelerating after hitting a 5.7 percent pace in January. Continued gains in the aggregate-payrolls index are a positive sign for consumer income and spending, and are likely to support continued economic expansion.

A solid October jobs report suggests continued economic expansion. However, growth has slowed and may leave the economy more vulnerable to erratic policies and elevated uncertainty.