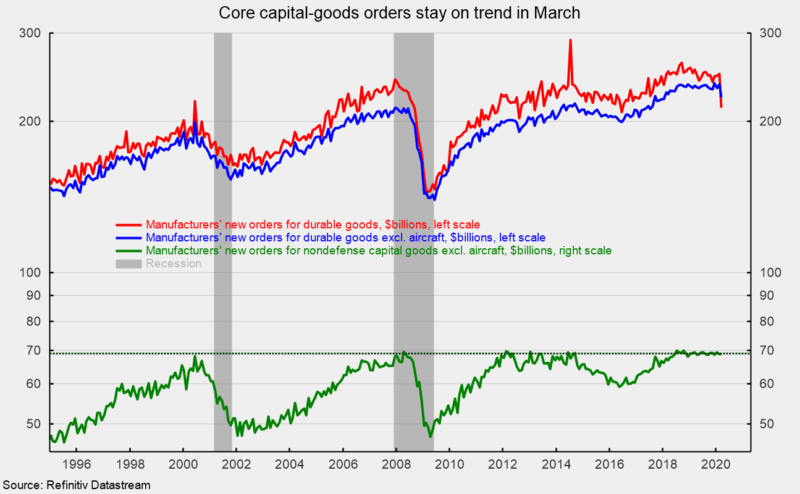

Nondefense Capital-Goods Orders Excluding Aircraft Remain in a Flat Trend

New orders for durable goods plunged 14.4 percent in March following a 1.1 percent gain in February. If aircraft are excluded, new orders for durable goods decreased 5.8 percent in March following a 1.6 percent gain in February. Durable goods orders excluding aircraft had been trending flat, around the $235 billion level since mid-2018 before posting a sharp decline in March (see chart).

New orders for nondefense capital goods excluding aircraft, a proxy for business investment, rose 0.1 percent in March following a drop of 0.8 percent in February. This key category has also been trending flat since mid-2018, hovering at just under $70 billion (see chart). The slight gain for March is a pleasant surprise in an otherwise terrible tsunami of poor economic data.

The results for the categories of durable goods shown in the report were generally on the negative side in the latest month. Among the industries showing decreases were nondefense aircraft, plunging 295.7 percent to -$16.3 billion (negative orders represent cancellation of previously placed orders), motor vehicles, down 41.0 percent for the month, primary metals, dropping 2.5 percent, fabricated metal products, off 0.5 percent, machinery, decreasing 0.2 percent, and computers and electronic products, posting a 0.1 percent fall.

Categories showing gains for March were the catch-all “other durables” category, up 0.5 percent in March, electrical equipment and appliances, up 1.5 percent, and defense aircraft, increasing by 63.7 percent.

The report on durable goods orders reflects the collapse in some industries, particularly air travel. Some bright spots such as core capital goods orders are a pleasant surprise, but these data are for March, before the most severe restrictions on economic activity fully kicked in. Economic distortions are dramatic and likely to continue in reported economic data for a few more months.