New Single-Family Home Sales Bounce Back in November

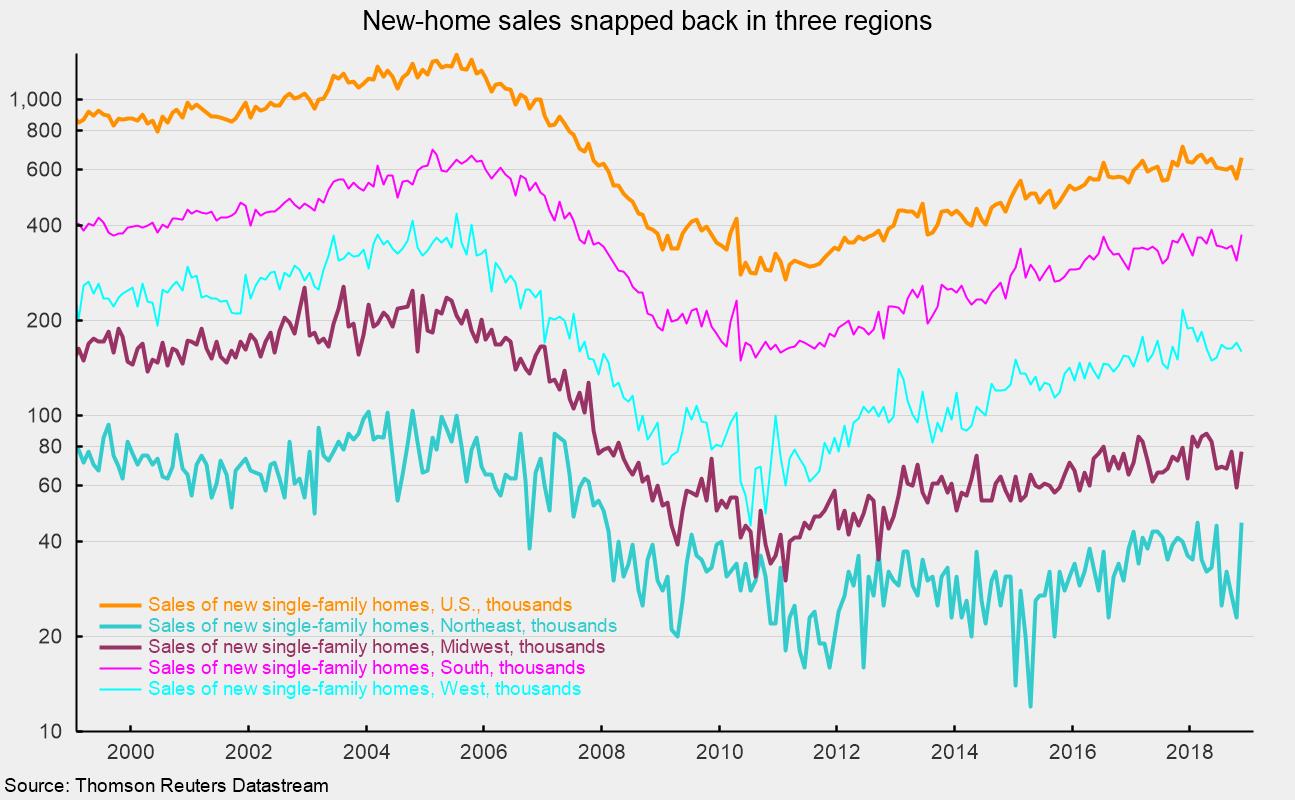

Sales of new single-family homes jumped 16.9 percent in November to a 657,000 seasonally adjusted annual rate. Sales are down 7.7 percent from a year ago, the recent peak in sales. Sales declined in three of the four regions tallied: sales surged 100.0 percent in the Northeast, putting sales 15.0 percent above year-ago levels; sales were up 30.5 percent in the Midwest but were 2.5 percent below the year-ago level; and sales rose 20.6 percent in the South, leaving that region’s sales rate 0.8 percent below the year-ago pace. On the downside, sales fell 5.9 percent for the month in the West and are 25.9 percent below the November 2017 rate. The surge in sales appears to negate recent downtrends in sales (see chart). However, it is unlikely to be the start of a new sustained surge in housing activity over the next several months and quarters.

Total inventory of new single-family homes for sale gained 0.6 percent to 330,000 in November, the eighth increase in a row, leaving the months’ supply (inventory times 12 divided by the annual selling rate) at 6.0, down 14.3 percent from October but 22.4 percent above the year-ago level.

The combination of rising home prices and higher interest rates has likely been weighing on housing activity. However, rates have declined since early November, possibly providing a short-term boost. Still, home affordability overall has been trending lower after surging from 2009 to 2012 because at that time a combination of extraordinarily low interest rates and falling home prices made for a buyer’s market. For the housing market overall, affordability remains favorable, though the declining trend is likely to continue. Despite the November results, sales are unlikely to move significantly higher in the coming months, and new-home construction is unlikely to contribute significantly to growth in gross domestic product in coming quarters. Still, other areas of the economy remain healthy, supported by a tight labor market, rising incomes, strong balance sheets, and high levels of consumer confidence. The main risks on the horizon are uncertainty surrounding fiscal and trade policy, and fallout from escalating trade wars.