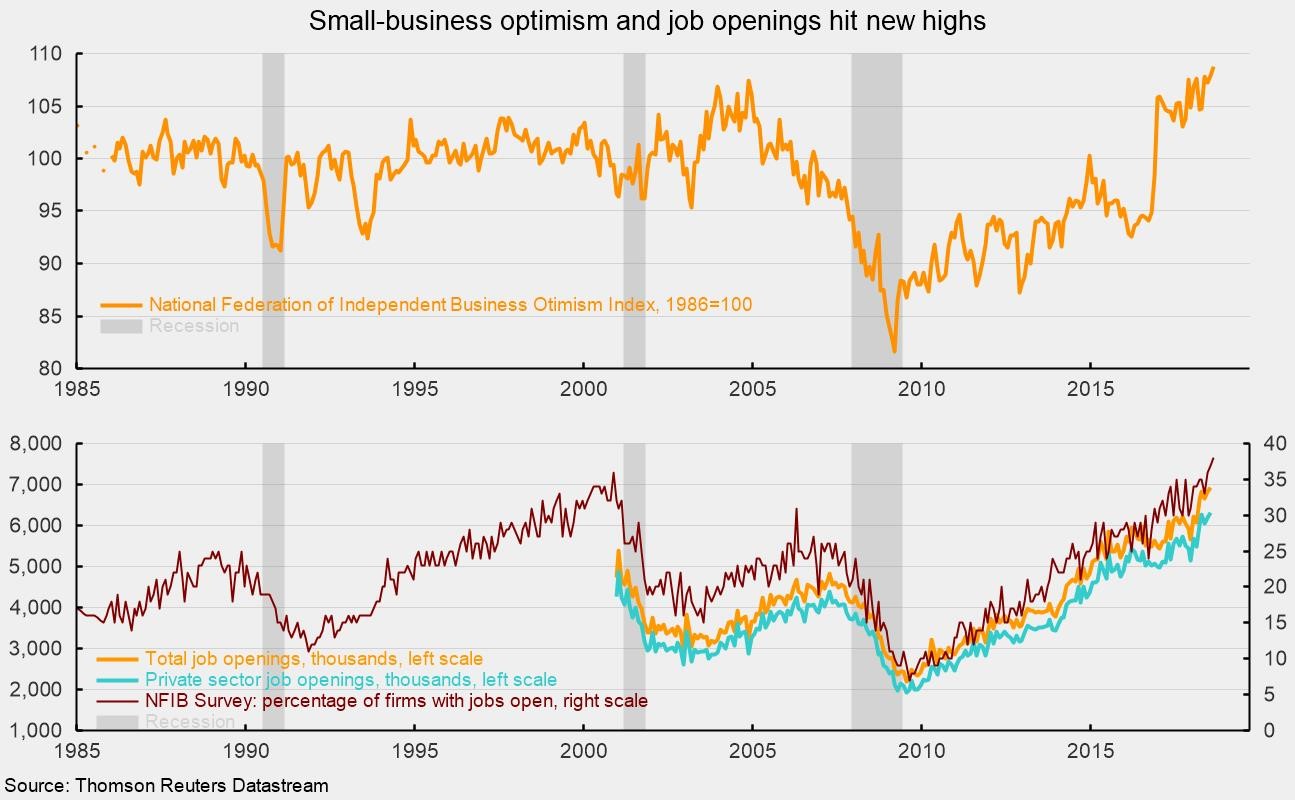

New Record Highs for Small-Business Confidence and Job Openings

The small-business-optimism index from the National Federation of Independent Business jumped to 108.8 in August, a new all-time high. That is up 0.9 points from 107.9 in July and tops the previous record of 108.0 in July 1983. The latest result extends a run of 21 consecutive months above 100, a very high figure by historical comparison (see top chart). Of the 10 individual indicators that make up the overall optimism index, 6 improved in the latest month, and many are at very high levels. The single most important problem among small businesses remains the declining quality of the available labor force, particularly in the context of an already tight labor market and the record-high percentage of firms with open jobs (see bottom chart).

According to the National Federation of Independent Business’s chief economist, Bill Dunkelberg, “At the beginning of this historic run, Index gains were dominated by expectations: good time to expand, expected real sales, inventory satisfaction, expected credit conditions, and expected business conditions. Now the Index is dominated by real business activity that makes GDP grow: job creation plans, job openings, strong capital spending plans, record inventory investment plans, and earnings. Small business is clearly helping to drive that four percent growth in the domestic economy.”

The general outlook remained positive as the percentage of respondents believing now is a good time to expand came in at 34, up from 32 in July and matching the cycle high of 34 in May. The net percentage of respondents expecting better economic conditions (“better” minus “worse”) came in at 34, down slightly from 35 in July but still quite high compared to negative numbers from 2016. A net 26 percent expect higher sales over the coming months while a net 10 percent reported higher sales for the most recent three months versus the prior three months.

The percentage of firms planning to increase employment rose to a record 26 percent from 23 percent in July. A record 38 percent of firms report having openings they are not able to fill at the moment (see bottom chart again). At the same time, the percentage of firms reporting few or no qualified applicants for job openings was 55 percent, matching the record-high 55 percent in June. That combination in the labor market of healthy demand and weak supply has a net 32 percent of firms saying they have already increased compensation over the past three months while 21 percent intend to increase worker pay over the coming months.

The labor-market dynamics have made quality of labor the most important issue for small businesses. Among the 10 issues listed in the survey, quality of labor ranks first at 25 percent, a record high. Taxes came in second at 15 percent, though that is down sharply from the survey high of 32 percent, and government regulation and red tape was third on the list at 13 percent, also well below the survey high of 27 percent. At the bottom of the list were inflation, and financing and interest rates, with just 2 percent saying these two were significant issues. Inflation has been at the bottom of the list for several years, reflecting the slow pace of price increases over the current cycle.

Capital expenditures by small businesses also remains solid, with 56 percent of such businesses having made capital expenditures during the past six months, down from 58 percent last month. That is below the typical percentage in the upper 60s during the late 1990s but well above the mid-40s percentages during the last recession. Thirty-three percent of firms have plans for capital expenditures over the next three to six months, up from 30 percent last month and the highest since 2006.

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the number of open positions in the economy and in the private sector rose to a new record in July, confirming the strong readings from the National Federation of Independent Business survey. Total job openings rose to 6.939 million while private job openings in the United States totaled 6.316 million in July versus 6.183 million in June. The industries with the largest number of openings were health care (1.136 million), professional and business services (1.203 million), leisure and hospitality (1.003 million), and retail (757,000).

The job-openings rate, openings divided by the sum of jobs and openings, was unchanged at 4.7 percent for the private sector, matching the high reached last month. The highest openings rates were in health care (5.4 percent), accommodation and food services (6.1 percent), and professional and business services (5.4 percent).

Further signs of labor-market strength may be seen in the layoffs rate, which held at 1.2 percent for private employers. While slightly above the all-time low of 1.1 percent from March 2018, it is well below the 2.2 percent peak rate in 2009. The low layoffs rate is consistent with the multidecade-low level of initial claims for unemployment insurance. Combined, the high number of openings, the high openings rate, and the low layoffs rate all suggest the labor market remains very tight.

Overall, the data relating to the labor market continue to show strength. Payroll increases appear to be on a solid path, and layoffs remain low. The substantial number of open positions in the economy suggests wage gains may continue to experience upward pressure. Still, attracting and retaining qualified labor is likely to remain a critical issue for business in the immediate future.